Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 9.6A (Algo) Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6, 9-7 Problem 9.6A (Algo) Preparing a

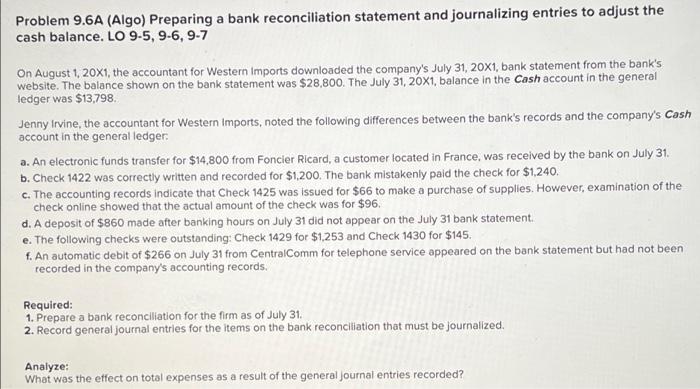

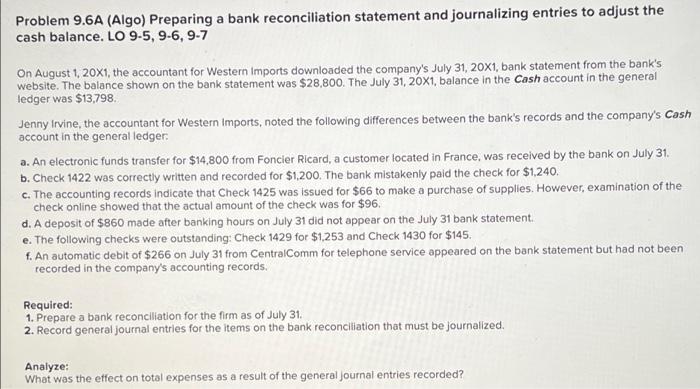

Problem 9.6A (Algo) Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6, 9-7

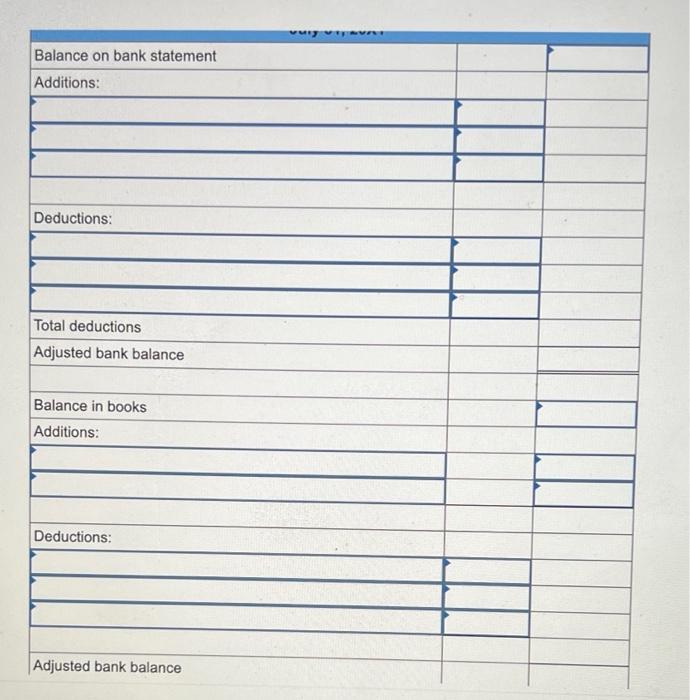

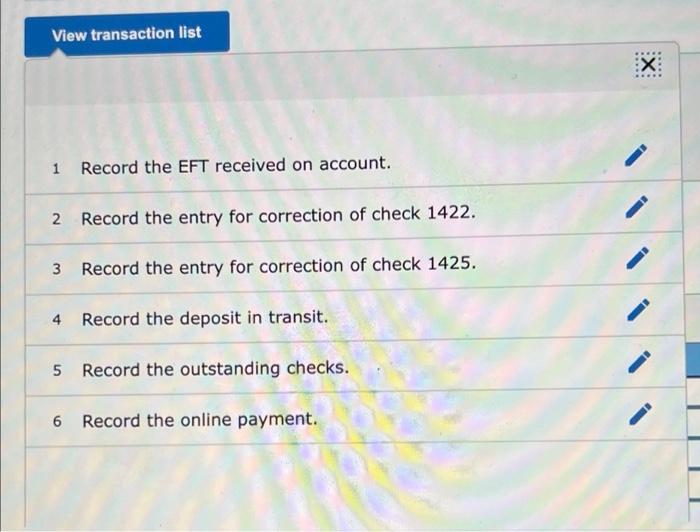

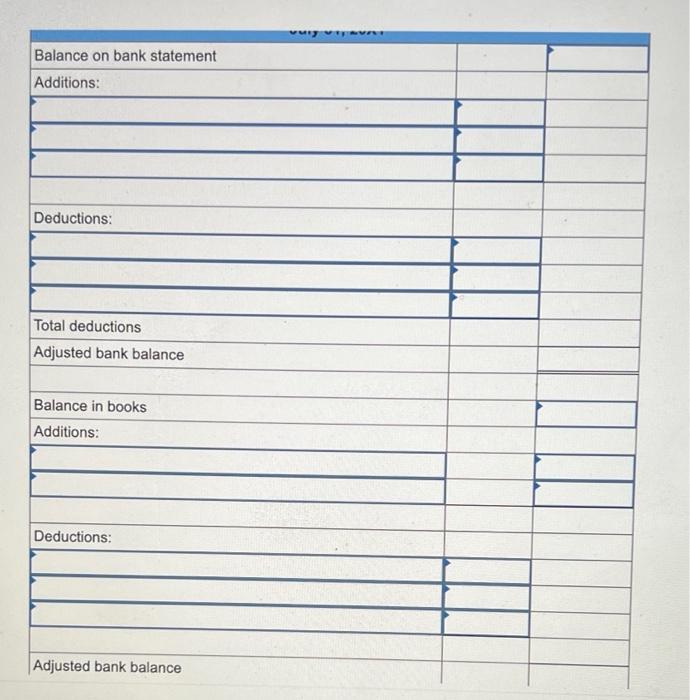

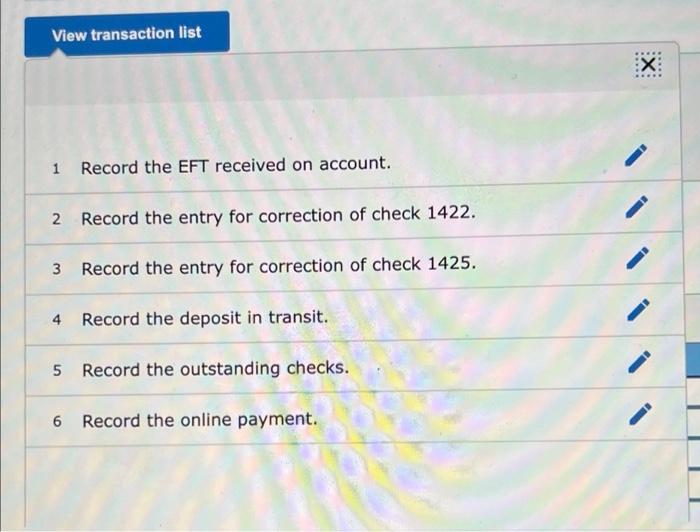

Problem 9.6A (Algo) Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6, 9-7 On August 1, 20X1, the accountant for Western Imports downloaded the company's July 31, 20X1, bank statement from the bank's website. The balance shown on the bank statement was $28,800. The July 31, 20X1, balance in the Cash account in the general ledger was $13,798. Jenny Irvine, the accountant for Western Imports, noted the following differences between the bank's records and the company's Cash account in the general ledger: a. An electronic funds transfer for $14,800 from Foncier Ricard, a customer located in France, was received by the bank on July 31. b. Check 1422 was correctly written and recorded for $1,200. The bank mistakenly paid the check for $1,240. c. The accounting records indicate that Check 1425 was issued for $66 to make a purchase of supplies. However, examination of the check online showed that the actual amount of the check was for $96. d. A deposit of $860 made after banking hours on July 31 did not appear on the July 31 bank statement. e. The following checks were outstanding: Check 1429 for $1,253 and Check 1430 for $145. f. An automatic debit of $266 on July 31 from CentralComm for telephone service appeared on the bank statement but had not been recorded in the company's accounting records. Required: 1. Prepare a bank reconciliation for the firm as of July 31. 2. Record general journal entries for the items on the bank reconciliation that must be journalized. Analyze: What was the effect on total expenses as a result of the general journal entries recorded? Balance on bank statement Additions: Deductions: Total deductions Adjusted bank balance Balance in books Additions: Deductions: Adjusted bank balance vuiy vijave View transaction list 1 Record the EFT received on account. 2 Record the entry for correction of check 1422. 3 Record the entry for correction of check 1425. 4 Record the deposit in transit. 5 Record the outstanding checks. 6 Record the online payment. ***** EX EX Bank Rec General: Journal Analyze What was the effect on total expenses as a result of the general journal entries recorded? Total expenses will by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started