Answered step by step

Verified Expert Solution

Question

1 Approved Answer

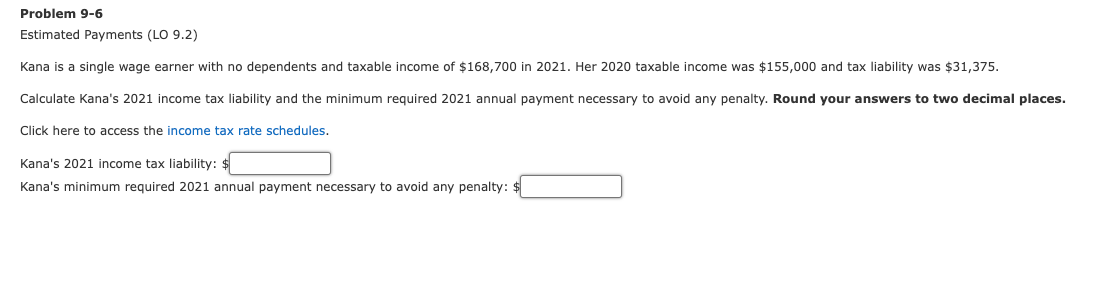

Problem 9-6 Estimated Payments (LO 9.2) Kana is a single wage earner with no dependents and taxable income of $168,700 in 2021. Her 2020

