Question

Problem One: Refer to TSMC's financial statements in Appendix A in the textbook, as well as the company's website, and answer the following: a)TSMC is

Problem One:

Refer to TSMC's financial statements in Appendix A in the textbook, as well as the company's website, and answer the following:

a)TSMC is traded on the Taiwan and New York Stock exchanges.

1)If TSMC were a New Zealand company trading on the New Zealand Stock Exchange, would it fall under Tier I IFRS, Tier II IFRS, or no Tier at all?Explain your answer.

2)Would your answer change if TSMC were a "small" company trading on the Exchange?Why or why not?

3)What is the fundamental difference between the financial reporting requirements under Tier I and Tier II?

b)Per the Conceptual Framework ("CF"), the objective of financial reporting is to provide financial information about the reporting entity.

1)How has TSMC applied the reporting entity concept?

2)How has TSMC summarised its financial information?

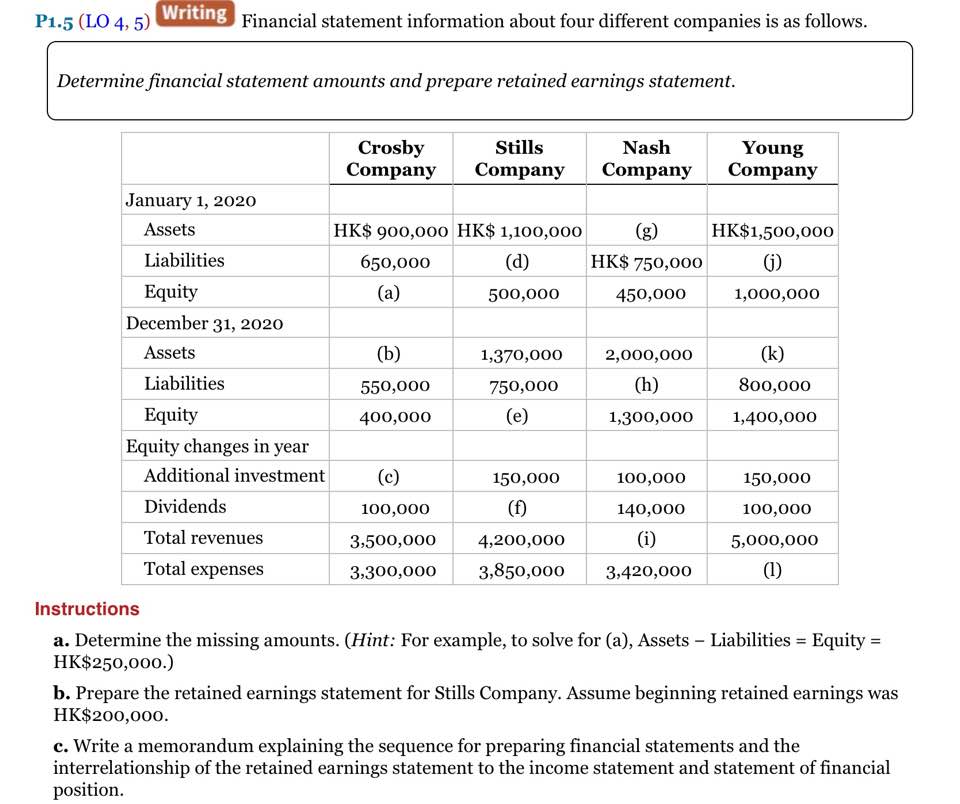

3)Chapter 1 in the textbook claims that a Statement of Retained Earnings is a required financial statement.Do you find this Statement in the appendix?If not, what statement is presented instead, and can you gather from it the same information shown on a Statement of Retained Earnings?Explain your answer.

c)The concept of materiality is defined as an entity specific application of the fundamental qualitative characteristic of relevance.Discuss how you think TSMC applied this concept to the non-current asset category of Property, Plant and Equipment.

