Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem (Participating Mortgage) Bob is thinking of buying a property whose five-year net cash flow projection is shown in the following table (occurring at the

Problem

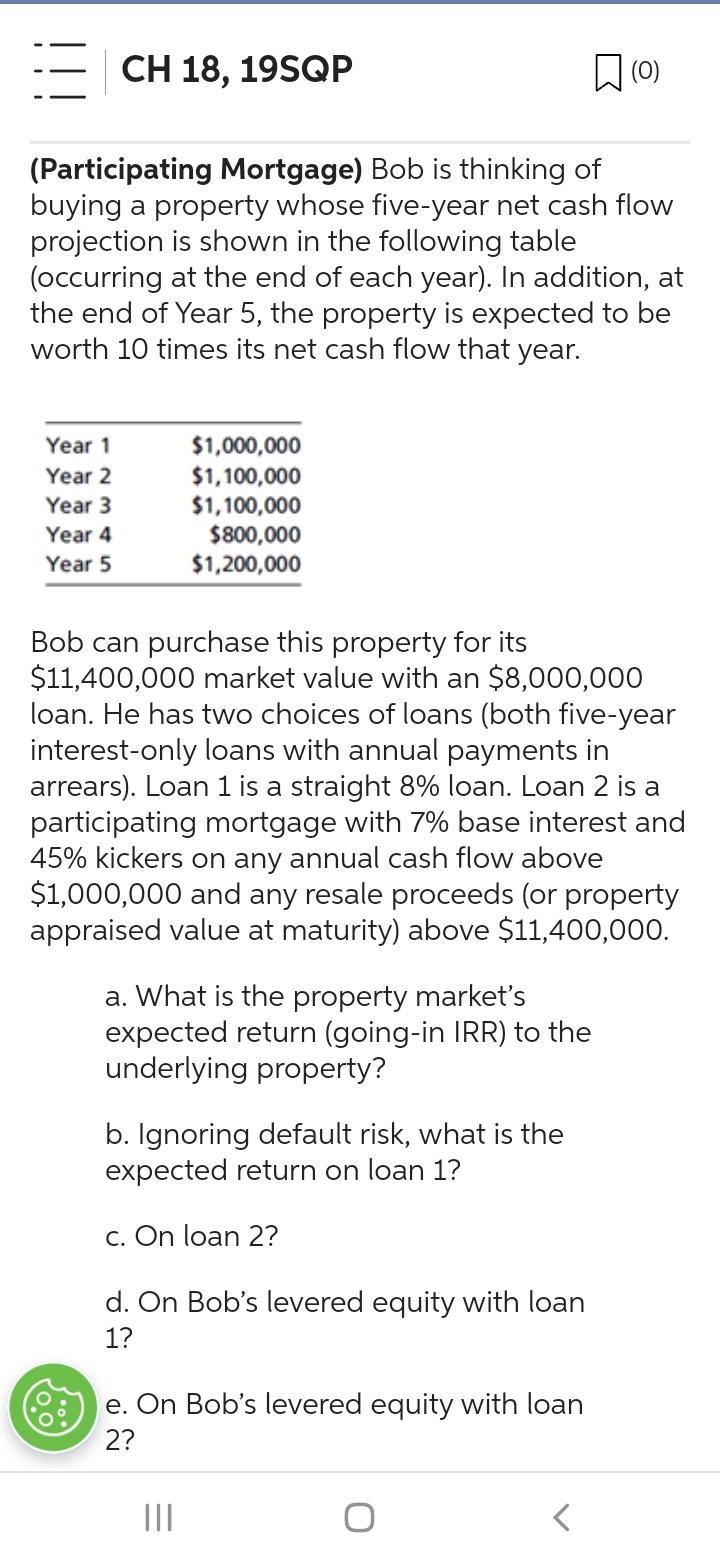

(Participating Mortgage) Bob is thinking of buying a property whose five-year net cash flow projection is shown in the following table (occurring at the end of each year). In addition, at the end of Year 5, the property is expected to be worth 10 times its net cash flow that year. Bob can purchase this property for its $11,400,000 market value with an $8,000,000 loan. He has two choices of loans (both five-year interest-only loans with annual payments in arrears). Loan 1 is a straight 8% loan. Loan 2 is a participating mortgage with 7% base interest and 45% kickers on any annual cash flow above $1,000,000 and any resale proceeds (or property appraised value at maturity) above $11,400,000. a. What is the property market's expected return (going-in IRR) to the underlying property? b. Ignoring default risk, what is the

(Participating Mortgage) Bob is thinking of buying a property whose five-year net cash flow projection is shown in the following table (occurring at the end of each year). In addition, at the end of Year 5, the property is expected to be worth 10 times its net cash flow that year. Bob can purchase this property for its $11,400,000 market value with an $8,000,000 loan. He has two choices of loans (both five-year interest-only loans with annual payments in arrears). Loan 1 is a straight 8% loan. Loan 2 is a participating mortgage with 7% base interest and 45% kickers on any annual cash flow above $1,000,000 and any resale proceeds (or property appraised value at maturity) above $11,400,000. a. What is the property market's expected return (going-in IRR) to the underlying property? b. Ignoring default risk, what is the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started