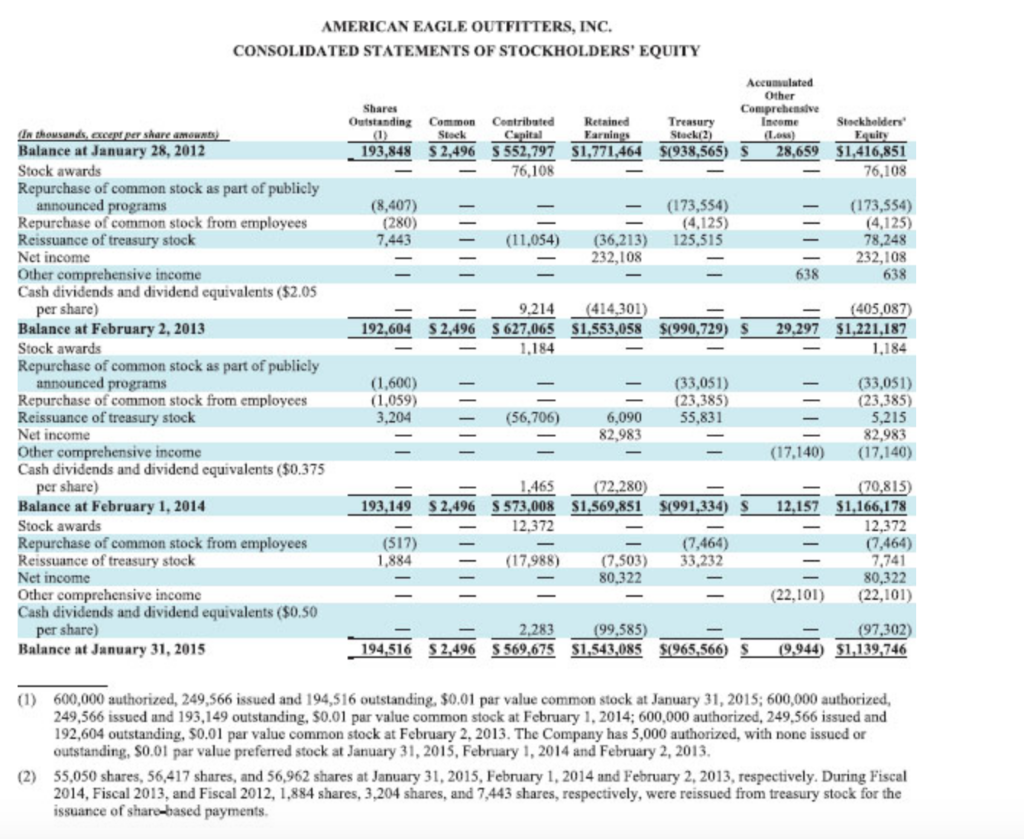

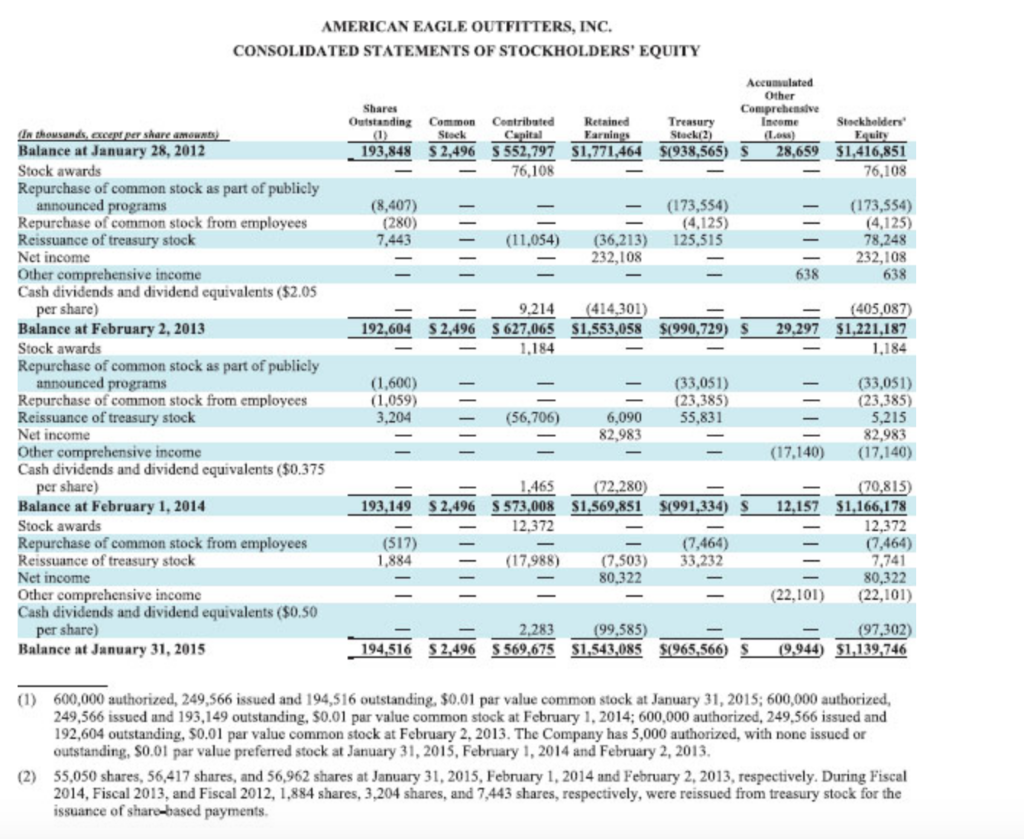

Problem IX: Key Ratios A. What does the return on equity (ROE) measure? Answer B. Using the financial statements provided in Appendix A of your textbook for American Eagle Outfitters, Inc., calculate their return on equity for the years ended 1/31/15 and 2/1/14, respectively. Round to at least two decimal points. Note: Use the Consolidated Statements of Stockholders' Equity (page A-7 in your textbook) to determine the average stockholders' equity balances. Return on Equity (ROE)-net income+average stockholders' equity Answers: ROE for year ended 1/31/15 ROE for year ended 2/1/14- C. Did American Eagle Outfitters, Inc.'s ROE improve from 2014 to 2015? Answer: AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Shares Outstanding Common Centribsted Retained Treasury ncome share amowNts Balance at January 28, 2012 Stock awards Repurchase of common stock as part of publicly 193,848 $2,496 S552,797 S1.771464 $(938,565) S 28,659 $1416.851 76,108 76,108 (173,554) 4,125) 125,515 (173,554) (4,125 78,248 232,108 638 Repurchase of common stock from employees Reissuance of treasury stock Net income Other comprehensive income Cash dividends and dividend equivalents ($2.05 (280) 7,443 (11,054) (36,213) 232,108 - per share) Balance at February 2,2013 Stock awards Repurchase of common stock as part of publicly 9.214 (414,301) 1405.08 192,604 S2,496 S 627,065 $1,553,058 $(990,729) 29.297 $1,221,187 1.184 (1,600) 1,059) 3,204 (33,051) (23,385) 5,215 82,983 (17,140) (17,140) (33,051) (23,385) 55,831 Repurchase of common stock from employees Reissuance of treasury stock (56,706) 6,090 82,983 Net income Other comprehensive income Cash dividends and dividend equivalents ($0.375 per share) Balance at February 1, 2014 Stock awards Repurchase of common stock from employees Reissuance of treasury stock Net income Other comprehensive income Cash dividends and dividend equivalents ($0.50 