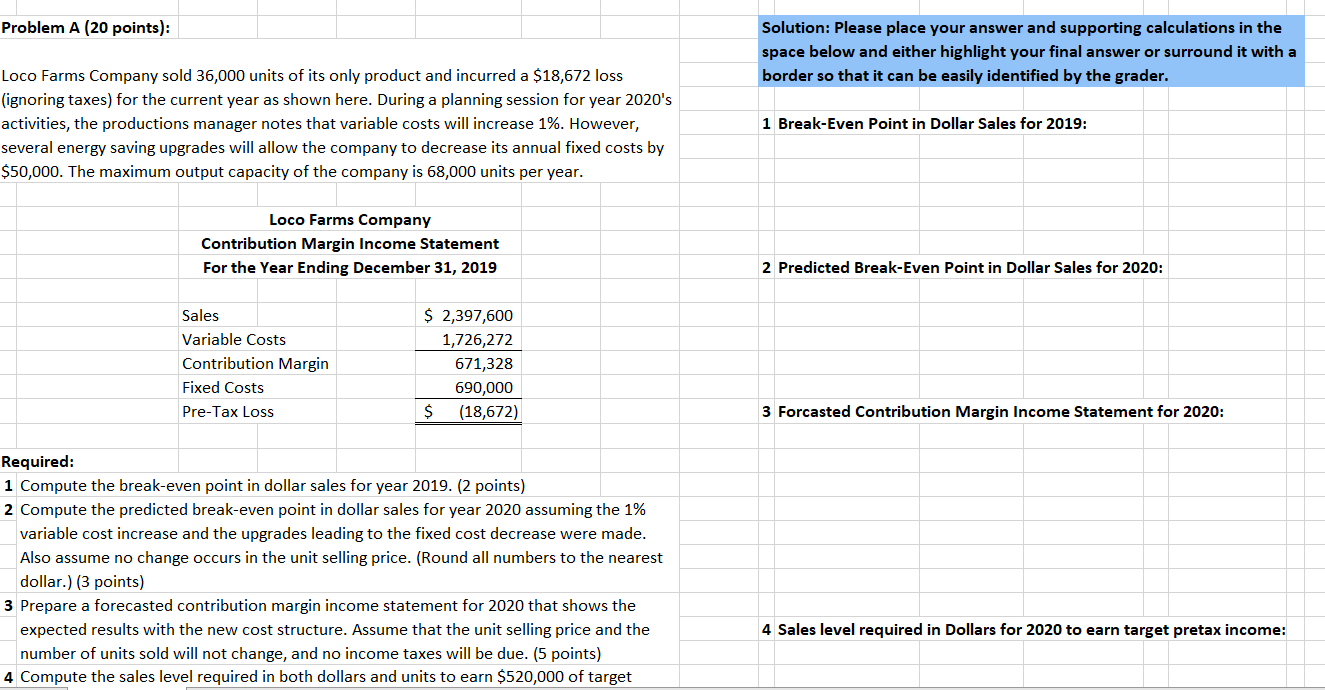

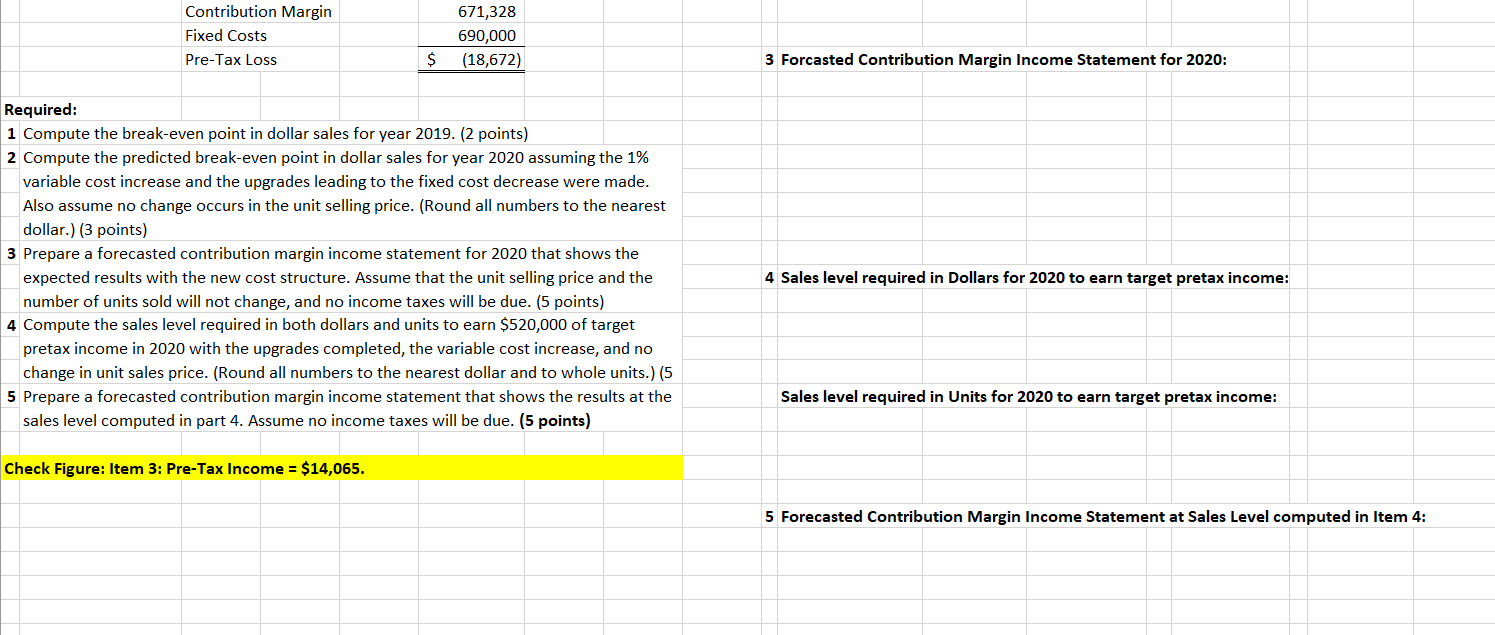

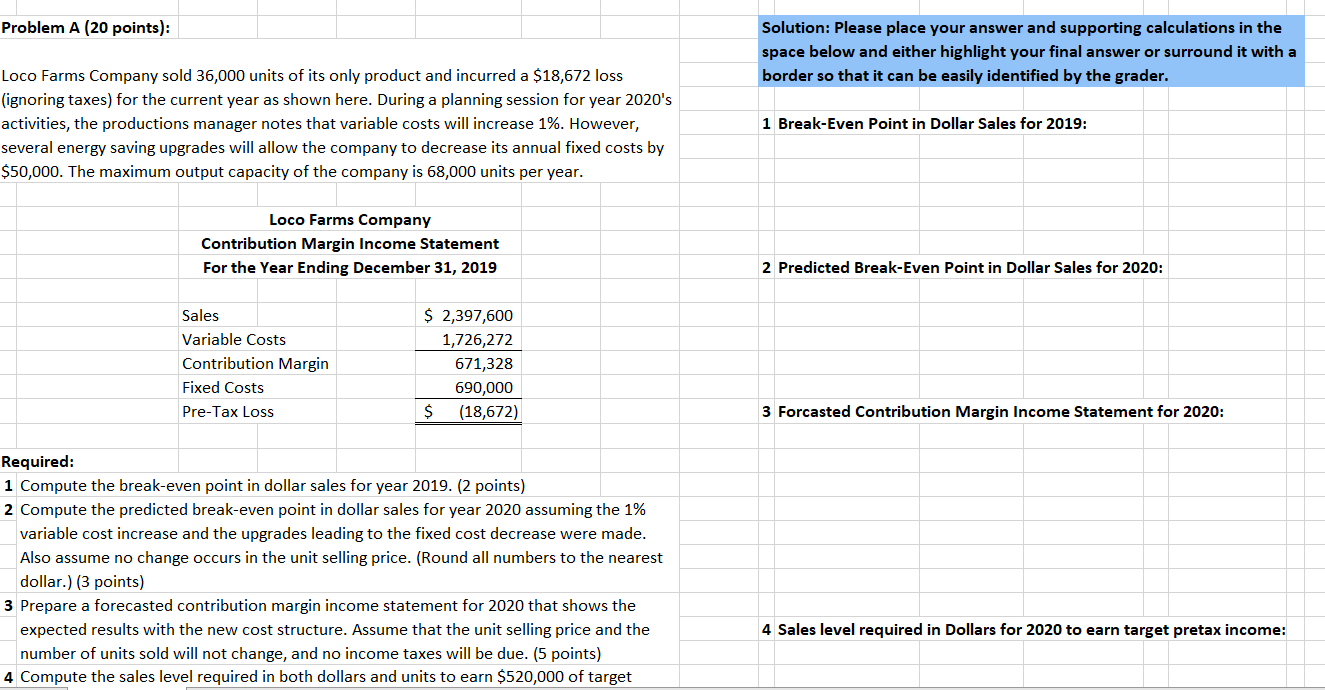

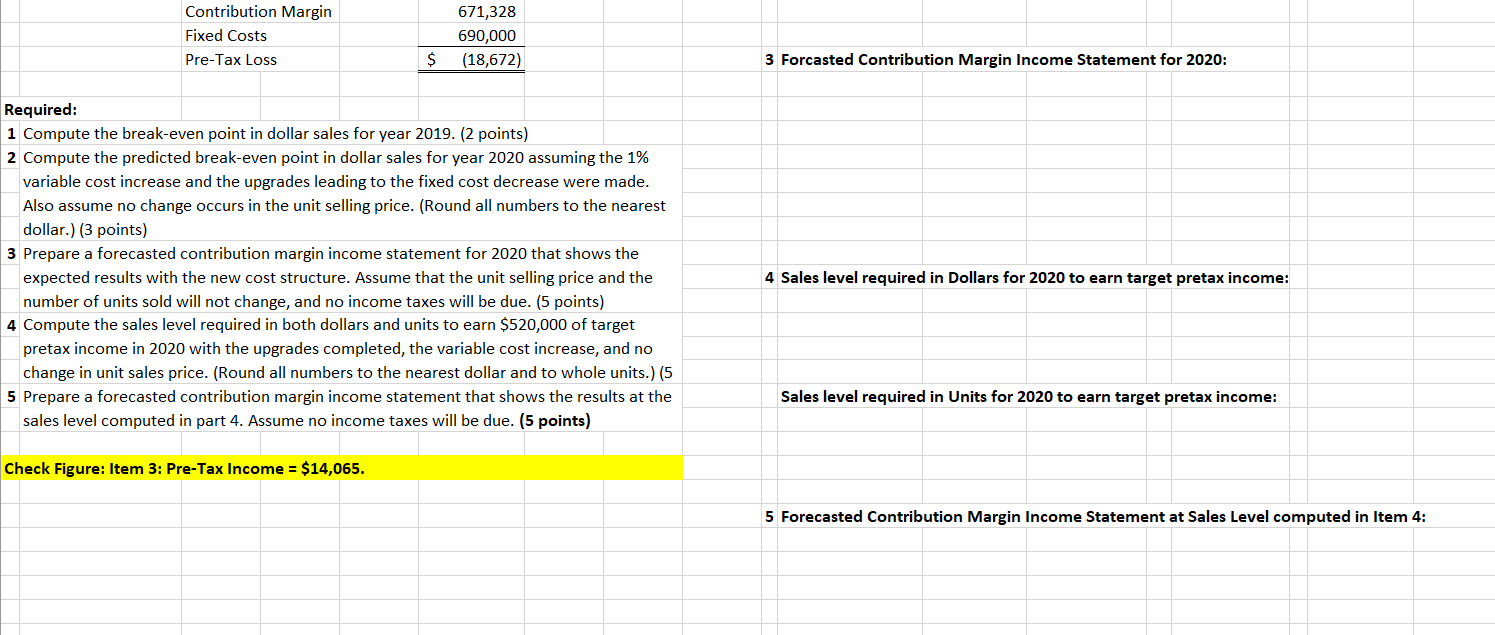

Problem A (20 points): Solution: Please place your answer and supporting calculations in the space below and either highlight your final answer or surround it with a border so that it can be easily identified by the grader. Loco Farms Company sold 36,000 units of its only product and incurred a $18,672 loss (ignoring taxes) for the current year as shown here. During a planning session for year 2020's activities, the productions manager notes that variable costs will increase 1%. However, several energy saving upgrades will allow the company to decrease its annual fixed costs by $50,000. The maximum output capacity of the company is 68,000 units per year. 1 Break-Even Point in Dollar Sales for 2019: Loco Farms Company Contribution Margin Income Statement For the Year Ending December 31, 2019 2 Predicted Break-Even Point in Dollar Sales for 2020: Sales Variable Costs Contribution Margin Fixed Costs Pre-Tax Loss $ 2,397,600 1,726,272 671,328 