Answered step by step

Verified Expert Solution

Question

1 Approved Answer

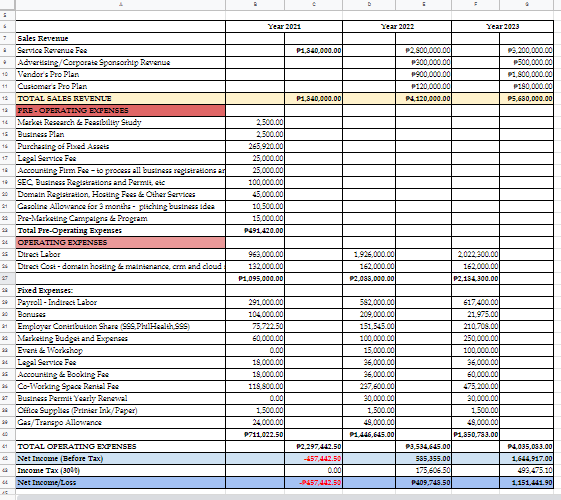

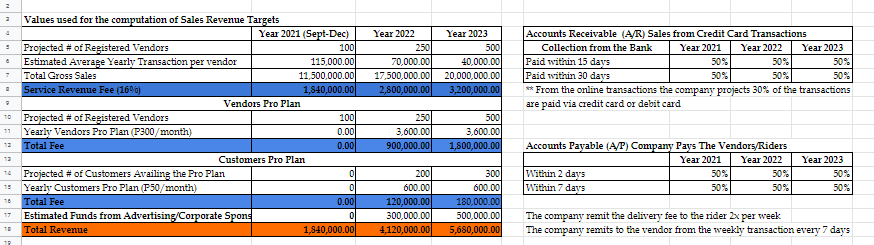

Problem: Company ABC is venturing on a business opportunity. In order to assess if the business is a doable and good investment, the company prepares

Problem: Company ABC is venturing on a business opportunity. In order to assess if the business is a doable and good investment, the company prepares a financial plan for 3 years. Basing on the data below: Compute the Financial Ratio

