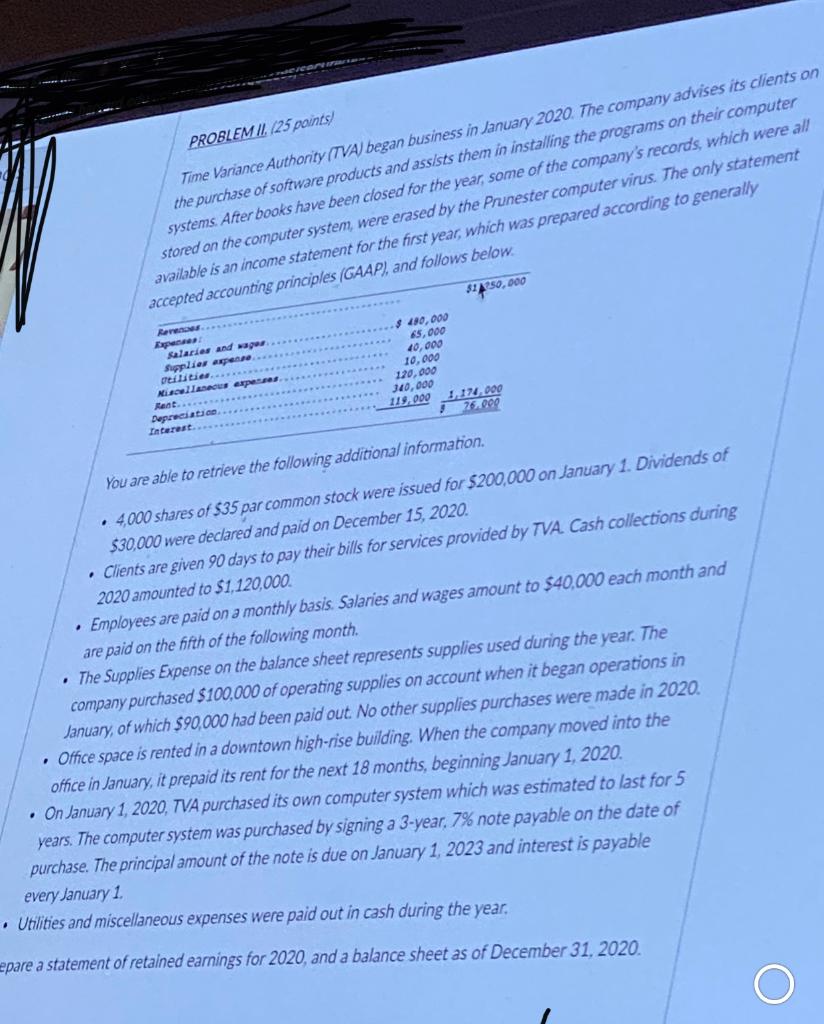

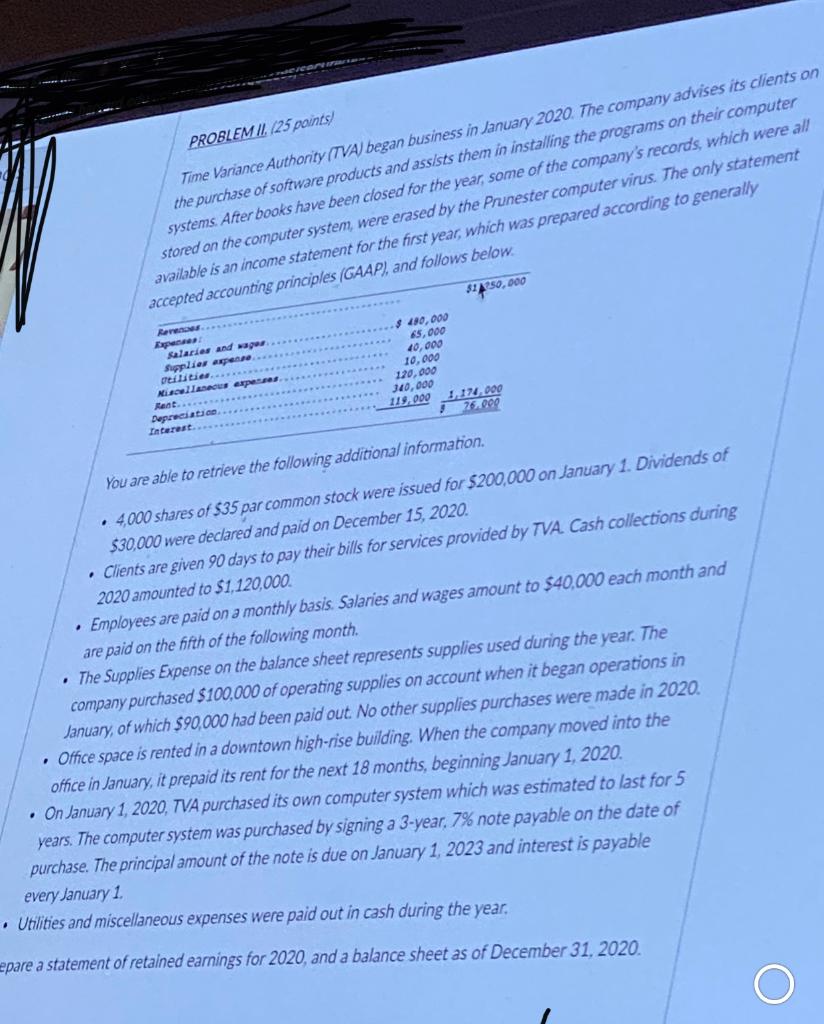

PROBLEM II. (25 points) Time Variance Authority (TVA) began business in January 2020. The company advises its clients on the purchase of software products and assists them in installing the programs on their computer systems. After books have been closed for the year, some of the company's records, which were all stored on the computer system, were erased by the Prunester computer virus. The only statement available is an income statement for the first year, which was prepared according to generally accepted accounting principles (GAAP), and follows below. $11250,000 Rer AR Salaries and was Supplier expense pilities. ***** Kiellanus expenses kant.. Depreciation Interest, $ 110,000 65,000 10,000 10,000 170,000 340,000 119.000 1.174.000 75.000 You are able to retrieve the following additional information. 4,000 shares of $35 par common stock were issued for $200,000 on January 1. Dividends of $30,000 were declared and paid on December 15, 2020. Clients are given 90 days to pay their bills for services provided by TVA. Cash collections during 2020 amounted to $1,120,000. Employees are paid on a monthly basis. Salaries and wages amount to $40,000 each month and are paid on the fifth of the following month. The Supplies Expense on the balance sheet represents supplies used during the year. The company purchased $100,000 of operating supplies on account when it began operations in January, of which $90,000 had been paid out. No other supplies purchases were made in 2020. Office space is rented in a downtown high-rise building. When the company moved into the office in January, it prepaid its rent for the next 18 months, beginning January 1, 2020. On January 1, 2020, TVA purchased its own computer system which was estimated to last for 5 years. The computer system was purchased by signing a 3-year, 7% note payable on the date of purchase. The principal amount of the note is due on January 1, 2023 and interest is payable every January 1 Utilities and miscellaneous expenses were paid out in cash during the year. epare a statement of retained earnings for 2020, and