Question

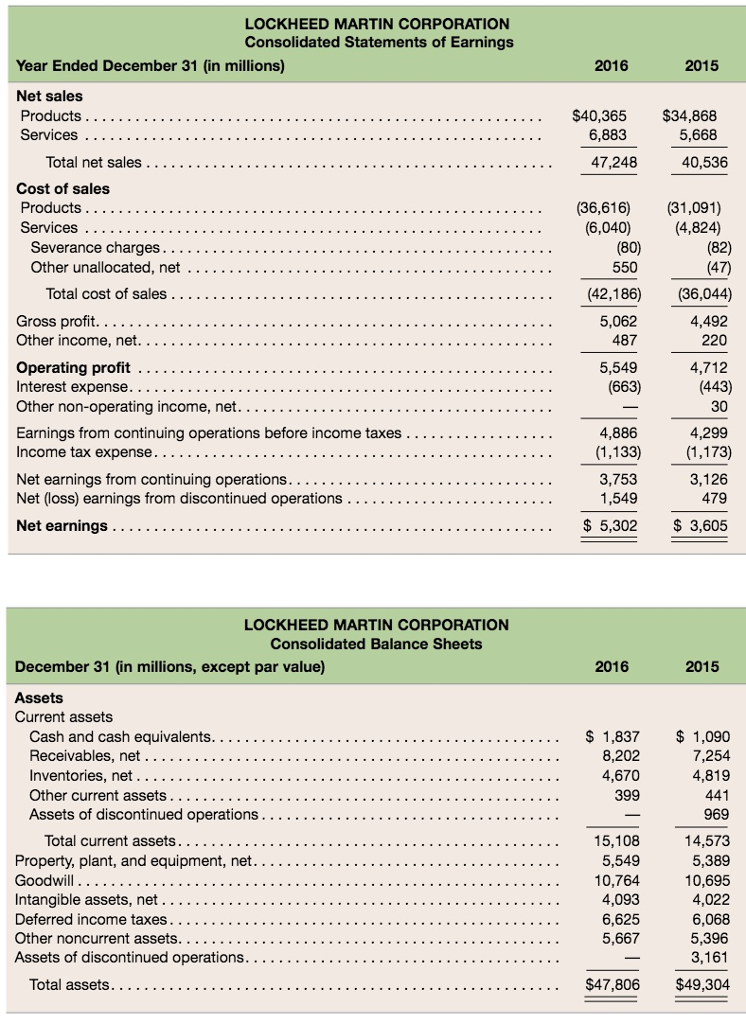

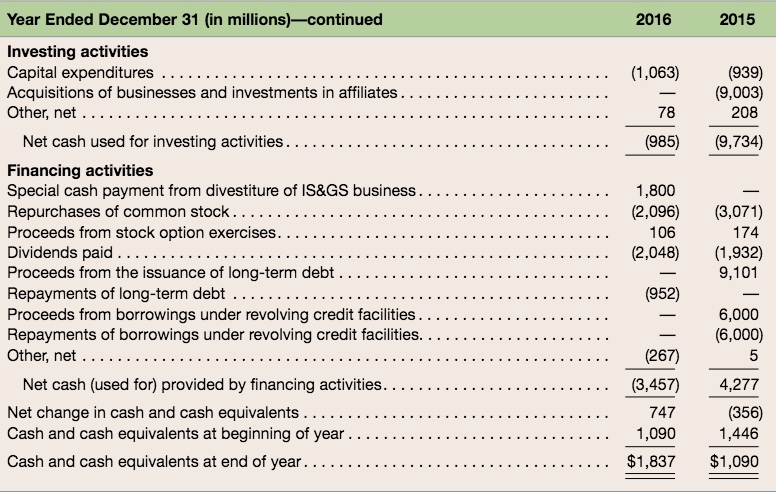

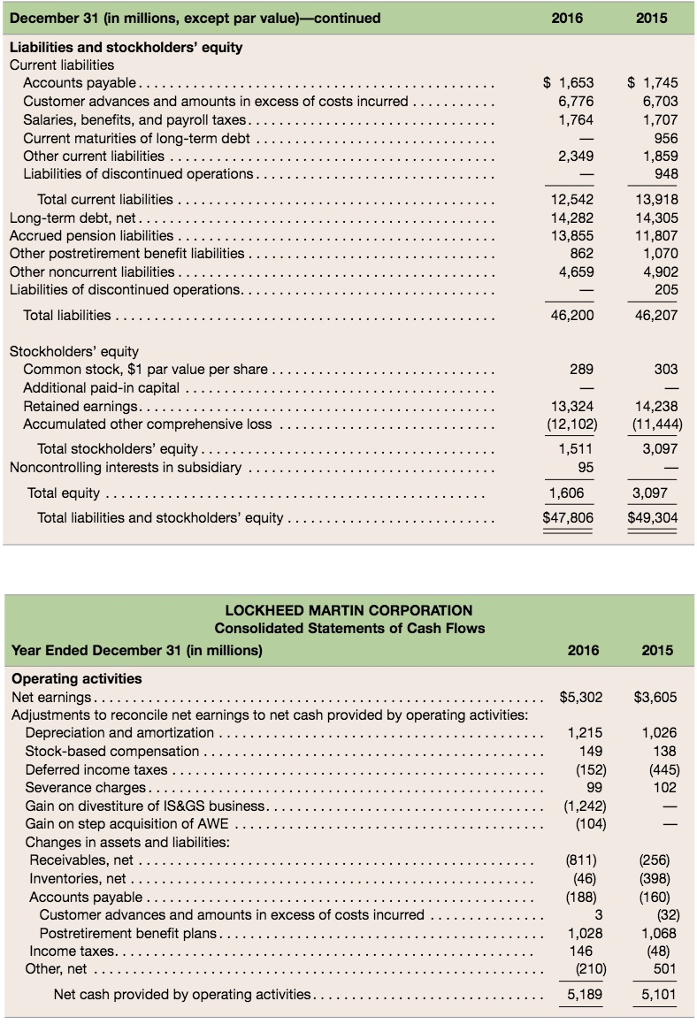

Problem P4-30 from Financial Statement Analysis and Valuation, FIFTH EDITION : Refer to the Lockheed Martin 2016 financial statements below, to answer the following requirements:

Problem P4-30 from Financial Statement Analysis and Valuation, FIFTH EDITION :

Refer to the Lockheed Martin 2016 financial statements below, to answer the following requirements:

A. Compute the following seven Moodys metrics for Lockheed Martin.

Information in the financial statements and footnotes also reveal that amortization and depreciation