690,000 $ (18,672) 3 Forcasted Contribution Margin Income Statement for 2020: Required: 1 Compute the break-even point in dollar sales for year 2019. (2 points) 2 Compute the predicted break-even point in dollar sales for year 2020 assuming the 1% variable cost increase and the upgrades leading to the fixed cost decrease were made. Also assume no change occurs in the unit selling price. (Round all numbers to the nearest dollar.) (3 points) 3 Prepare a forecasted contribution margin income statement for 2020 that shows the expected results with the new cost structure. Assume that the unit selling price and the number of units sold will not change, and no income taxes will be due. (5 points) 4 Compute the sales level required in both dollars and units to earn $520,000 of target 4 Sales level required in Dollars for 2020 to earn target pretax income: Contribution Margin Fixed Costs Pre-Tax Loss 671,328 690,000 (18,672) $ 3 Forcasted Contribution Margin Income Statement for 2020: Required: 1 Compute the break-even point in dollar sales for year 2019. (2 points) 2 Compute the predicted break-even point in dollar sales for year 2020 assuming the 1% variable cost increase and the upgrades leading to the fixed cost decrease were made. Also assume no change occurs in the unit selling price. (Round all numbers to the nearest dollar.) (3 points) 3 Prepare a forecasted contribution margin income statement for 2020 that shows the expected results with the new cost structure. Assume that the unit selling price and the number of units sold will not change, and no income taxes will be due. (5 points) 4 Compute the sales level required in both dollars and units to earn $520,000 of target pretax income in 2020 with the upgrades completed, the variable cost increase, and no change in unit sales price. (Round all numbers to the nearest dollar and to whole units.) (5 5 Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume no income taxes will be due. (5 points) 4 Sales level required in Dollars for 2020 to earn target pretax income: Sales level required in Units for 2020 to earn target pretax income: Check Figure: Item 3: Pre-Tax Income = $14,065. 5 Forecasted Contribution Margin Income Statement at Sales Level computed in Item 4