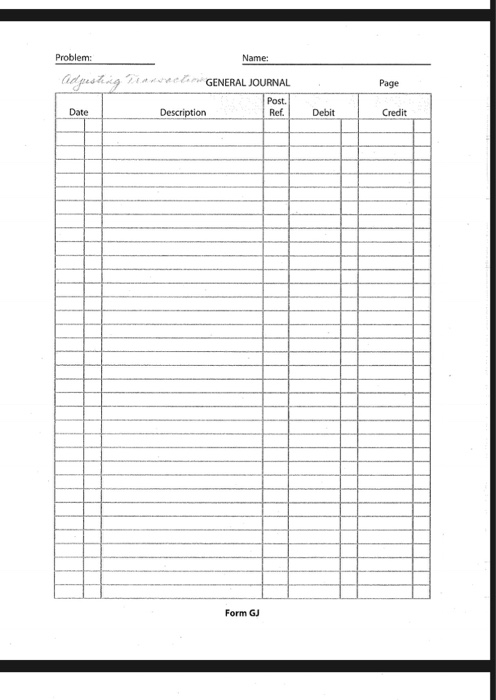

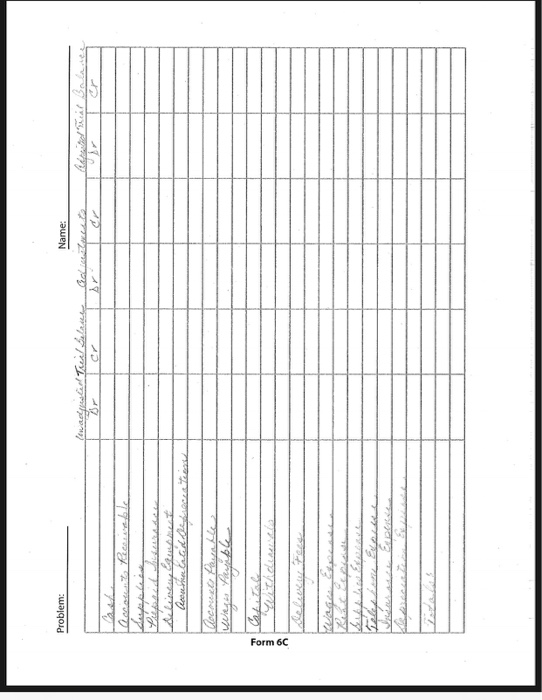

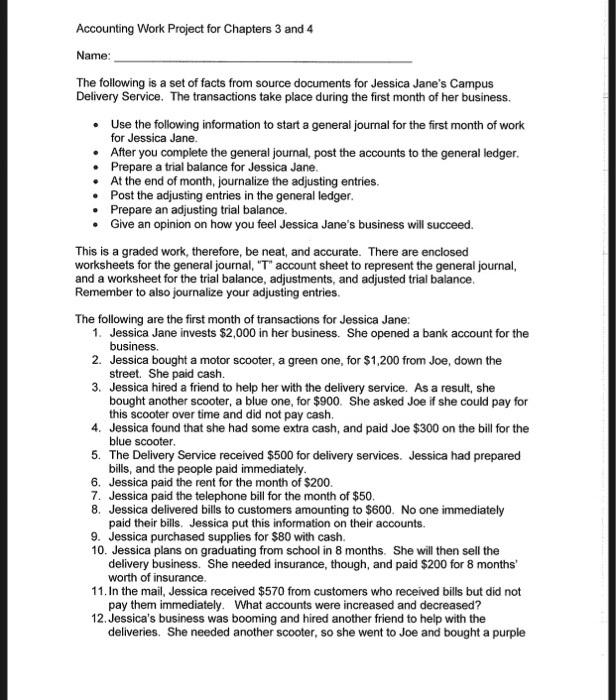

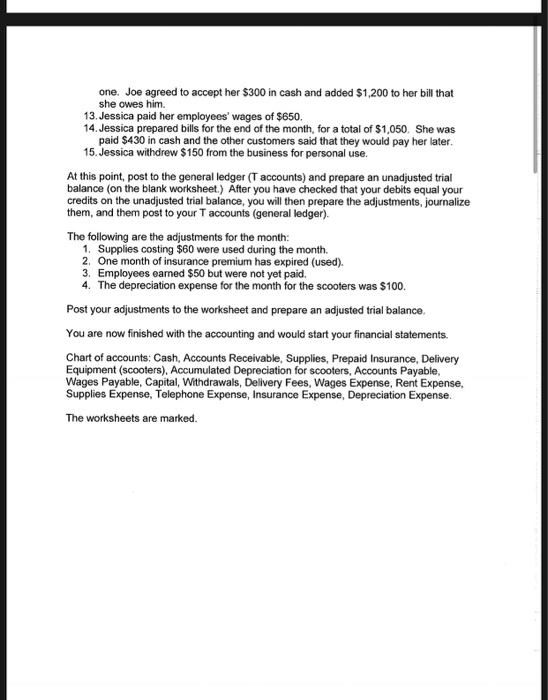

Problem: Name: and gust ing raeccli GENERAL JOURNAL Page Post Ref. Date Description Debit Credit Form GJ Form 6C Problem: Name: wadyst eente Rable pplesn Lajaiedlissde ileinen liat CcohCata arthaaunche Accounting Work Project for Chapters 3 and 4 Name: Delivery Service. The transactions take place during the first month of her business. Use the following information to start a general jounal for the first month of work for Jessica Jane. After you complete the general journal, post the accounts to the general ledger. Prepare a trial balance for Jessica Jane At the end of month, journalize the adjusting entries. Post the adjusting entries in the general ledger. Prepare an adjusting trial balance. Give an opinion on how you feel Jessica Jane's business will succeed This is a graded work, therefore, be neat, and accurate. There are enclosed worksheets for the general journal, "T" account sheet to represent the general journal, and a worksheet for the trial balance, adjustments, and adjusted trial balance. Remember to also journalize your adjusting entries. The following are the first month of transactions for Jessica Jane: 1. Jessica Jane invests $2,000 in her business. She opened a bank account for the business. 2. Jessica bought a motor scooter, a green one, for $1,200 from Joe, down the street. She paid cash. 3. Jessica hired a friend to help her with the delivery service. As a result, she bought another scooter, a blue one, for $900. She asked Joe if she could pay for this scooter over time and did not pay cash. 4. Jessica found that she had some extra cash, and paid Joe $300 on the bill for the blue scooter. 5. The Delivery Service received $500 for delivery services. Jessica had prepared bills, and the people paid immediately. 6. Jessica paid the rent for the month of $200. 7. Jessica paid the telephone bill for the month of $50. 