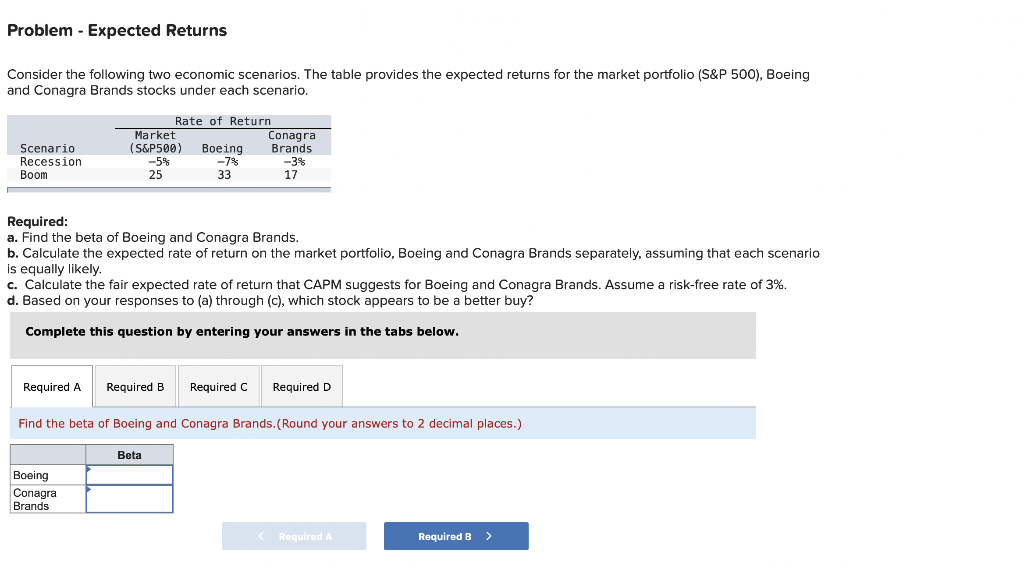

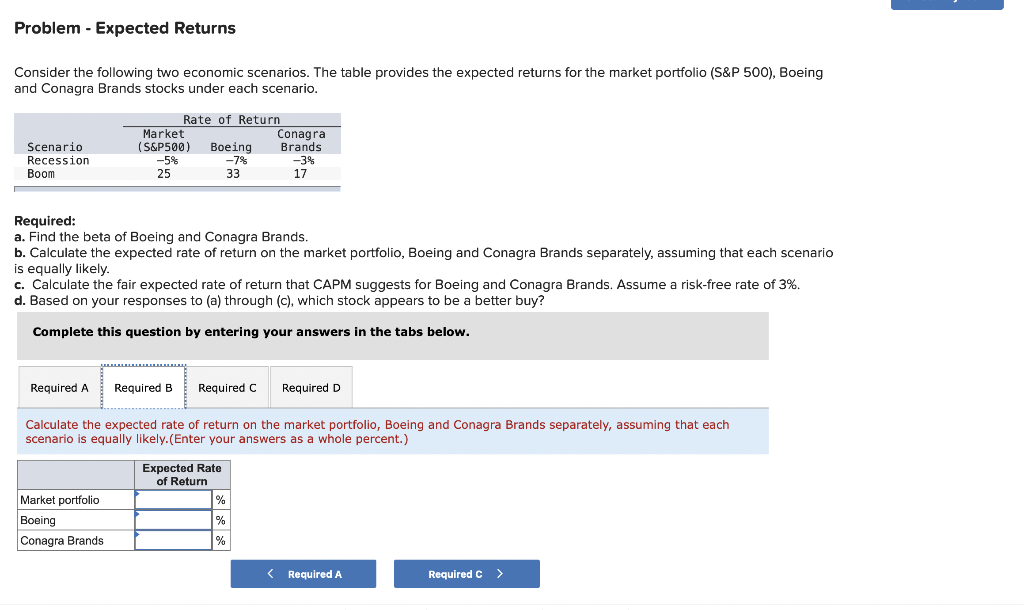

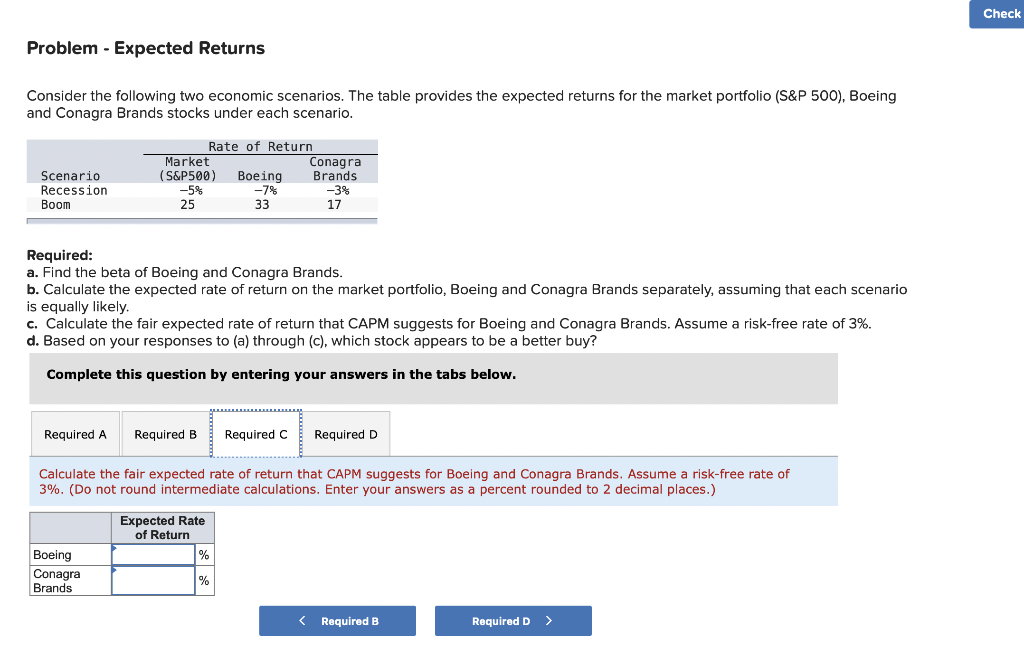

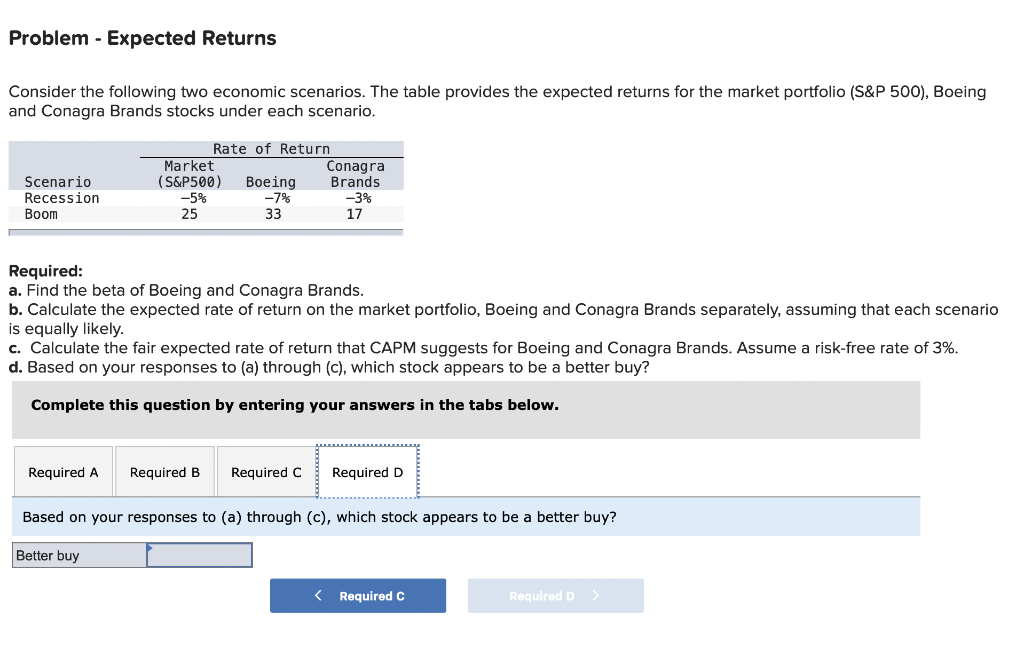

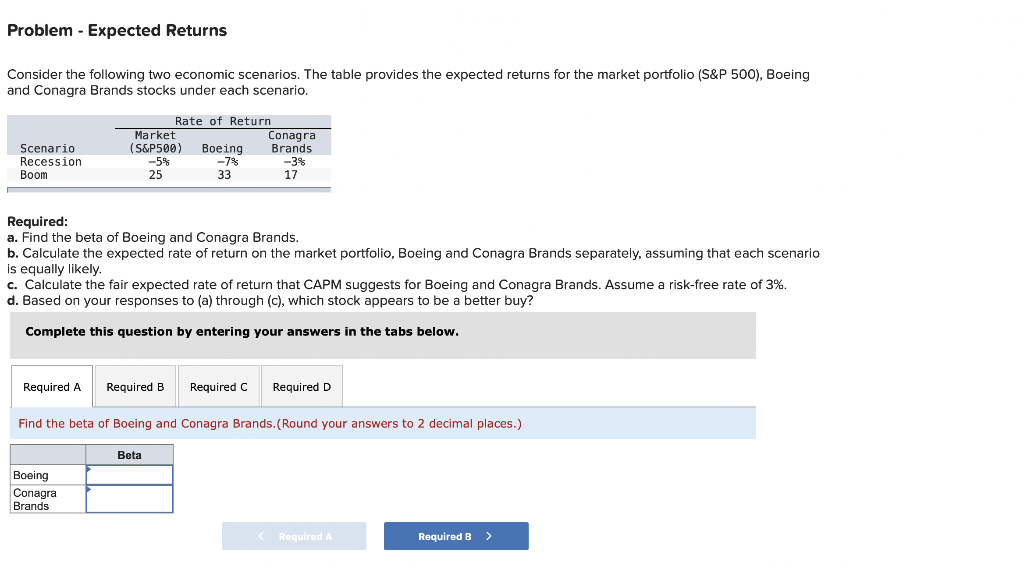

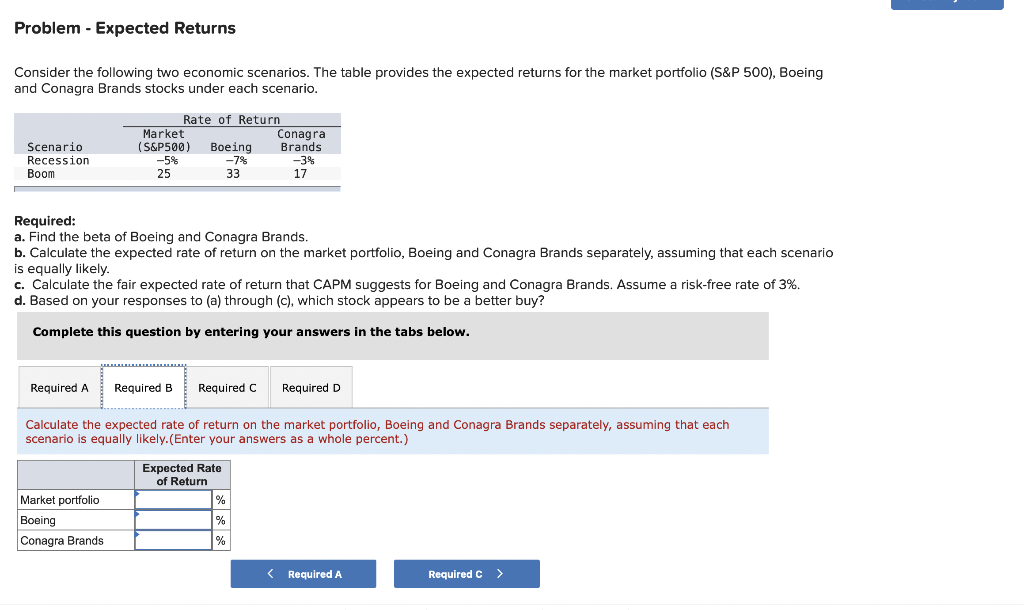

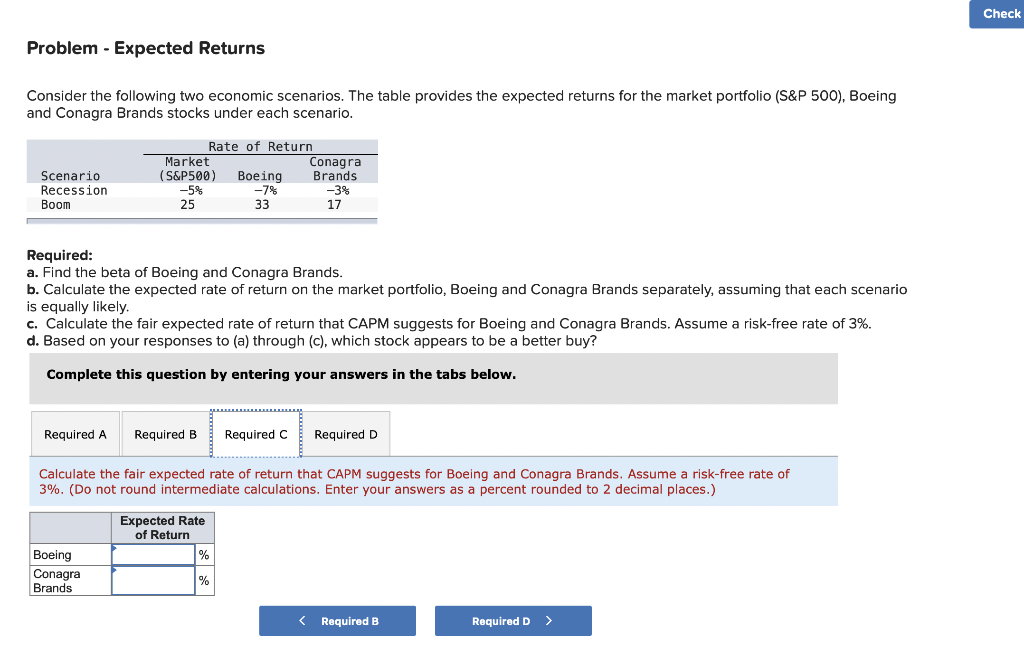

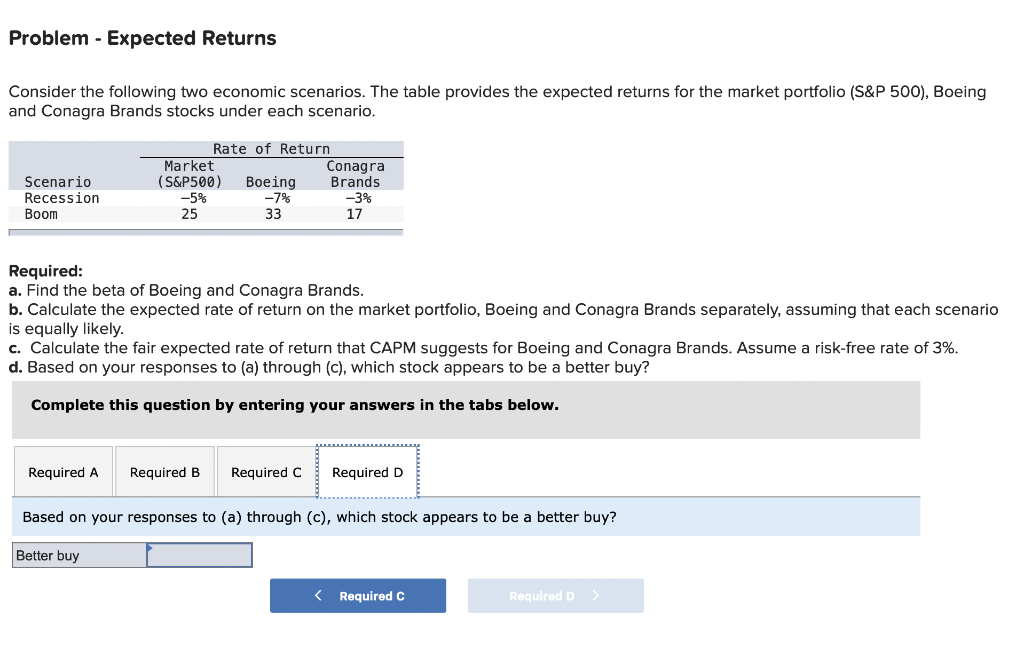

Problem - Expected Returns Consider the following two economic scenarios. The table provides the expected returns for the market portfolio (S&P 500), Boeing and Conagra Brands stocks under each scenario. Scenario Recession Boom Rate of Return Market Conagra (S&P500) Boeing Brands -5% -7% -3% 25 33 17 Required: a. Find the beta of Boeing and Conagra Brands. b. Calculate the expected rate of return on the market portfolio, Boeing and Conagra Brands separately, assuming that each scenario