Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem background (Comprehensive presentation of the problem mentioned in the task.) Discussion, analysis, and recommendation (Comprehensive discussion and indepth analysis of the issues.) Calculations, graphical

| Problem background (Comprehensive presentation of the problem mentioned in the task.) |

| Discussion, analysis, and recommendation (Comprehensive discussion and indepth analysis of the issues.) |

| Calculations, graphical presentation, diagrams, and analysis (Accuracy and clearness of calculations, significant graphs and diagrams, and in-depth analysis) |

| English language, writing style, and references (Overall format and style, spelling and grammar mistakes, and standard referencing style) |

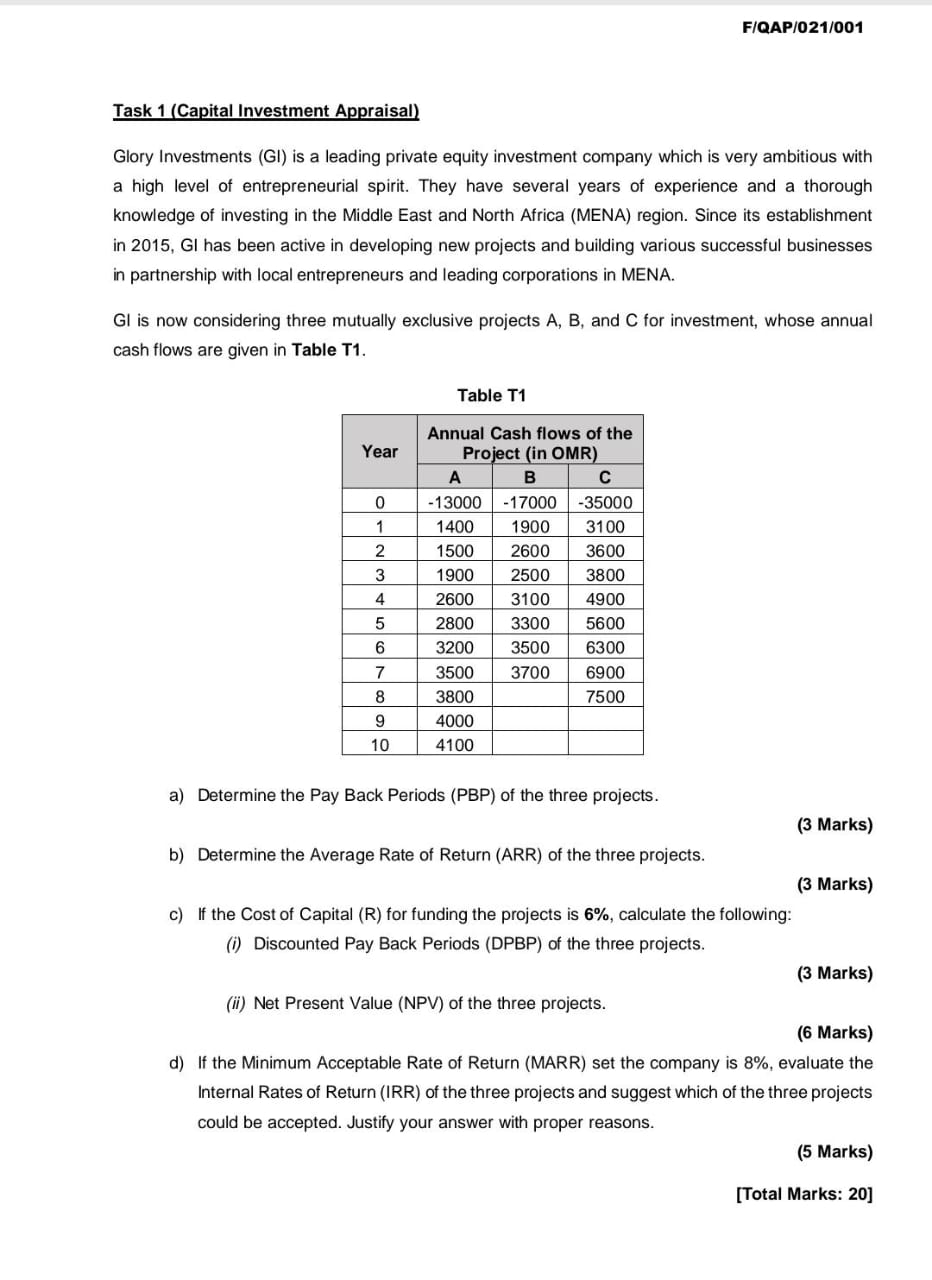

Task 1 (Capital Investment Appraisal) Glory Investments (GI) is a leading private equity investment company which is very ambitious with a high level of entrepreneurial spirit. They have several years of experience and a thorough knowledge of investing in the Middle East and North Africa (MENA) region. Since its establishment in 2015, GI has been active in developing new projects and building various successful businesses in partnership with local entrepreneurs and leading corporations in MENA. GI is now considering three mutually exclusive projects A, B, and C for investment, whose annual cash flows are given in Table T1. Tahle T1 a) Determine the Pay Back Periods (PBP) of the three projects. (3 Marks) b) Determine the Average Rate of Return (ARR) of the three projects. (3 Marks) c) If the Cost of Capital (R) for funding the projects is 6%, calculate the following: (i) Discounted Pay Back Periods (DPBP) of the three projects. (3 Marks) (ii) Net Present Value (NPV) of the three projects. (6 Marks) d) If the Minimum Acceptable Rate of Return (MARR) set the company is 8%, evaluate the Internal Rates of Return (IRR) of the three projects and suggest which of the three projects could be accepted. Justify your answer with proper reasons

Task 1 (Capital Investment Appraisal) Glory Investments (GI) is a leading private equity investment company which is very ambitious with a high level of entrepreneurial spirit. They have several years of experience and a thorough knowledge of investing in the Middle East and North Africa (MENA) region. Since its establishment in 2015, GI has been active in developing new projects and building various successful businesses in partnership with local entrepreneurs and leading corporations in MENA. GI is now considering three mutually exclusive projects A, B, and C for investment, whose annual cash flows are given in Table T1. Tahle T1 a) Determine the Pay Back Periods (PBP) of the three projects. (3 Marks) b) Determine the Average Rate of Return (ARR) of the three projects. (3 Marks) c) If the Cost of Capital (R) for funding the projects is 6%, calculate the following: (i) Discounted Pay Back Periods (DPBP) of the three projects. (3 Marks) (ii) Net Present Value (NPV) of the three projects. (6 Marks) d) If the Minimum Acceptable Rate of Return (MARR) set the company is 8%, evaluate the Internal Rates of Return (IRR) of the three projects and suggest which of the three projects could be accepted. Justify your answer with proper reasons Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started