8. Jessica delivered bills to customers amounting to $600. No one immediately paid their bills. Jessica put this information on their accounts. 9. Jessica purchased supplies for $80 with cash. 10. Jessica plans on graduating from school in 8 months. She will then sell the delivery business. She needed insurance, though, and paid $200 for 8 months' worth of insurance 11. In the mail, Jessica received $570 from customers who received bills but did not pay them immediately. What accounts were increased and decreased? 12. Jessica's business was booming and hired another friend to help with the deliveries. She needed another scooter, so she went to Joe and bought a purple one. Joe agreed to accept her $300 in cash and added $1,200 to her bill that she owes him. 13. Jessica paid her employees' wages of $650 14. Jessica prepared bills for the end of the month, for a total of $1,050. She was paid $430 in cash and the other customers said that they would pay her later. 15. Jessica withdrew $150 from the business for personal use. At this point, post to the general ledger (T accounts) and prepare an unadjusted trial balance (on the blank worksheet.) After you have checked that your debits equal your credits on the unadjusted trial balance, you will then prepare the adjustments, journalize them, and them post to your T accounts (general ledger) The following are the adjustments for the month: 1. Supplies costing $60 were used during the month. 2. One month of insurance premium has expired (used) 3. Employees eamed $50 but were not yet paid. 4. The depreciation expense for the month for the scooters was $100. Post your adjustments to the worksheet and prepare an adjusted trial balance. You are now finished with the accounting and would start your financial statements. Chart of accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Delivery Equipment (scooters), Accumulated Depreciation for scooters, Accounts Payable Wages Payable, Capital, Withdrawals, Delivery Fees, Wages Expense, Rent Expense, Supplies Expense, Telephone Expense, Insurance Expense, Depreciation Expense. The worksheets are marked