Answered step by step

Verified Expert Solution

Question

1 Approved Answer

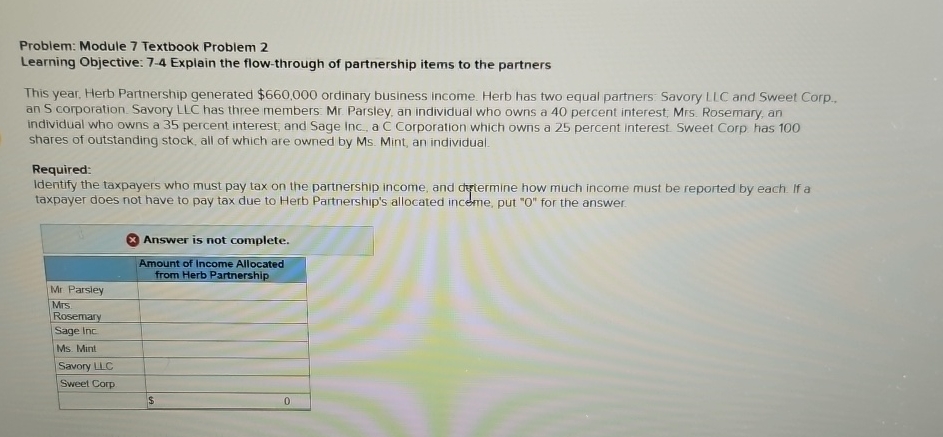

Problem: Module 7 Textbook Problem 2 Learning Objective: 7 - 4 Explain the flow - through of partnership items to the partners This year, Herb

Problem: Module Textbook Problem

Learning Objective: Explain the flowthrough of partnership items to the partners

This year, Herb Partnership generated $ ordinary business income. Herb has two equal partners: Savory LIC and Sweet Corp., an S corporation. Savory LLC has three members: Mr Parsley, an individual who owns a percent interest, Mrs Rosemary, an individual who owns a percent interest; and Sage Inc, a C Corporation which owns a percent interest Sweet Corp has shares of outstanding stock, all of which are owned by Ms Mint, an individual.

Required:

Identify the taxpayers who must pay tax on the partnership income, and dytermine how much income must be reported by each. If a taxpayer does not have to pay tax due to Herb Partnership's allocated inceme, put for the answer.

Answer is not complete.

tabletableAmount of income Allocatedfrom Herb PartnershipMr Parsiey,tableMrsRosemarySage Inc,Ms Mint,Savory LLCSweet Corp,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started