Question

Problem Leida Cruz, a recent law school graduate, was penniless on December 25, 20X0. 1. On December 26, Cruz inherited an enormous sum of money.

Problem

Leida Cruz, a recent law school graduate, was penniless on December 25, 20X0.

1. On December 26, Cruz inherited an enormous sum of money.

2. On December 27, she placed $60,000 in a business checking account for her unincorporated law practice.

3. On December 28, she purchased a home for a down payment of $120,000 plus a home mortgage payable of $230,000.

4. On December 28, Cruz agreed to rent a law office. She provided a $1,000 cash damage deposit (from her business cash), which will be fully refundable when she vacates the premises. This deposit is a business asset. She will make rental payments in advance on the first business day of each month. (The first payment of $700 is not to be made until January 2, 20X1.)

5. On December 28, Cruz purchased a computer for her law practice for $2,000 cash, plus a $3,000 promissory note due in 90 days.

6. On December 28, she purchased legal supplies for $1,000 on open account.

7. On December 28, Cruz purchased office furniture for her practice for $4,000 cash.

8. On December 29, Cruz hired a legal assistant receptionist for $380 per week. She was to report to work on January 2.

9. On December 30, Cruzs law practice lent $3,000 cash in return for a 1-year note from Sam Whitman, a local candy store owner. Whitman had indicated that he would spread the news about the new lawyer.

Required

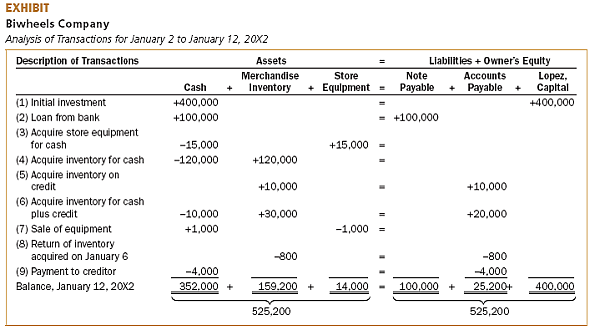

1. Use the format demonstrated in Exhibit to analyze the transactions of Leida Cruz, lawyer. To avoid crowding, put your numbers in thousands of dollars. Do not restrict yourself to the account titles in.

2. Prepare a balance sheet as of December 31, 20X0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started