Year 2021 Year 2022 Year 2023 P1,840,000.00 P2.800,000.00 200,000.00 P900,000.00 P120,000.00 24.120.000.00 8 200,000.00 P500,000.00 P: 800,000.00 P7.90,000.00 PS 680.000.00 11 1.840,000.00 Sales Tevenue Service Revenue Fee Advertising/Corporate Sponsorhig Revenue Vendors Pro Plan Cusiomers Pro Plan TOTAL SALES REVENLE PRE-OPERATING EXPENSES 16 Market Research & Feasibility Study Business Plan 15 Purchasing of Pxed Assets 13 Legal Service For 16 Accounting Flm Fee-to process all business reglarations + SEC. Business Registradone and Pem, etc Domain Registration. Hosting Fees & Other Services Caroline Allowance for a months - ploching business idea 4 Pre-Marketing Campaigns & Program Total Pre-Operating Expenses OPERATING EXPENSES Direct Labor Direct Cost-domain horing & mareenance.com and cloud 2500.00 2,500.00 265,920.00 25.000,00 25,000.00 100,000.00 45,000.00 10 500.00 15,000.00 P491 420.00 1 963,000.00 192,000.00 P1,095,000.00 1.926.000.00 162,000.00 22,085,000.00 2.022,300.00 162,000.00 P2,154,300.00 Fixed Expenses * Payroll - Indirect Labor Bonuses 51 Employer Contbution Share SSS. PHI Health 999 - Marketing Budget and Express * Event Workshop 24 Legal Service Fee * Accounting & Booking Fee * Cs-Verlang Space Rental Fee Business Permit Yearly Renewal Celice Supplies Printer Ink/Paper Cas/Transpo Allowance 291,000.00 104.000.00 75.722.50 40,000.00 0.00 15,000.00 19.000.00 119.800.00 0.00 1,500.00 24,000.00 P711.022.50 562.000.00 209,000.00 151.545.00 100,000.00 15,000.00 36,000.00 36,000.00 287,600.00 30,000.00 1,500.00 49,000.00 P1.446.645.00 617.400.00 21,975.00 210,708.00 250,000.00 100,000.00 94,000.00 50,000.00 475,200.00 30,000.00 1.500.00 49,000.00 P1.850.783.00 P3,534.645.00 24.035,083.00 585,355.00 1,644.917.00 175.606.30 499,475.10 P409,748.50 1,151.41.90 TOTAL OFERATING EXPENSES Net Income (Before Tax) Income Tax (3000) Net Income/Loss P2.297 442.50 -457 442.50 0.00 -P457 442.50 2 2 a 3 a Year 2022 250 70,000.00 17,500,000.00 2,800,000.00 Year 2023 5001 40,000.00 20,000,000.00 3,200,000.00 Accounts Receivable (A/R) Sales from Credit Card Transactions Collection from the Bank Year 2021 Year 2022 Year 2023 Paid within 15 days 50% 50% 50% Paid within 30 days 50% 50% 50% ** From the online transactions the company projects 30% of the transactions are paid via credit card or debit card 2 Values used for the computation of Sales Revenue Targets Year 2021 (Sept-Dec) Projected # of Registered Vendors 100 Estimated Average Yearly Transaction per vendor 115,000.00 Total Gross Sales 11,500,000.00 Service Revenue Fee (169) 1,840,000.00 Vendors Pro Plan Projected # of Registered Vendors 1001 Yearly Vendors Pro Plan (P300/month) 0.00 Total Fee 0.00 Customers Pro Plan Projected # of Customers Availing the Pro Plan 0 Yearly Customers Pro Plan (P50/month) Total Fee 0.00 Estimated Funds from Advertising/Corporate Spons 0 Total Revenue 1,840,000.00 11 250 3,600.00 900,000.00 5001 3,600.00 1,800,000.00 12 10 Accounts Payable (A/P) Company Pays The Vendors/Riders Year 2021 Year 2022 Within 2 days 50% 50% Within 7 days 50% 50% Year 2023 50% 50% 13 0 18 2001 600.00 120,000.00 300,000.00 4,120,000.00 300 600.00 180,000.00 500,000.00 5,680,000.00 7 The company remit the delivery fee to the rider 2x per week The company remits to the vendor from the weekly transaction every 7 days Year 2021 Year 2022 Year 2023 P1,840,000.00 P2.800,000.00 200,000.00 P900,000.00 P120,000.00 24.120.000.00 8 200,000.00 P500,000.00 P: 800,000.00 P7.90,000.00 PS 680.000.00 11 1.840,000.00 Sales Tevenue Service Revenue Fee Advertising/Corporate Sponsorhig Revenue Vendors Pro Plan Cusiomers Pro Plan TOTAL SALES REVENLE PRE-OPERATING EXPENSES 16 Market Research & Feasibility Study Business Plan 15 Purchasing of Pxed Assets 13 Legal Service For 16 Accounting Flm Fee-to process all business reglarations + SEC. Business Registradone and Pem, etc Domain Registration. Hosting Fees & Other Services Caroline Allowance for a months - ploching business idea 4 Pre-Marketing Campaigns & Program Total Pre-Operating Expenses OPERATING EXPENSES Direct Labor Direct Cost-domain horing & mareenance.com and cloud 2500.00 2,500.00 265,920.00 25.000,00 25,000.00 100,000.00 45,000.00 10 500.00 15,000.00 P491 420.00 1 963,000.00 192,000.00 P1,095,000.00 1.926.000.00 162,000.00 22,085,000.00 2.022,300.00 162,000.00 P2,154,300.00 Fixed Expenses * Payroll - Indirect Labor Bonuses 51 Employer Contbution Share SSS. PHI Health 999 - Marketing Budget and Express * Event Workshop 24 Legal Service Fee * Accounting & Booking Fee * Cs-Verlang Space Rental Fee Business Permit Yearly Renewal Celice Supplies Printer Ink/Paper Cas/Transpo Allowance 291,000.00 104.000.00 75.722.50 40,000.00 0.00 15,000.00 19.000.00 119.800.00 0.00 1,500.00 24,000.00 P711.022.50 562.000.00 209,000.00 151.545.00 100,000.00 15,000.00 36,000.00 36,000.00 287,600.00 30,000.00 1,500.00 49,000.00 P1.446.645.00 617.400.00 21,975.00 210,708.00 250,000.00 100,000.00 94,000.00 50,000.00 475,200.00 30,000.00 1.500.00 49,000.00 P1.850.783.00 P3,534.645.00 24.035,083.00 585,355.00 1,644.917.00 175.606.30 499,475.10 P409,748.50 1,151.41.90 TOTAL OFERATING EXPENSES Net Income (Before Tax) Income Tax (3000) Net Income/Loss P2.297 442.50 -457 442.50 0.00 -P457 442.50 2 2 a 3 a Year 2022 250 70,000.00 17,500,000.00 2,800,000.00 Year 2023 5001 40,000.00 20,000,000.00 3,200,000.00 Accounts Receivable (A/R) Sales from Credit Card Transactions Collection from the Bank Year 2021 Year 2022 Year 2023 Paid within 15 days 50% 50% 50% Paid within 30 days 50% 50% 50% ** From the online transactions the company projects 30% of the transactions are paid via credit card or debit card 2 Values used for the computation of Sales Revenue Targets Year 2021 (Sept-Dec) Projected # of Registered Vendors 100 Estimated Average Yearly Transaction per vendor 115,000.00 Total Gross Sales 11,500,000.00 Service Revenue Fee (169) 1,840,000.00 Vendors Pro Plan Projected # of Registered Vendors 1001 Yearly Vendors Pro Plan (P300/month) 0.00 Total Fee 0.00 Customers Pro Plan Projected # of Customers Availing the Pro Plan 0 Yearly Customers Pro Plan (P50/month) Total Fee 0.00 Estimated Funds from Advertising/Corporate Spons 0 Total Revenue 1,840,000.00 11 250 3,600.00 900,000.00 5001 3,600.00 1,800,000.00 12 10 Accounts Payable (A/P) Company Pays The Vendors/Riders Year 2021 Year 2022 Within 2 days 50% 50% Within 7 days 50% 50% Year 2023 50% 50% 13 0 18 2001 600.00 120,000.00 300,000.00 4,120,000.00 300 600.00 180,000.00 500,000.00 5,680,000.00 7 The company remit the delivery fee to the rider 2x per week The company remits to the vendor from the weekly transaction every 7 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started