Question

Problem for LN-1 material. You have been notified that you will be receiving an amount of $2,000 a year for the next 2 years (end

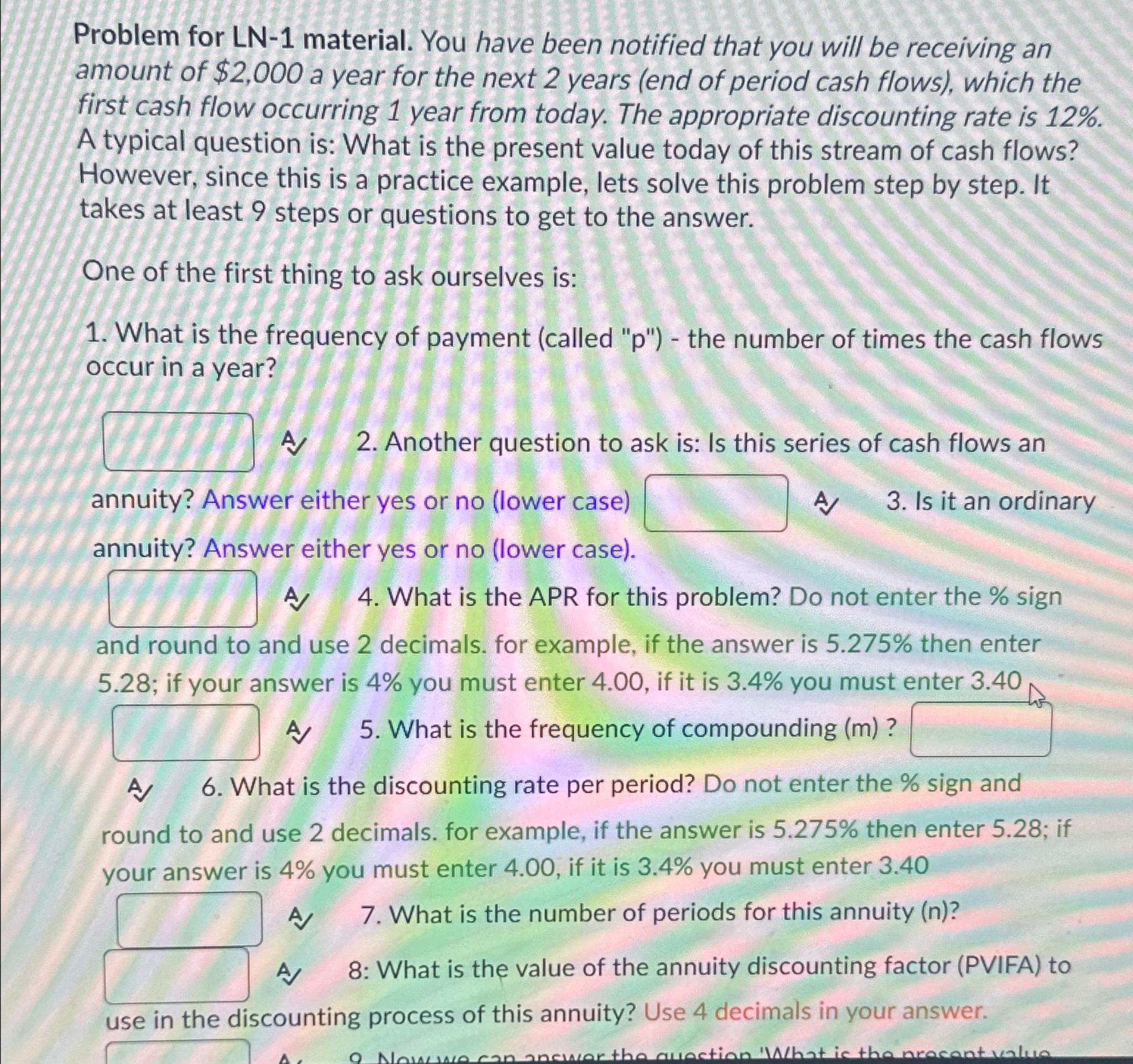

Problem for LN-1 material. You have been notified that you will be receiving an amount of

$2,000a year for the next 2 years (end of period cash flows), which the first cash flow occurring 1 year from today. The appropriate discounting rate is

12%. A typical question is: What is the present value today of this stream of cash flows? However, since this is a practice example, lets solve this problem step by step. It takes at least 9 steps or questions to get to the answer.\ One of the first thing to ask ourselves is:\ What is the frequency of payment (called "p") - the number of times the cash flows occur in a year?\ A 2. Another question to ask is: Is this series of cash flows an annuity? Answer either yes or no (lower case)\ A 3 . Is it an ordinary\ annuity? Answer either yes or no (lower case).\ A 4. What is the APR for this problem? Do not enter the % sign and round to and use 2 decimals. for example, if the answer is

5.275%then enter 5.28 ; if your answer is

4%you must enter 4.00 , if it is

3.4%you must enter 3.40\ A 5 . What is the frequency of compounding

(m)?\ A 6. What is the discounting rate per period? Do not enter the % sign and round to and use 2 decimals. for example, if the answer is

5.275%then enter 5.28 ; if your answer is

4%you must enter 4.00 , if it is

3.4%you must enter 3.40\ A 7 . What is the number of periods for this annuity

(n)?\ A 8: What is the value of the annuity discounting factor (PVIFA) to\ use in the discounting process of this annuity? Use 4 decimals in your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started