is equally likely c. Calculate the fair expected rate of return that CAPM suggests for Boeing and Conagra Brands. Assume a risk-free rate of 3%. d. Based on your responses to (a) through (c), which stock appears to be a better buy? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Find the beta of Boeing and Conagra Brands.(Round your answers to 2 decimal places.) Beta Boeing Conagra Brands Problem - Expected Returns Consider the following two economic scenarios. The table provides the expected returns for the market portfolio (S&P 500), Boeing and Conagra Brands stocks under each scenario. Scenario Recession Boom Rate of Return Market Conagra (S&P500) Boeing Brands -5% -7% -3% 25 33 17 Required: a. Find the beta of Boeing and Conagra Brands. b. Calculate the expected rate of return on the market portfolio, Boeing and Conagra Brands separately, assuming that each scenario is equally likely. c. Calculate the fair expected rate of return that CAPM suggests for Boeing and Conagra Brands. Assume a risk-free rate of 3%. d. Based on your responses to (a) through (c), which stock appears to be a better buy? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate the expected rate of return on the market portfolio, Boeing and Conagra Brands separately, assuming that each scenario is equally likely. (Enter your answers as a whole percent.) Expected Rate of Return % Market portfolio Boeing Conagra Brands % Check Problem - Expected Returns Consider the following two economic scenarios. The table provides the expected returns for the market portfolio (S&P 500), Boeing and Conagra Brands stocks under each scenario. Scenario