70,815) 193.149 S2,496 S 573.008 51.569.851 $(991334) S12.157 1.166,178 12,372 (7,464) ,741 80,322 22,101) (22,101) 12,372 17.988) (7,503) 33,232 80,322 1,884 2,283 S569.675 99,585 S,543,085 per share) Balance at January 31,2015 (97,302) 9944 $1.139.746 194,516 $2,496 $(965,566) 1) 600,000 authorized, 249,566 issued and 194,516 outstanding, $0.01 par value common stock at January 31, 2015;600,000 authorized, 249,566 issued and 193,149 outstanding, $0.01 par value common stock at February 1, 2014; 600,000 authorized, 249,566 issued and 192,604 outstanding, $0.01 par value common stock at February 2, 2013. The Company has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock at January 31, 2015, February 1, 2014 and February 2, 2013 (2) 55,050 shares, 56,417 shares, and 56,962 shares at January 31,2015, February 1, 2014 and February 2, 2013, respectively. During Fiscal 2014, Fiscal 2013, and Fiscal 2012, 1,884 shares, 3,204 shares, and 7,443 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Problem IX: Key Ratios A. What does the return on equity (ROE) measure? Answer B. Using the financial statements provided in Appendix A of your textbook for American Eagle Outfitters, Inc., calculate their return on equity for the years ended 1/31/15 and 2/1/14, respectively. Round to at least two decimal points. Note: Use the Consolidated Statements of Stockholders' Equity (page A-7 in your textbook) to determine the average stockholders' equity balances. Return on Equity (ROE)-net income+average stockholders' equity Answers: ROE for year ended 1/31/15 ROE for year ended 2/1/14- C. Did American Eagle Outfitters, Inc.'s ROE improve from 2014 to 2015? Answer: AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Shares Outstanding Common Centribsted Retained Treasury ncome share amowNts Balance at January 28, 2012 Stock awards Repurchase of common stock as part of publicly 193,848 $2,496 S552,797 S1.771464 $(938,565) S 28,659 $1416.851 76,108 76,108 (173,554) 