Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pronto Cleaners, a chain of dry- cleaning stores, has the opportunity to invest in one of two dry cleaning machines. Machine A has a

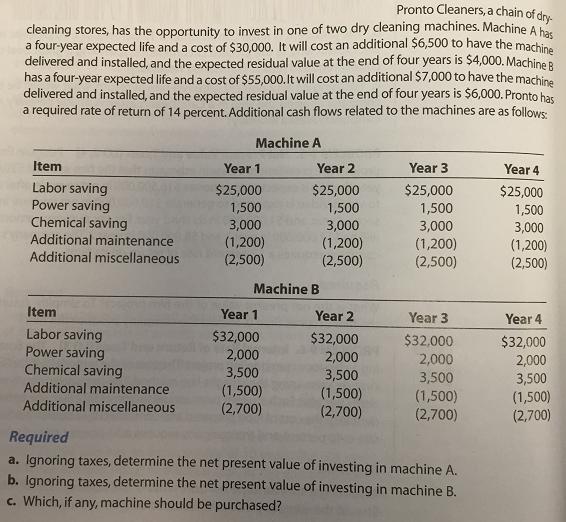

Pronto Cleaners, a chain of dry- cleaning stores, has the opportunity to invest in one of two dry cleaning machines. Machine A has a four-year expected life and a cost of $30,000. It will cost an additional $6,500 to have the machine delivered and installed, and the expected residual value at the end of four years is $4,000. Machine B has a four-year expected life and a cost of $55,000. It will cost an additional $7,000 to have the machine delivered and installed, and the expected residual value at the end of four years is $6,000. Pronto has a required rate of return of 14 percent. Additional cash flows related to the machines are as follows: Machine A Item Year 1 Year 2 Year 3 Year 4 Labor saving Power saving Chemical saving $25,000 $25,000 $25,000 $25,000 1,500 3,000 (1,200) (2,500) 1,500 1,500 1,500 3,000 (1,200) (2,500) 3,000 3,000 (1,200) (2,500) Additional maintenance (1,200) (2,500) Additional miscellaneous Machine B Item Year 1 Year 2 Year 3 Year 4 Labor saving Power saving Chemical saving $32,000 2,000 3,500 (1,500) (2,700) $32,000 2,000 3,500 (1,500) (2,700) $32,000 2,000 $32,000 3,500 (1,500) (2,700) 2,000 3,500 (1,500) (2,700) Additional maintenance Additional miscellaneous Required a. Ignoring taxes, determine the net present value of investing in machine A. b. Ignoring taxes, determine the net present value of investing in machine B. c. Which, if any, machine should be purchased?

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Ignoring taxes determine the net present value of in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started