Answered step by step

Verified Expert Solution

Question

1 Approved Answer

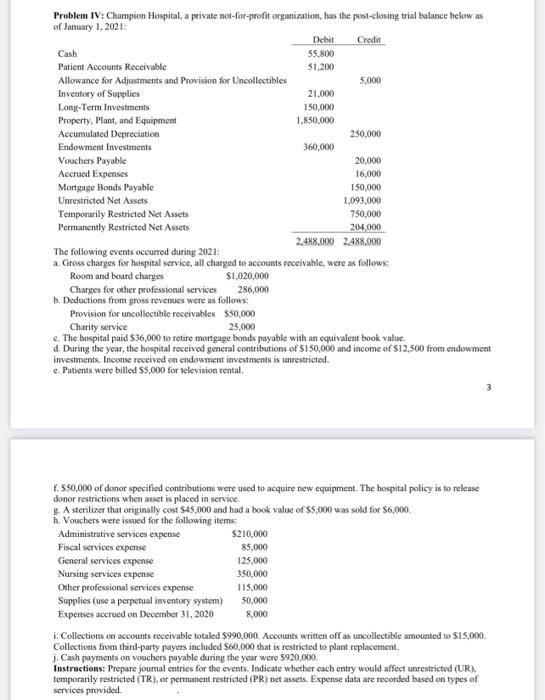

Problem IV: Champion Hospital, a private not-for-profit organization, has the post-closing trial balance below as of January 1, 2021: Cash Patient Accounts Receivable Allowance for

Problem IV: Champion Hospital, a private not-for-profit organization, has the post-closing trial balance below as of January 1, 2021: Cash Patient Accounts Receivable Allowance for Adjustments and Provision for Uncollectibles Inventory of Supplies Long-Term Investments Property, Plant, and Equipment Accumulated Depreciation Endowment Investments Vouchers Payable Accrued Expenses Mortgage Bonds Payable Unrestricted Net Assets Temporarily Restricted Net Assets Permanently Restricted Net Assets Debit 55,800 51,200 21,000 150,000 1,850,000 360,000 General services expense Nursing services expense Other professional services expense Supplies (use a perpetual inventory system) Expenses accrued on December 31, 2020 Credit $210,000 85,000 125,000 350,000 115,000 50,000 8,000 5,000 250,000 The following events occurred during 2021: a. Gross charges for hospital service, all charged to accounts receivable, were as follows: Room and board charges $1,020,000 286,000 20,000 16,000 150,000 1,093,000 750,000 204,000 2,488,000 2,488,000 Charges for other professional services b. Deductions from gross revenues were as follows: Provision for uncollectible receivables $50,000 25,000 Charity service c. The hospital paid $36,000 to retire mortgage bonds payable with an equivalent book value. d. During the year, the hospital received general contributions of $150,000 and income of $12,500 from endowment investments. Income received on endowment investments is unrestricted. e. Patients were billed $5,000 for television rental. f. $50,000 of donor specified contributions were used to acquire new equipment. The hospital policy is to release donor restrictions when asset is placed in service. g. A sterilizer that originally cost $45,000 and had a book value of $5,000 was sold for $6,000. h. Vouchers were issued for the following items: Administrative services expense Fiscal services expense i. Collections on accounts receivable totaled $990,000. Accounts written off as uncollectible amounted to $15,000. Collections from third-party payers included $60,000 that is restricted to plant replacement. j. Cash payments on vouchers payable during the year were $920,000. Instructions: Prepare journal entries for the events. Indicate whether each entry would affect unrestricted (UR), temporarily restricted (TR), or permanent restricted (PR) net assets. Expense data are recorded based on types of services provided. 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started