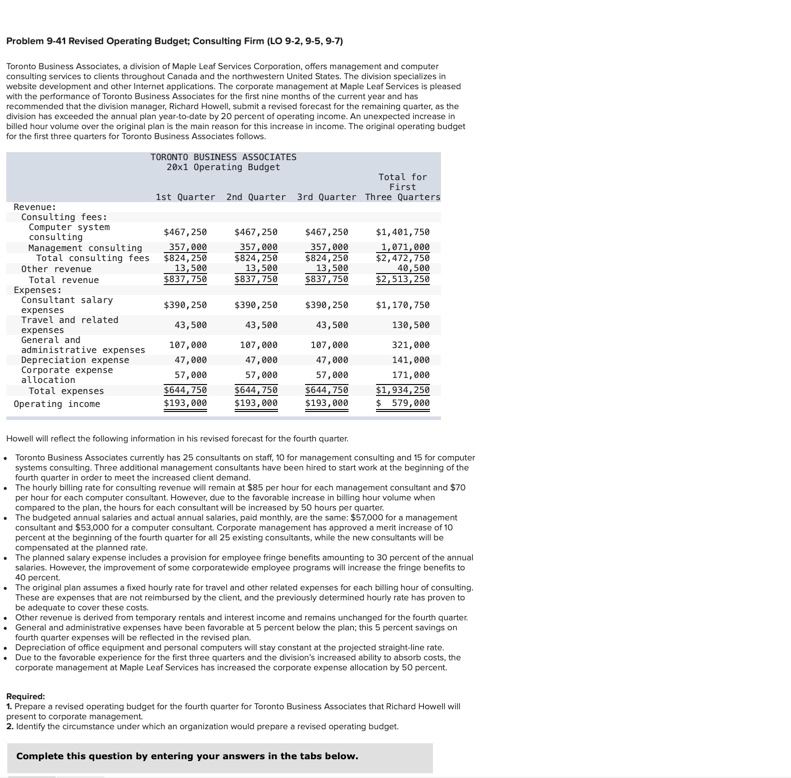

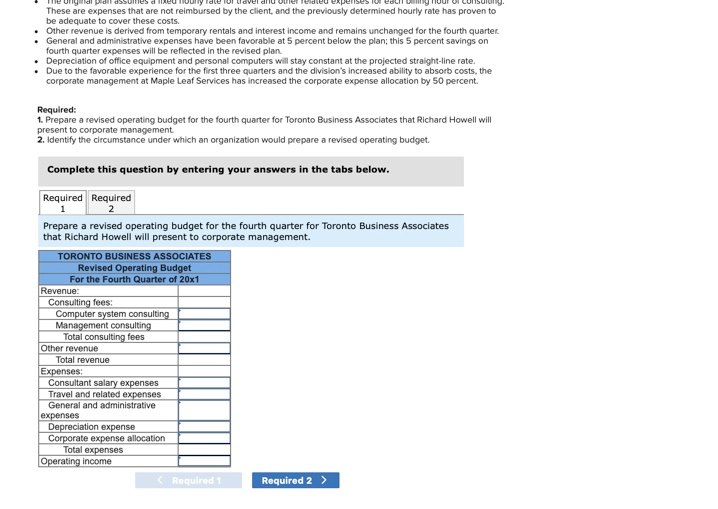

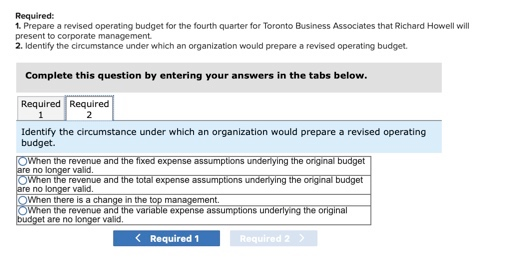

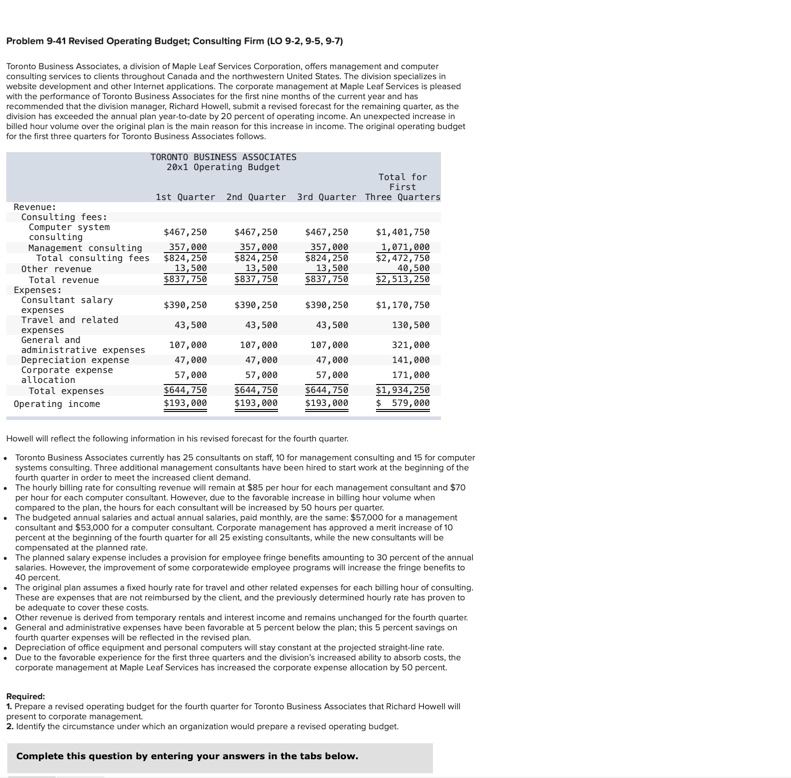

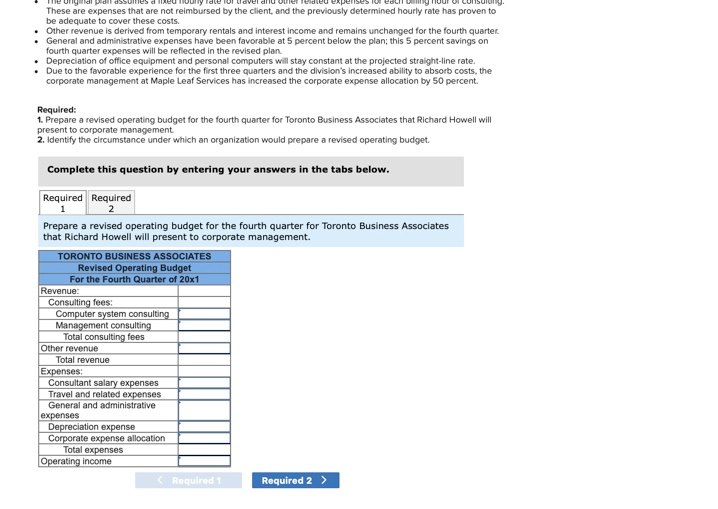

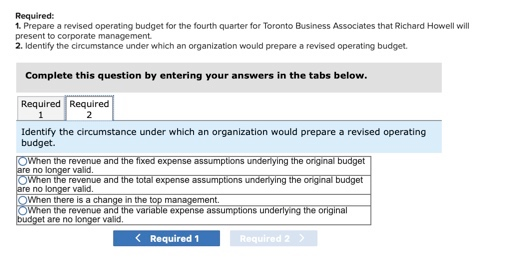

Problem 9-41 Revised Operating Budget; Consulting Firm (LO 9-2, 9-5, 9-7) Toronto Business Associates, a division of Maple Leaf Services Corporation, offers management and computer consulting services to clients throughout Canada and the northwestern United States. The division specializes in website development and other internet applications. The corporate management at Maple Leaf Services is pleased with the performance of Toronto Business Associates for the first nine months of the current year and has recommended that the division manager, Richard Howell, submit a revised forecast for the remaining quarter, as the division has exceeded the annual plan year-to-date by 20 percent of operating income. An unexpected increase in billed hour volume over the original plan is the main reason for this increase in income. The original operating budget for the first three quarters for Toronto Business Associates follows. TORONTO BUSINESS ASSOCIATES 28x1 Operating Budget Total for First 1st Quarter 2nd Quarter 3rd Quarter Three Quarters Revenue: Consulting fees: Computer system $467,250 consulting $467,250 $467,250 $1,481,750 Management consulting 357,000 357,000 357,000 1,071,000 Total consulting fees $824,250 $824, 258 $824,250 $2,472,750 Other revenue 13,500 13,500 13,500 40,500 Total revenue $837,750 $837,750 $837,750 $2,513,250 Expenses : Consultant salary expenses $390,250 $390, 250 $390, 250 $1,170,750 Travel and related expenses 43,580 43,500 43,500 130,500 General and 107,000 187,000 107,000 administrative expenses 321,000 Depreciation expense 47,000 47,800 47,000 141,000 Corporate expense allocation 57,000 57,000 57,000 171,000 Total expenses $644,750 $644,750 $644,750 $1,934,250 Operating income $193,000 $193,000 $193,000 $ 579,000 Howell will reflect the following information in his revised forecast for the fourth quarter. Toronto Business Associates currently has 25 consultants on staff, 10 for management consulting and 15 for computer systems consulting. Three additional