Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM CONTINUING he following problem will continue from one chapter to the next carrying the balances forward from month to month. Each chapter will focus

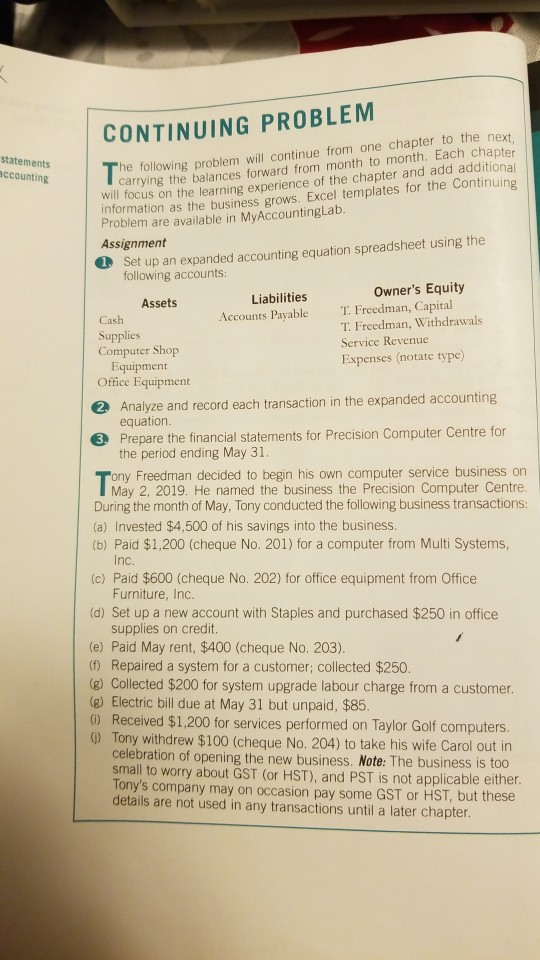

PROBLEM CONTINUING he following problem will continue from one chapter to the next carrying the balances forward from month to month. Each chapter will focus on the learning experience of the chapter and add additional information as the business grows. Excel templates for the Continuing Problem are available in MyAccountingLab. statements accounting Set up an expanded accounting equation spreadsheet using the following accounts: Assignment Owner's Equity T Freedman, Capital T Freedman, Withdrawals Service Revenue Liabilities Assets Accounts Payable Cash Supplies Computer Shop Equipment Office Equipment Expenses (notate type) 2 Analyze and record each transaction in the expanded accounting equation. Prepare the financial statements for Precision Computer Centre for the period ending May 31. 3 ony Freedman decided to begin his own computer service business on May 2, 2019. He named the business the Precision Computer Centre. During the month of May, Tony conducted the following business transactions: (a) Invested $4,500 of his savings into the business. (b) Paid $1,200 (cheque No. 201) for a computer from Multi Systems, Inc. (c) Paid $600 (cheque No. 202) for office equipment from Office Furniture, Inc. (d) Set up a new account with Staples and purchased $250 in office supplies on credit. (e) Paid May rent, $400 (cheque No. 203). (f) Repaired a system for a customer; collected $250. (g) Collected $200 for system upgrade labour charge from a customer. (g) Electric bill due at May 31 but unpaid, $85 () Received $1,200 for services performed on Taylor Golf computers. ()Tony withdrew $100 (cheque No. 204) to take his wife Carol out in celebration of opening the new business. Note: The business is too small to worry about GST (or HST), and PST is not applicable either. Tony's company may on occasion pay some GST or HST, but these details are not used in any transactions until a later chapter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started