Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem C-2A Consider present value (LOC-2, C-3) Bruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for

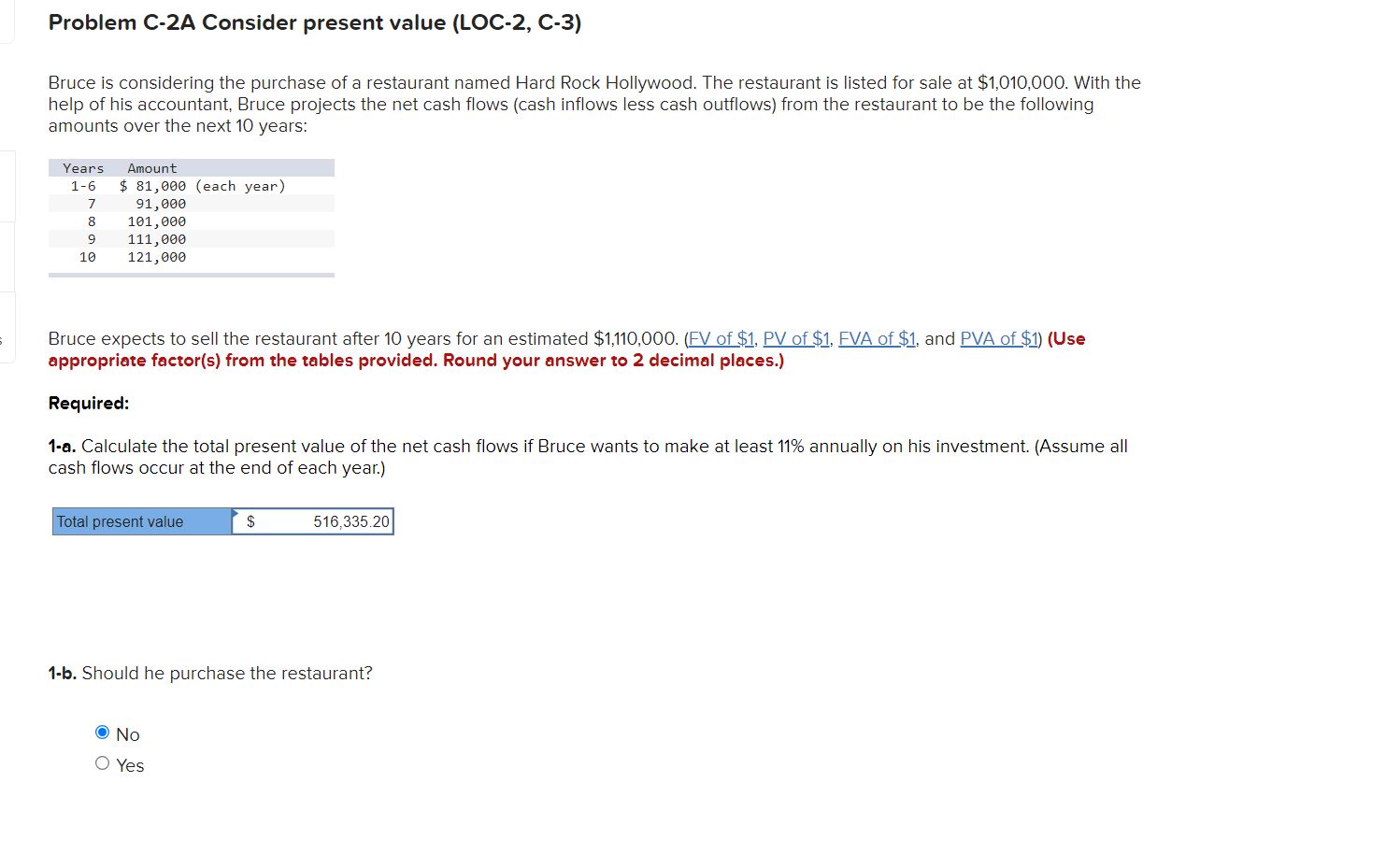

Problem C-2A Consider present value (LOC-2, C-3) Bruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for sale at $1,010,000. With the help of his accountant, Bruce projects the net cash flows (cash inflows less cash outflows) from the restaurant to be the following amounts over the next 10 years: Years Amount 1-6 $ 81,000 (each year) 7 8 91,000 101,000 111,000 10 121,000 Bruce expects to sell the restaurant after 10 years for an estimated $1,110,000. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to 2 decimal places.) Required: 1-a. Calculate the total present value of the net cash flows if Bruce wants to make at least 11% annually on his investment. (Assume all cash flows occur at the end of each year.) Total present value $ 516,335.20 1-b. Should he purchase the restaurant? No Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started