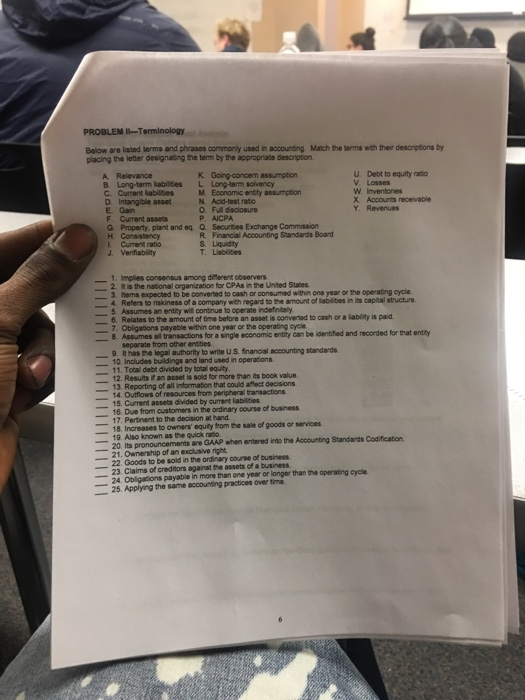

PROBLEM Ii-Terminology Below are isted terms and phrases commonly used in accounting Match the terms with their descriptions by placing the letter designating the term by the appropriate description U. Debt to equity ratio V. Losses W. Inventories K Going-concern assumption B. Long-term liabilises L Long-Herm solvency C. Current labilties D. Intangble asset E. Gain F. Current assets M. Economic entty assumption N Acid-test rato o. Full dsclosure P A CPA Accounts recevable Y. Revenues Property. plant and eq. Q Securtes Exchange Commission L Current ratio R. Financial Accounting Standards Board S. Lquidty T. Liabilities 2 is the national organization for CPAs n United States. 3 herns expected to be converted to cash orconsumed wehn one year orthe ating cycle 4. Refers to riskiness of a company with regard to the amount of liabilibies in its capeal structure 5. Assumes an entity will continue to operate indefnitely 6. Relates to the amount of time before an asset is converted to cash or a labity is paid 7. Obligations payable within one year or the operating eyce 8. Assumes al transactions for a single economic entity can be identifed and recorded for that entity 9. thas the legal authority to write U.S. financial accounting standards 12. Results if an asset is sold for more than its book value separate from other 10. Inodes buldings and land used i, operation 11. Total debt divided by total equity -13 Reporting of all infrmation that could afect deosons 14. Outflows of resources from peripheral transactions 15. Current assets divided by current labilities 16. Due from customers in the ordinary course of business 17. Pertinent to the decision at hand 18. Increases to owners' equity from the sale of goods or services 19. Also known as the quick ratio are GAAP when entered into the Accounting Standards Codification 20. Its 21. Ownership of an exclusive right 22. Goods to be sold in the ordinary course of business 23. Claims of creditors against the assets of a business 24. Obligations payable in more than one year or longer than the operating cycle 25. Applying the same accounting practices over time