management consultants have been hired to start work at the beginning of the fourth quarter in order to meet the increased client demand. The hourly billing rate for consulting revenue will remain at $85 per hour for each management consultant and $70 per hour for each computer consultant. However, due to the favorable increase in billing hour volume when compared to the plan, the hours for each consultant will be increased by 50 hours per quarter. The budgeted annual salaries and actual annual salaries, paid monthly, are the same: $57,000 for a management consultant and $53,000 for a computer consultant Corporate management has approved a merit increase of 10 percent at the beginning of the fourth quarter for all 25 existing consultants, while the new consultants will be compensated at the planned rate. The planned salary expense includes a provision for employee fringe benefits amounting to 30 percent of the annual salaries. However, the improvement of some corporatewide employee programs will increase the fringe benefits to 40 percent. The original plan assumes a fixed hourly rate for travel and other related expenses for each billing hour of consulting, These are expenses that are not reimbursed by the client, and the previously determined hourly rate has proven to be adequate to cover these costs. Other revenue is derived from temporary rentals and interest income and remains unchanged for the fourth quarter . General and administrative expenses have been favorable at 5 percent below the plan; this 5 percent savings on fourth quarter expenses will be reflected in the revised plan Depreciation of office equipment and personal computers will stay constant at the projected straight-line rate. . Due to the favorable experience for the first three quarters and the division's increased ability to absorb costs, the corporate management at Maple Leaf Services has increased the corporate expense allocation by 50 percent. Required: 1. Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Hawell will present to corporate management. 