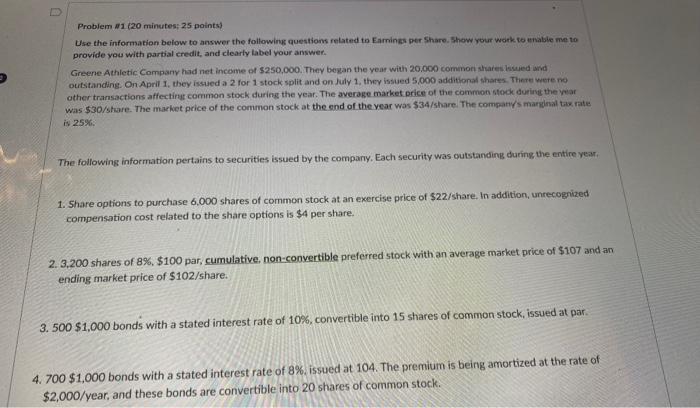

Problem III 120 minutes: 25 points) Use the information below to answer the following questions related to Earninzs per Share. Show your work to enable me to provide you with partial credit, and clearly label your answer. Greene Athietic Company had net income of \$250,000. They began the year with 20,000 common shares lisued und Greene Athletic Company had net income of 5250,000 . They bogan the On April 1, they issued a 2 for 1 stock split and on July 1, they issued 5,000 additional shares. There were no other transactions affectirut common stock during the year. The average market price of the common sfock durinet the vear was $30/ share. The market price of the common stock at the end of the vear was $34/ share. The compan/s marninal tix rate is 25% : The following information pertains to securities issued by the company. Each security was outstanding during the entire year, 1. Share options to purchase 6,000 shares of common stock at an exercise price of $22/ share. In addition, unrecognized compensation cost related to the share options is $4 per share. 2. 3,200 shares of 8%,$100 par, cumulative, non-convertible preferred stock with an average market price of $107 and an ending market price of $102/ share. 3. 500$1,000 bonds with a stated interest rate of 10%, convertible into 15 shares of common stock, issued at par. 4. 700$1,000 bonds with a stated interest rate of 8% issued at 104. The premium is being amortized at the rate of $2,000/year, and these bonds are convertible into 20 shares of common stock. Question 13 5pts Compute Greene : Basic Earnings per Share. Edit View insert Format Toob Table p ( (1) 0 words Question 14 3 pts Given the information that you have about the options, are they potentially dilutive? Why or wiy not? Edit View insert Format Tools Table Question 15 Given the information you have about the shares of the 8%,$100 par preferred stock, are they potentially dilutive? Whiv or why not? Edit View Insert Format Tools Table Question 16 3 ots Given the information you have about the 10% bonds, are they potentially dilutive? Why or wivy not? Edit View insert Formut Tools Table