a balance sheet as of December 31, 2020. PROBLEM II. (25 points) Time Variance Authority (TVA) began business in January 2020. The company advises its clients on the purchase of software products and assists them in installing the programs on their computer systems. After books have been closed for the year, some of the company's records, which were all stored on the computer system, were erased by the Prunester computer virus. The only statement available is an income statement for the first year, which was prepared according to generally accepted accounting principles (GAAP), and follows below. $11250,000 Rer AR Salaries and was Supplier expense pilities. ***** Kiellanus expenses kant.. Depreciation Interest, $ 110,000 65,000 10,000 10,000 170,000 340,000 119.000 1.174.000 75.000 You are able to retrieve the following additional information. 4,000 shares of $35 par common stock were issued for $200,000 on January 1. Dividends of $30,000 were declared and paid on December 15, 2020. Clients are given 90 days to pay their bills for services provided by TVA. Cash collections during 2020 amounted to $1,120,000. Employees are paid on a monthly basis. Salaries and wages amount to $40,000 each month and are paid on the fifth of the following month. The Supplies Expense on the balance sheet represents supplies used during the year. The company purchased $100,000 of operating supplies on account when it began operations in January, of which $90,000 had been paid out. No other supplies purchases were made in 2020. Office space is rented in a downtown high-rise building. When the company moved into the office in January, it prepaid its rent for the next 18 months, beginning January 1, 2020. On January 1, 2020, TVA purchased its own computer system which was estimated to last for 5 years. The computer system was purchased by signing a 3-year, 7% note payable on the date of purchase. The principal amount of the note is due on January 1, 2023 and interest is payable every January 1 Utilities and miscellaneous expenses were paid out in cash during the year. epare a statement of retained earnings for 2020, and a balance sheet as of December 31, 2020