2. Identify the circumstance under which an organization would prepare a revised operating budget. Complete this question by entering your answers in the tabs below. ng didil das These are expenses that are not reimbursed by the client and the previously determined hourly rate has proven to be adequate to cover these costs. Other revenue is derived from temporary rentals and interest income and remains unchanged for the fourth quarter General and administrative expenses have been favorable at 5 percent below the plan; this 5 percent savings on fourth quarter expenses will be reflected in the revised plan Depreciation of office equipment and personal computers will stay constant at the projected straight-line rate. Due to the favorable experience for the first three quarters and the division's increased ability to absorb costs, the corporate management at Maple Leaf Services has increased the corporate expense allocation by 50 percent. Required: 1. Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Howell will 2. Identify the circumstance under which an organization would prepare a revised operating budget. Complete this question by entering your answers in the tabs below. Required Required 1 2 Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Howell will present to corporate management. TORONTO BUSINESS ASSOCIATES Revised Operating Budget For the Fourth Quarter of 20x1 Revenue: Consulting fees: Computer system consulting Management consulting Total consulting fees Other revenue Total revenue Expenses: Consultant salary expenses Travel and related expenses General and administrative expenses Depreciation expense Corporate expense allocation Total expenses Operating Income Required Required 2 > Required: 1. Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Howell will present to corporate management. 2. Identify the circumstance under which an organization would prepare a revised operating budget. Complete this question by entering your answers in the tabs below. Required Required 2 Identify the circumstance under which an organization would prepare a revised operating budget. When the revenue and the fixed expense assumptions underlying the original budget are no longer valid. When the revenue and the total expense assumptions underlying the original budget are no longer valid, When there is a change in the top management When the revenue and the variable expense assumptions underlying the original budget are no longer valid.