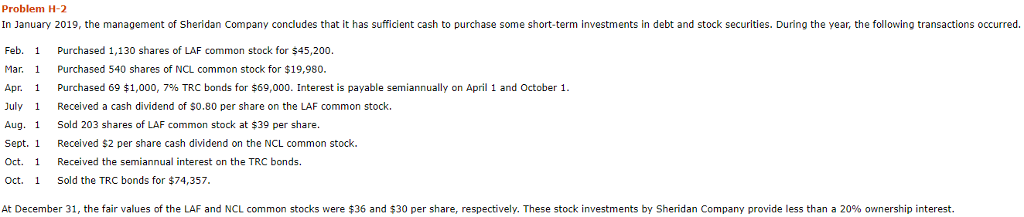

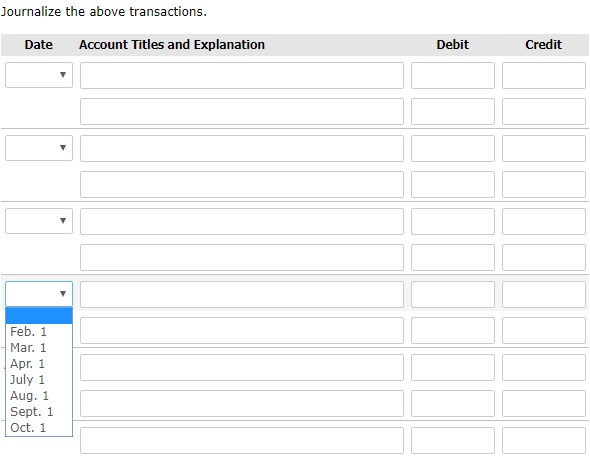

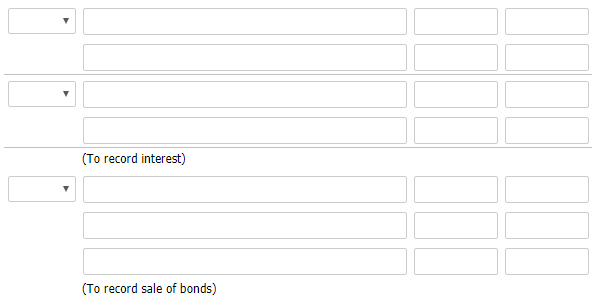

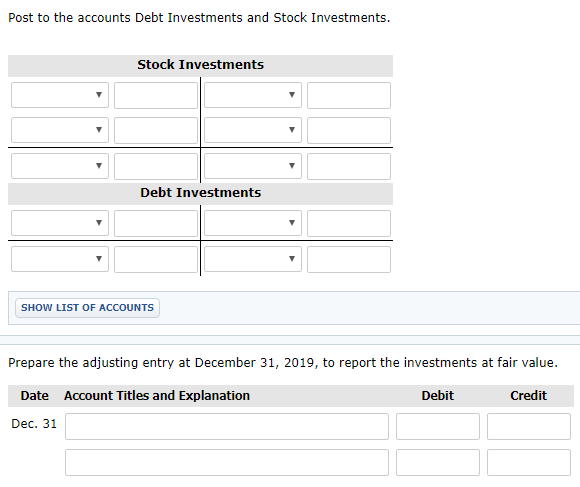

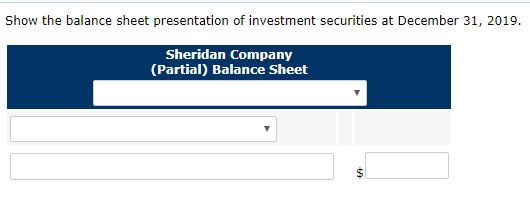

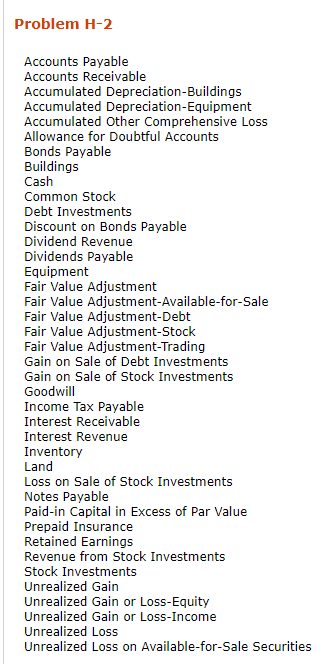

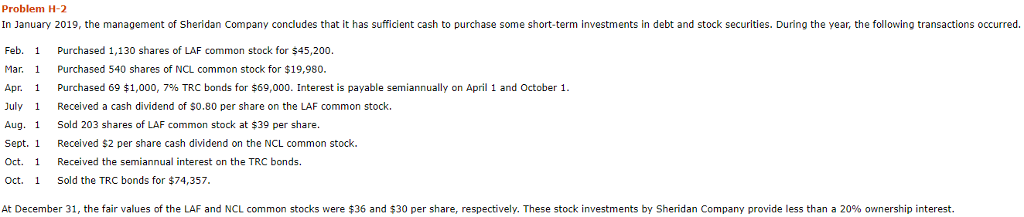

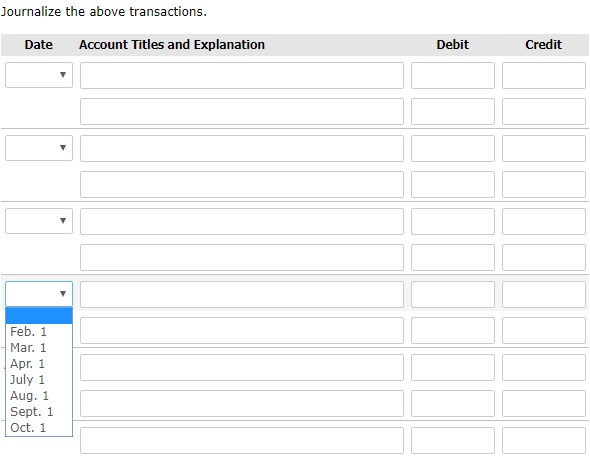

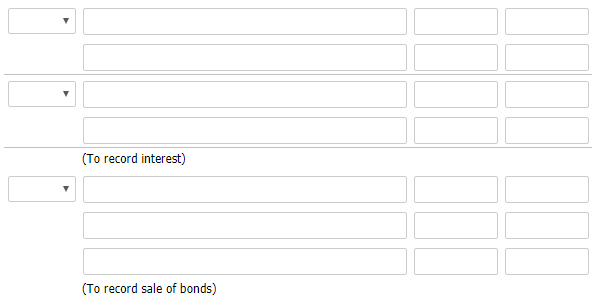

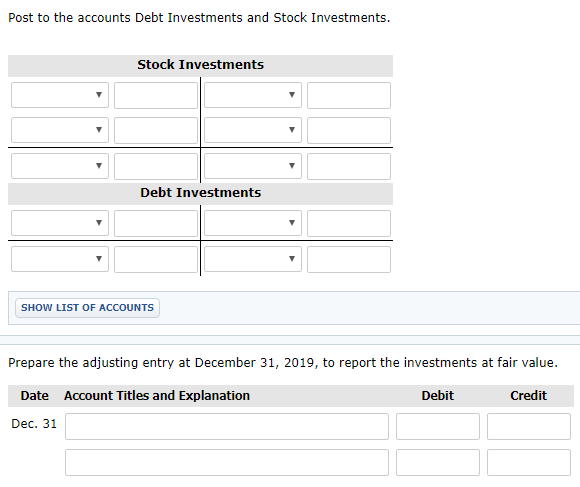

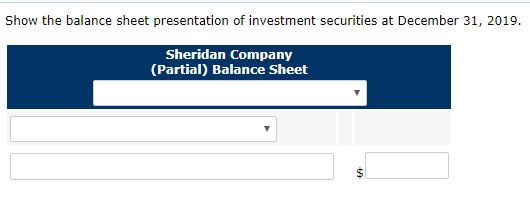

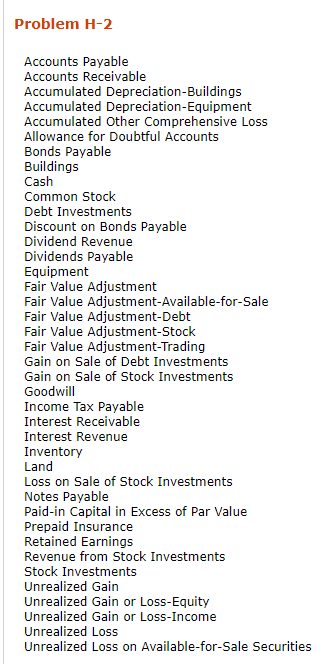

Problem H-2 In January 2019, the management of Sheridan Company concludes that it has sufficient cash to purchase some short-term investments in debt and stock securities. During the year, the following transactions occurred. Feb. 1 Purchased 1,130 shares of LAF common stock for $45,200 Mar. Purchased 540 shares of NCL common stock for $19,980. Apr. 1 Purchased 69 $1,000, 7% TRC bonds for $69,000. Interest is payable semiannually on April 1 and October 1 JulyReceived a cash dividend of s0.80 per share on the LAF common stock. Aug. 1 Sold 203 shares of LAF common stock at $39 per share. Sept. 1 Received $2 per share cash dividend on the NCL common stock Oct. 1 Received the semiannual interest on the TRC bonds. Oct. 1 Sold the TRC bonds for $74,357,. At December 31, the fair values of the LAF and NCL common stocks were $36 and $30 per share, respectively. These stock investments by Sheridan Company provide less than a 20% ownership