4,125) 125,515 (173,554) (4,125 78,248 232,108 638 Repurchase of common stock from employees Reissuance of treasury stock Net income Other comprehensive income Cash dividends and dividend equivalents ($2.05 (280) 7,443 (11,054) (36,213) 232,108 - per share) Balance at February 2,2013 Stock awards Repurchase of common stock as part of publicly 9.214 (414,301) 1405.08 192,604 S2,496 S 627,065 $1,553,058 $(990,729) 29.297 $1,221,187 1.184 (1,600) 1,059) 3,204 (33,051) (23,385) 5,215 82,983 (17,140) (17,140) (33,051) (23,385) 55,831 Repurchase of common stock from employees Reissuance of treasury stock (56,706) 6,090 82,983 Net income Other comprehensive income Cash dividends and dividend equivalents ($0.375 per share) Balance at February 1, 2014 Stock awards Repurchase of common stock from employees Reissuance of treasury stock Net income Other comprehensive income Cash dividends and dividend equivalents ($0.50 70,815) 193.149 S2,496 S 573.008 51.569.851 $(991334) S12.157 1.166,178 12,372 (7,464) ,741 80,322 22,101) (22,101) 12,372 17.988) (7,503) 33,232 80,322 1,884 2,283 S569.675 99,585 S,543,085 per share) Balance at January 31,2015 (97,302) 9944 $1.139.746 194,516 $2,496 $(965,566) 1) 600,000 authorized, 249,566 issued and 194,516 outstanding, $0.01 par value common stock at January 31, 2015;600,000 authorized, 249,566 issued and 193,149 outstanding, $0.01 par value common stock at February 1, 2014; 600,000 authorized, 249,566 issued and 192,604 outstanding, $0.01 par value common stock at February 2, 2013. The Company has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock at January 31, 2015, February 1, 2014 and February 2, 2013 (2) 55,050 shares, 56,417 shares, and 56,962 shares at January 31,2015, February 1, 2014 and February 2, 2013, respectively. During Fiscal 2014, Fiscal 2013, and Fiscal 2012, 1,884 shares, 3,204 shares, and 7,443 shares, respectively, were reissued from treasury stock for the issuance of share-based payments