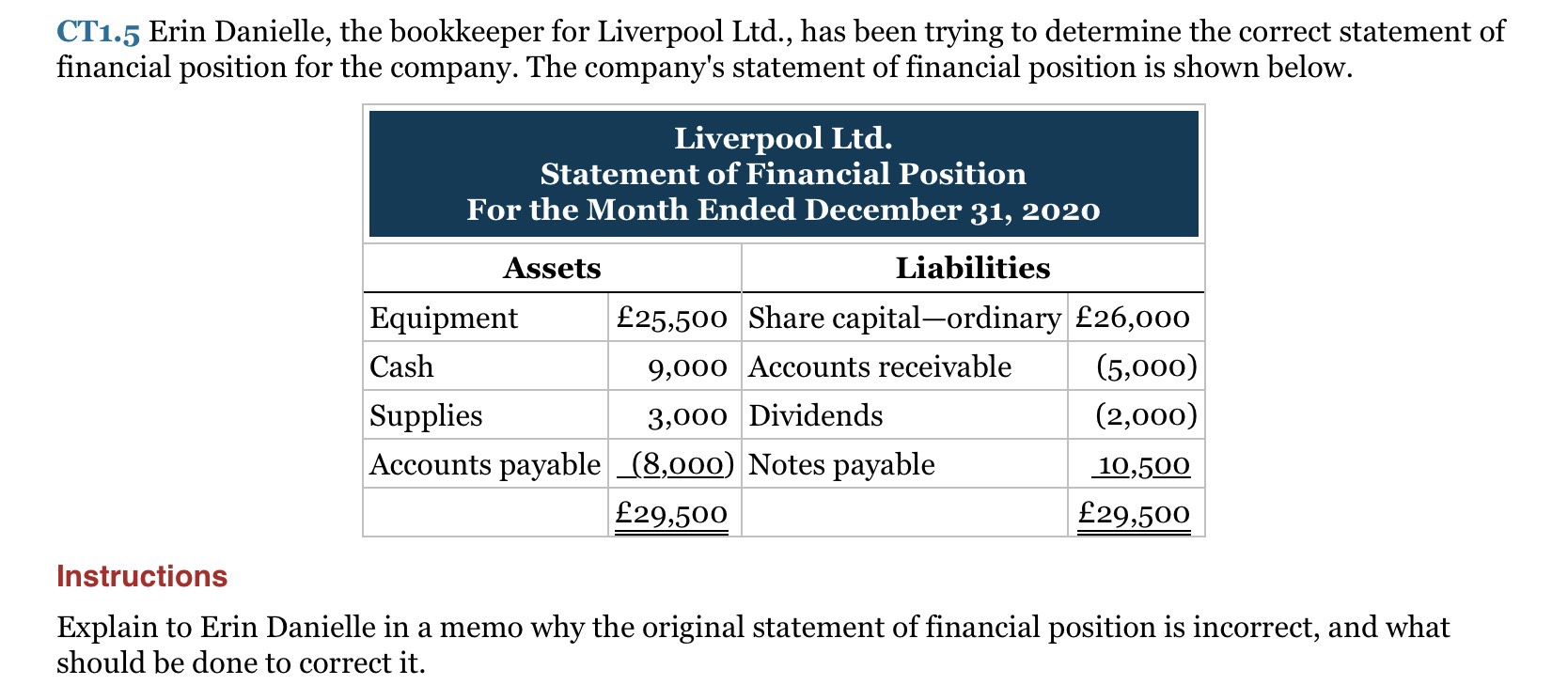

Problem Two:

Refer to CTP1.5 on page 1-45, but instead of a memo, write a corrected Balance Sheet using the same format used by TSMC in Appendix A and as shown in the solution to E1.13--see Canvas, tutorial 1 solutions.(Also follow the proper form?correct dollar sign placement--as shown in the Canvas solution.)Important additional information:a) assume that the Notes Payable is due 1 March 2022: b) "Dividends" is different from "Dividends Payable"--you may assume that the $2,000 of dividends were paid; c) the company uses a Retained Earning account; d) profit for the period was $3,000; and the Cash account should have a balance of $12,000 instead of the $9,000 shown in the textbook.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started