interest. Journalize the above transactions. Date Account Titles and Explanation Debit Credit Feb. 1 Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 To record interest) (To record sale of bonds) Post to the accounts Debt Investments and Stock Investments. Stock Investments Debt Investments SHOW LIST OF ACCOUNTS Prepare the adjusting entry at December 31, 2019, to report the investments at fair value. Date Account Titles and Explanation Debit Credit Dec. 31 Show the balance sheet presentation of investment securities at December 31, 2019. Sheridan Company (Partial) Balance Sheet Problem H-2 Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Other Comprehensive Loss Allowance for Doubtful Accounts Bonds Payable Buildings Cash Common Stock Debt Investments Discount on Bonds Payable Dividend Revenue Dividends Payable Equipment Fair Value Adjustment Fair Value Adjustment-Available-for-Sale Fair Value Adjustment-Debt Fair Value Adjustment-Stock Fair Value Adjustment-Trading Gain on Sale of Debt Investments Gain on Sale of Stock Investments Goodwill Income Tax Payable Interest Receivable Interest Revenue Inventory Land Loss on Sale of Stock Investments Notes Payable Paid-in Capital in Excess of Par Value Prepaid Insurance Retained Earnings Revenue from Stock Investments Stock Investments Unrealized Gain Unrealized Gain or Loss-Equity Unrealized Gain or Loss-Income Unrealized Loss Unrealized Loss on Available-for-Sale Securities