expense for 2016 was $468 million and $747 million respectively. Noncurrent deferred tax liabilities were $1,142 million for 2016.

1. EBITA to average assets

2. Operating margin

3. EBITA margin

4. EBITA interest coverage

5. Debt to EBITDA

6. Debt to book capitalization

7. Retained cash flow to net debt

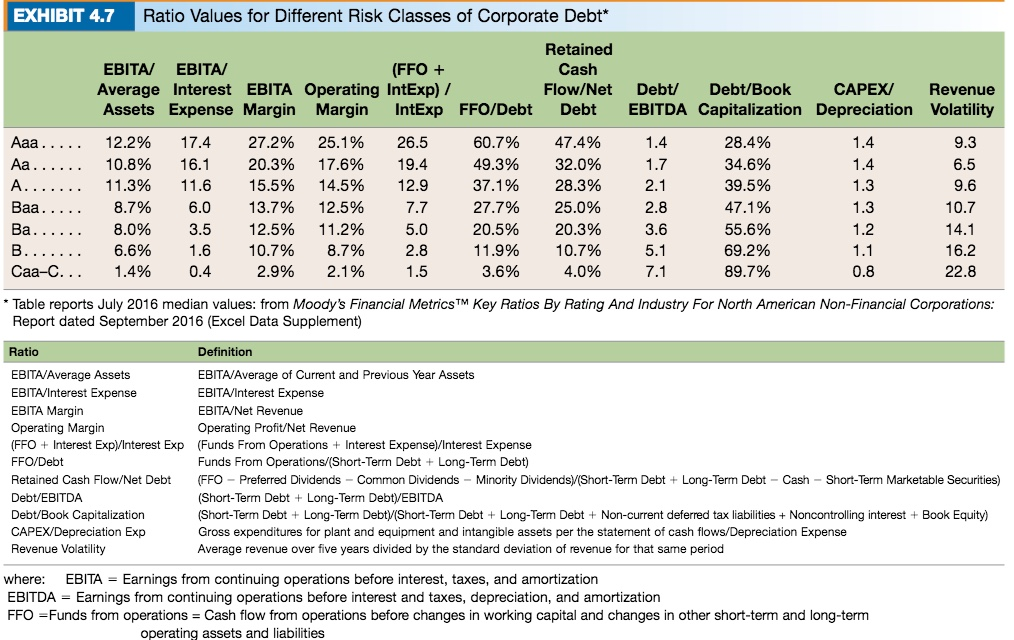

B . Use your computations from part a, along with measures from Exhibit 4.7, to estimate a credit rating for Lockheed Martin.

. Use your computations from part a, along with measures from Exhibit 4.7, to estimate a credit rating for Lockheed Martin.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started