Recession Boom Rate of Return Market Conagra (S&P500) Boeing Brands -5% -7% -3% 25 33 17 Required: a. Find the beta of Boeing and Conagra Brands. b. Calculate the expected rate of return on the market portfolio, Boeing and Conagra Brands separately, assuming that each scenario is equally likely. c. Calculate the fair expected rate of return that CAPM suggests for Boeing and Conagra Brands. Assume a risk-free rate of 3%. d. Based on your responses to (a) through (c), which stock appears to be a better buy? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate the fair expected rate of return that CAPM suggests for Boeing and Conagra Brands. Assume a risk-free rate of 3%. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected Rate of Return % Boeing Conagra Brands % Problem - Expected Returns Consider the following two economic scenarios. The table provides the expected returns for the market portfolio (S&P 500), Boeing and Conagra Brands stocks under each scenario. Scenario Recession Boom Rate of Return Market Conagra (S&P500) Boeing Brands -5% -7% -3% 25 33 17 Required: a. Find the beta of Boeing and Conagra Brands. b. Calculate the expected rate of return on the market portfolio, Boeing and Conagra Brands separately, assuming that each scenario is equally likely. c. Calculate the fair expected rate of return that CAPM suggests for Boeing and Conagra Brands. Assume a risk-free rate of 3%. d. Based on your responses to (a) through (c), which stock appears to be better buy? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Based on your responses to (a) through (c), which stock appears to be a better buy? Better buy