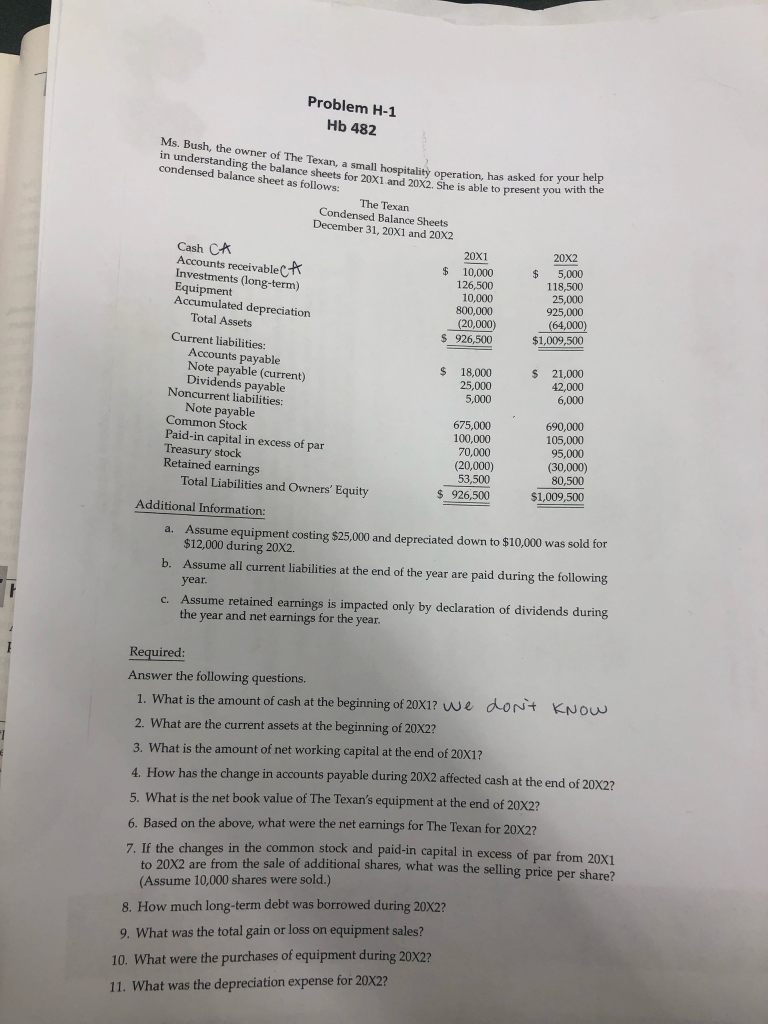

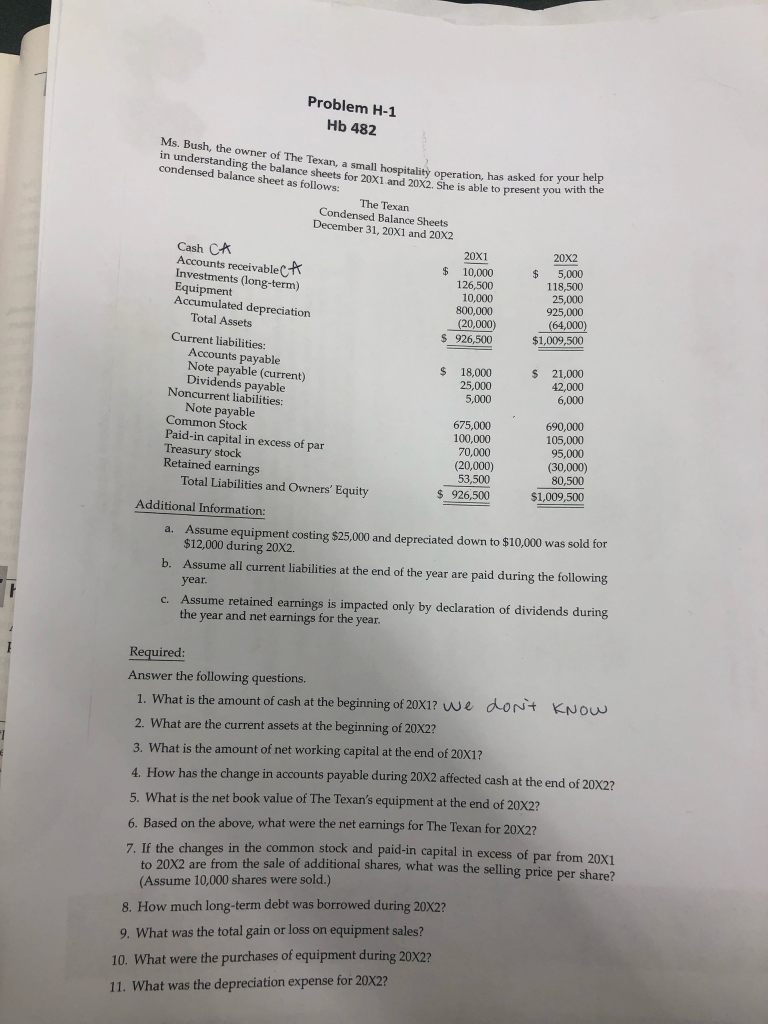

Problem H-1 Hb 482 Ms. Bush, the owner of The Texan, a in understanding the balance sheets for 20X1 and 20X2. She is able to present you condensed balance sheet as follows: small hospitality operation, has asked for your help Condensed Balance Sheets December 31, 20X1 and 20X2 Cash Ct Investments (long-term) Accumulated depreciation 20X1 20X2 t evabck 10,000 $% 5,000 118,500 25,000 925,000 (64,000) $1,009,500 126,500 10,000 800,000 (20,000) Total Assets Current liabilities: $ 926,500 Accounts payable $18,000 25,000 5,000 s 21,000 42,000 6,000 Note payable (current) Dividends payable Noncurrent liabilities Note payable Common Stock Paid-in capital in excess of par Treasury stock Retained earnings 675,000 100,000 70,000 (20,000) 53,500 $926,500 690,000 105,000 95,000 (30,000) 80,500 $1,009,500 Total Liabilities and Owners' Equity Additional Information: Assume equipment costing $25,000 and depreciated down to $10,000 was sold for $12,000 during 20X2. Assume all current liabilities at the end of the year are paid during the following year Assume retained earnings is impacted only by declaration of dividends during the year and net earnings for the year a. b. c. Required: Answer the following questions. 1. What is the amount of cash at the begining of 20X17 we dorit KNow 2. What are the current assets at the beginning of 20X2? 3. What is the amount of net working capital at the end of 20X1? 4. How has the change in accounts payable during 20x2 affected cash at the end of 20x2? 5. What is the net book value of The Texan's equipment at the end of 20x22 6. Based on the above, what were the net earnings for The Texan for 20X2? 7. If the changes in the common stock and paid-in capital in excess of par from 20X1 from the sale of additional shares, what was the selling price per share? to 20X2 are (Assume 10,000 shares were sold.) 8. How much long-term debt was borrowed during 20X22 9. What was the total gain or loss on equipment sales? 10. What were the purchases of equipment during 20x22 11. What was the depreciation expense for 20x22