Answered step by step

Verified Expert Solution

Question

1 Approved Answer

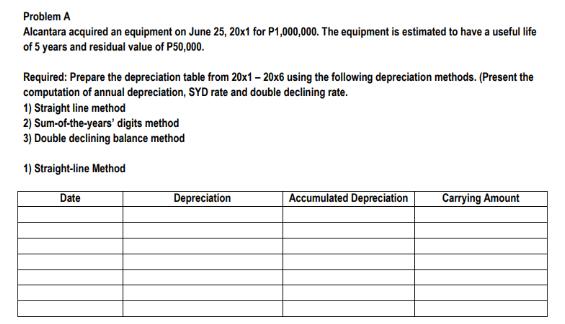

Problem A Alcantara acquired an equipment on June 25, 20x1 for P1,000,000. The equipment is estimated to have a useful life of 5 years

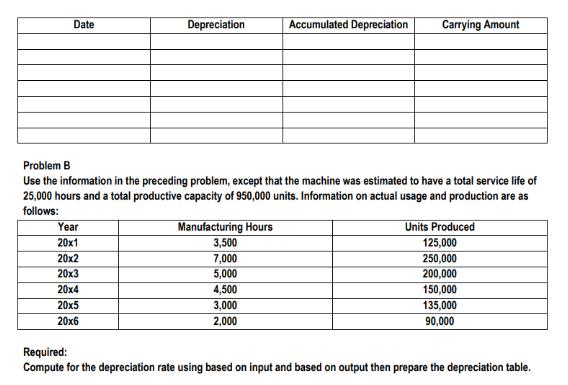

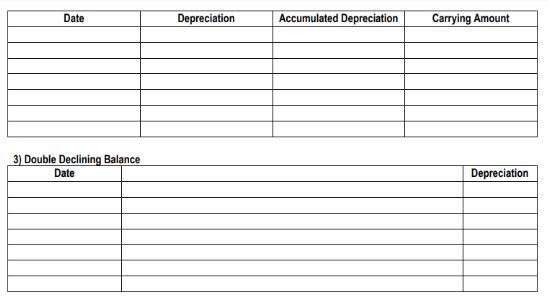

Problem A Alcantara acquired an equipment on June 25, 20x1 for P1,000,000. The equipment is estimated to have a useful life of 5 years and residual value of P50,000. Required: Prepare the depreciation table from 20x120x6 using the following depreciation methods. (Present the computation of annual depreciation, SYD rate and double declining rate. 1) Straight line method 2) Sum-of-the-years' digits method 3) Double declining balance method 1) Straight-line Method Date Depreciation Accumulated Depreciation Carrying Amount Date Year 20x1 20x2 20x3 Depreciation 20x4 20x5 20x6 Problem B Use the information in the preceding problem, except that the machine was estimated to have a total service life of 25,000 hours and a total productive capacity of 950,000 units. Information on actual usage and production are as follows: Accumulated Depreciation Manufacturing Hours 3,500 7,000 5,000 4,500 3,000 2,000 Carrying Amount Units Produced 125,000 250,000 200,000 150,000 135,000 90,000 Required: Compute for the depreciation rate using based on input and based on output then prepare the depreciation table. Date 3) Double Declining Balance Date Depreciation Accumulated Depreciation Carrying Amount Depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provided shows a set of problems related to calculating the depreciation of an asset using different methods Due to the nature of the questions I will address the depreciation calculations s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started