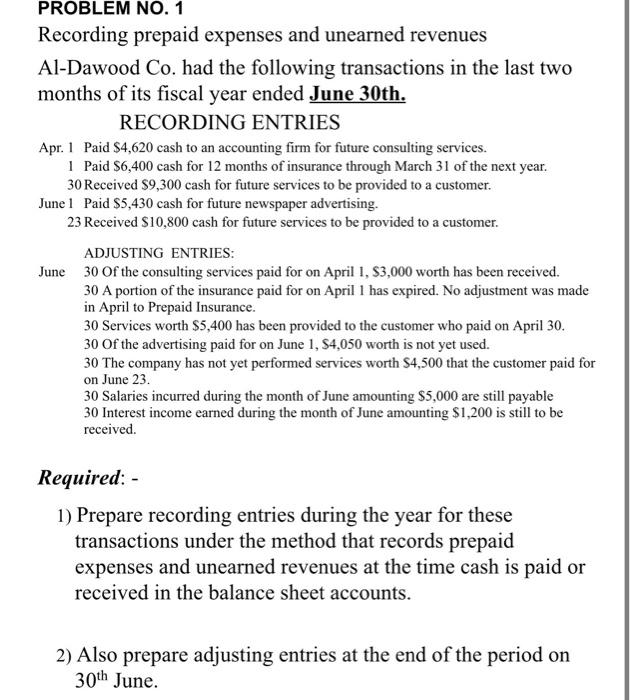

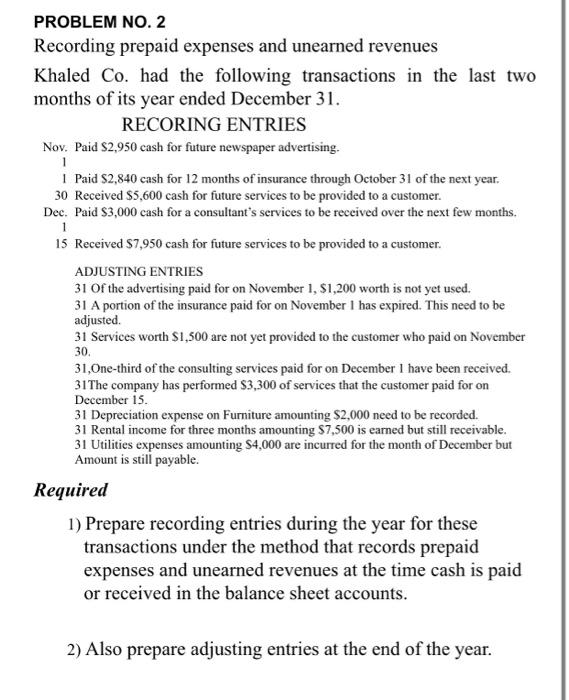

PROBLEM NO. 1 Recording prepaid expenses and unearned revenues Al-Dawood Co. had the following transactions in the last two months of its fiscal year ended June 30th. RECORDING ENTRIES Apr. 1 Paid $4,620 cash to an accounting firm for future consulting services. I Paid $6,400 cash for 12 months of insurance through March 31 of the next year. 30 Received 89,300 cash for future services to be provided to a customer. June 1 Paid $5,430 cash for future newspaper advertising. 23 Received $10,800 cash for future services to be provided to a customer. ADJUSTING ENTRIES: June 30 of the consulting services paid for on April 1, $3,000 worth has been received. 30 A portion of the insurance paid for on April 1 has expired. No adjustment was made in April to Prepaid Insurance. 30 Services worth $5,400 has been provided to the customer who paid on April 30. 30 Of the advertising paid for on June 1, S4,050 worth is not yet used. 30 The company has not yet performed services worth $4,500 that the customer paid for on June 23 30 Salaries incurred during the month of June amounting $5,000 are still payable 30 Interest income earned during the month of June amounting $1,200 is still to be received. Required: - 1) Prepare recording entries during the year for these transactions under the method that records prepaid expenses and unearned revenues at the time cash is paid or received in the balance sheet accounts. 2) Also prepare adjusting entries at the end of the period on 30th June. PROBLEM NO. 2 Recording prepaid expenses and unearned revenues Khaled Co. had the following transactions in the last two months of its year ended December 31. RECORING ENTRIES Nov. Paid $2,950 cash for future newspaper advertising. 1 I Paid $2,840 cash for 12 months of insurance through October 31 of the next year. 30 Received $5,600 cash for future services to be provided to a customer. Dec. Paid $3,000 cash for a consultants services to be received over the next few months. 1 15 Received 87,950 cash for future services to be provided to a customer. ADJUSTING ENTRIES 31 of the advertising paid for on November 1, $1,200 worth is not yet used. 31 A portion of the insurance paid for on November 1 has expired. This need to be adjusted. 31 Services worth $1,500 are not yet provided to the customer who paid on November 30. 31,One-third of the consulting services paid for on December I have been received. 31 The company has performed $3,300 of services that the customer paid for on December 15. 31 Depreciation expense on Furniture amounting $2,000 need to be recorded. 31 Rental income for three months amounting $7,500 is earned but still receivable. 31 Utilities expenses amounting S4,000 are incurred for the month of December but Amount is still payable. Required 1) Prepare recording entries during the year for these transactions under the method that records prepaid expenses and unearned revenues at the time cash is paid or received in the balance sheet accounts. 2) Also prepare adjusting entries at the end of the year