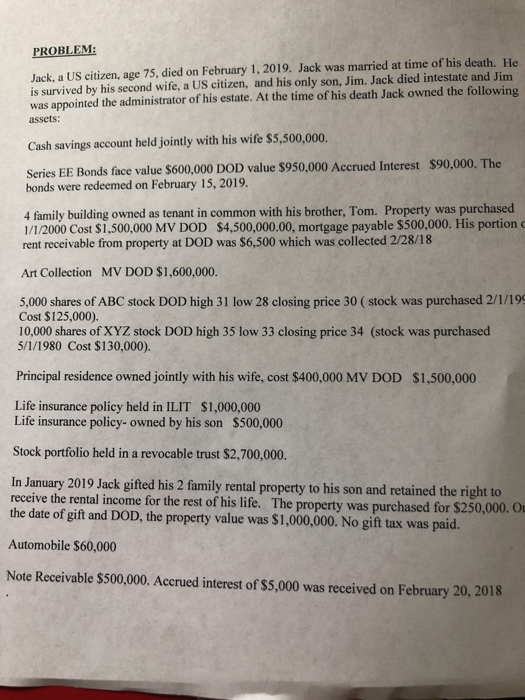

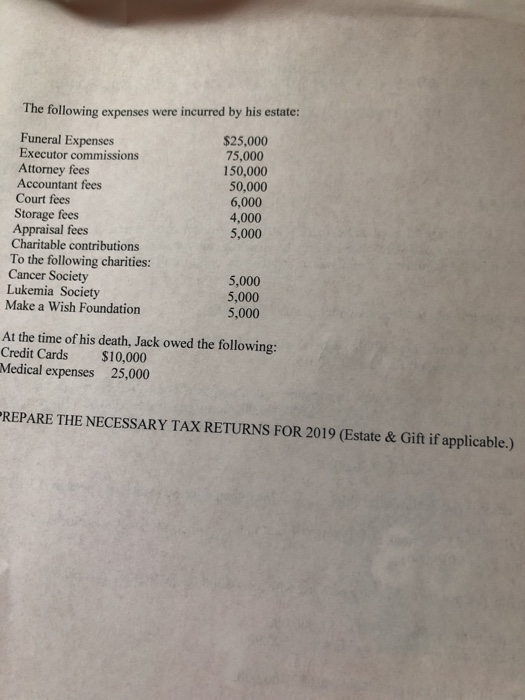

PROBLEM: Jack, a US citizen, age 75, died on February 1, 2019. Jack was married at time of his death. He is survived by his second wife, a US citizen, and his only son, Jim, Jack died intestate and Jim appointed the administrator of his estate. At the time of his death Jack owned the following was assets: Cash savings account held jointly with his wife $5,500,000. Series EE Bonds face value $600,000 DOD value $950,000 Accrued Interest $90,000. The bonds were redeemed on February 15, 2019. 4 family building owned as tenant in common with his brother, Tom. Property was 1/1/2000 Cost $1,500,000 MV DOD $4,500,000.00, mortgage payable $500,000. His portion c rent receivable from property at DOD was $6,500 which was collected 2/28/18 purchased Art Collection MV DOD $1,600,000. 5,000 shares of ABC stock DOD high 31 low 28 closing price 30 (stock was Cost $125,000) 10,000 shares of XYZ stock DOD high 35 low 33 closing price 34 (stock was 5/1/1980 Cost $130,000). purchased 2/1/199 purchased Principal residence owned jointly with his wife, cost $400,000 MV DOD $1,500,000 C Life insurance policy held in ILIT $1,000,000 Life insurance policy- owned by his son $500,000 Stock portfolio held in a revocable trust $2,700,000. In January 2019 Jack gifted his 2 family rental property to his son and retained the right to receive the rental income for the rest of his life. The property was purchased for $250,000. On the date of gift and DOD, the property value was $1,000,000. No gift tax was paid. Automobile $60,000 Note Receivable $500,000. Accrued interest of $5,000 was received on February 20, 2018 The following expenses were incurred by his estate: $25,000 75,000 150,000 50,000 6,000 4,000 5,000 Funeral Expenses Executor commissions Attorney fees Accountant fees Court fees Storage fees Appraisal fees Charitable contributions To the following charities: Cancer Society Lukemia Society Make a Wish Foundation 5,000 5,000 5,000 At the time of his death, Jack owed the following: Credit Cards $10,000 Medical expenses 25,000 REPARE THE NECESSARY TAX RETURNS FOR 2019 (Estate & Gift if applicable.) PROBLEM: Jack, a US citizen, age 75, died on February 1, 2019. Jack was married at time of his death. He is survived by his second wife, a US citizen, and his only son, Jim, Jack died intestate and Jim appointed the administrator of his estate. At the time of his death Jack owned the following was assets: Cash savings account held jointly with his wife $5,500,000. Series EE Bonds face value $600,000 DOD value $950,000 Accrued Interest $90,000. The bonds were redeemed on February 15, 2019. 4 family building owned as tenant in common with his brother, Tom. Property was 1/1/2000 Cost $1,500,000 MV DOD $4,500,000.00, mortgage payable $500,000. His portion c rent receivable from property at DOD was $6,500 which was collected 2/28/18 purchased Art Collection MV DOD $1,600,000. 5,000 shares of ABC stock DOD high 31 low 28 closing price 30 (stock was Cost $125,000) 10,000 shares of XYZ stock DOD high 35 low 33 closing price 34 (stock was 5/1/1980 Cost $130,000). purchased 2/1/199 purchased Principal residence owned jointly with his wife, cost $400,000 MV DOD $1,500,000 C Life insurance policy held in ILIT $1,000,000 Life insurance policy- owned by his son $500,000 Stock portfolio held in a revocable trust $2,700,000. In January 2019 Jack gifted his 2 family rental property to his son and retained the right to receive the rental income for the rest of his life. The property was purchased for $250,000. On the date of gift and DOD, the property value was $1,000,000. No gift tax was paid. Automobile $60,000 Note Receivable $500,000. Accrued interest of $5,000 was received on February 20, 2018 The following expenses were incurred by his estate: $25,000 75,000 150,000 50,000 6,000 4,000 5,000 Funeral Expenses Executor commissions Attorney fees Accountant fees Court fees Storage fees Appraisal fees Charitable contributions To the following charities: Cancer Society Lukemia Society Make a Wish Foundation 5,000 5,000 5,000 At the time of his death, Jack owed the following: Credit Cards $10,000 Medical expenses 25,000 REPARE THE NECESSARY TAX RETURNS FOR 2019 (Estate & Gift if applicable.)