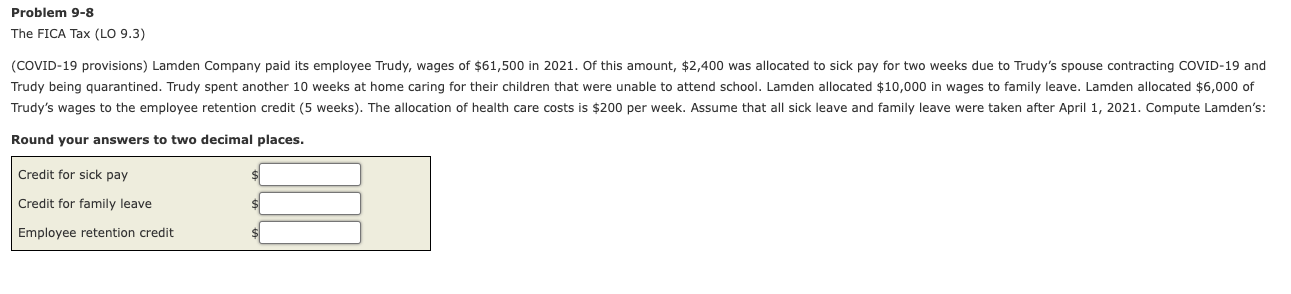

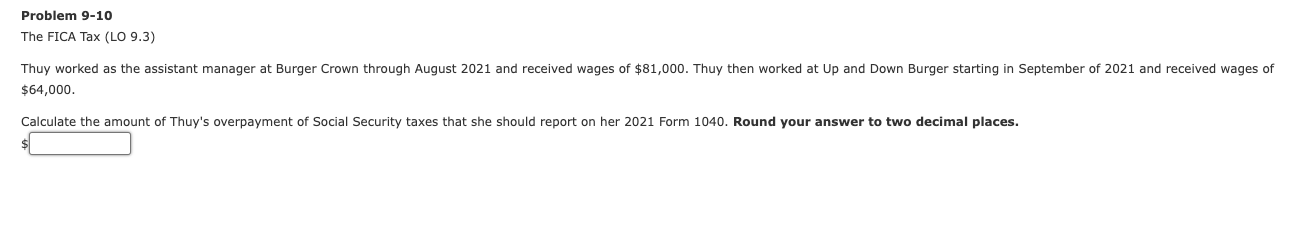

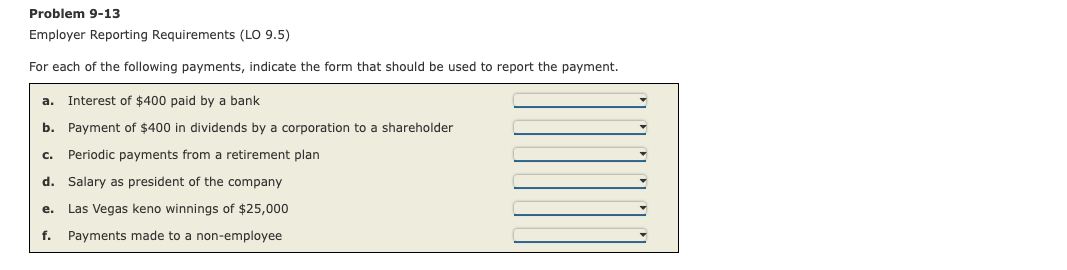

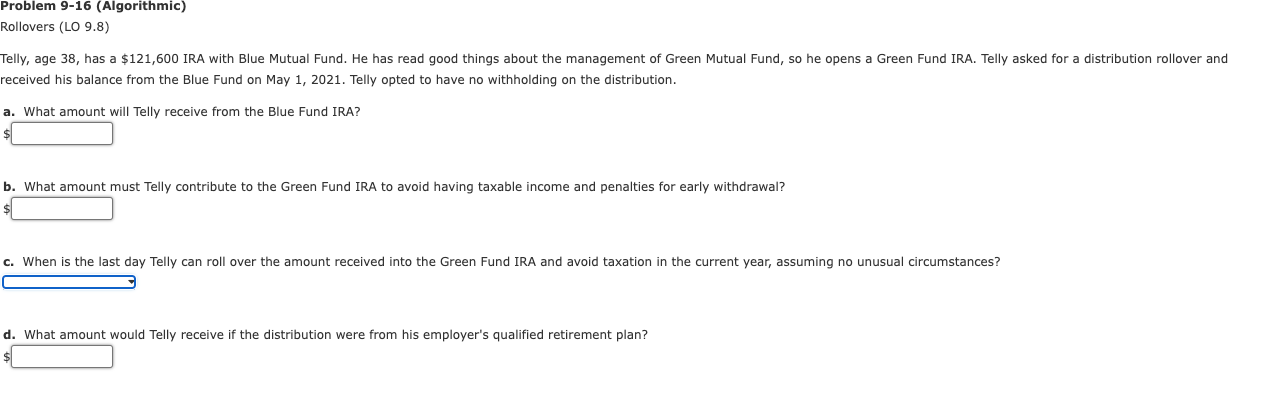

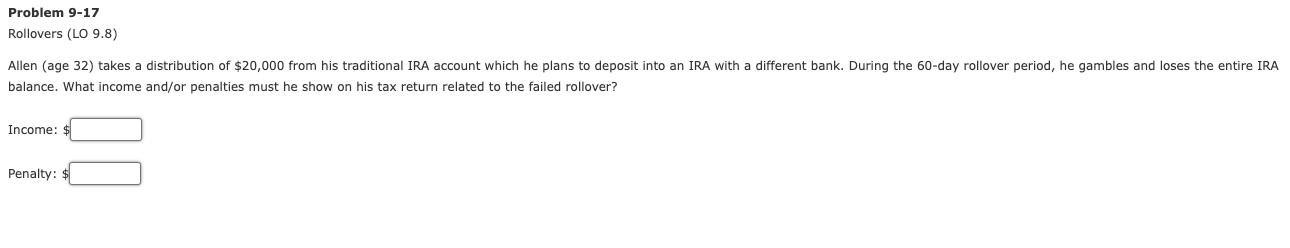

Problem 9-6 Estimated Payments (LO 9.2) Kana is a single wage earner with no dependents and taxable income of $168,700 in 2021. Her 2020 taxable income was $155,000 and tax liability was $31,375. Calculate Kana's 2021 income tax liability and the minimum required 2021 annual payment necessary to avoid any penalty. Round your answers to two decimal places. Click here to access the income tax rate schedules. Kana's 2021 income tax liability: $ Kana's minimum required 2021 annual payment necessary to avoid any penalty: $ Problem 9-8 The FICA Tax (LO 9.3) (COVID-19 provisions) Lamden Company paid its employee Trudy, wages of $61,500 in 2021. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudy's spouse contracting COVID-19 and Trudy being quarantined. Trudy spent another 10 weeks at home caring for their children that were unable to attend school. Lamden allocated $10,000 in wages to family leave. Lamden allocated $6,000 of Trudy's wages to the employee retention credit (5 weeks). The allocation of health care costs is $200 per week. Assume that all sick leave and family leave were taken after April 1, 2021. Compute Lamden's: Round your answers to two decimal places. Credit for sick pay Credit for family leave Employee retention credit Problem 9-10 The FICA Tax (LO 9.3) Thuy worked as the assistant manager at Burger Crown through August 2021 and received wages of $81,000. Thuy then worked at Up and Down Burger starting in September of 2021 and received wages of $64,000. Calculate the amount of Thuy's overpayment of Social Security taxes that she should report on her 2021 Form 1040. Round your answer to two decimal places. Problem 9-13 Employer Reporting Requirements (LO 9.5) For each of the following payments, indicate the form that should be used to report the payment. a. Interest of $400 paid by a bank b. Payment of $400 in dividends by a corporation to a shareholder C. Periodic payments from a retirement plan d. Salary as president of the company e. Las Vegas keno winnings of $25,000 f. Payments made to a non-employee Problem 9-16 (Algorithmic) Rollovers (LO 9.8) Telly, age 38, has a $121,600 IRA with Blue Mutual Fund. He has read good things about the management of Green Mutual Fund, so he opens a Green Fund IRA. Telly asked for a distribution rollover and received his balance from the Blue Fund on May 1, 2021. Telly opted to have no withholding on the distribution. a. What amount will Telly receive from the Blue Fund IRA? $ b. What amount must Telly contribute to the Green Fund IRA to avoid having taxable income and penalties for early withdrawal? c. When is the last day Telly can roll over the amount received into the Green Fund IRA and avoid taxation in the current year, assuming no unusual circumstances? d. What amount would Telly receive if the distribution were from his employer's qualified retirement plan? $ Problem 9-17 Rollovers (LO 9.8) Allen (age 32) takes a distribution of $20,000 from his traditional IRA account which he plans to deposit into an IRA with a different bank. During the 60-day rollover period, he gambles and loses the entire IRA balance. What income and/or penalties must he show on his tax return related to the failed rollover? Income: Penalty:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started