Answered step by step

Verified Expert Solution

Question

1 Approved Answer

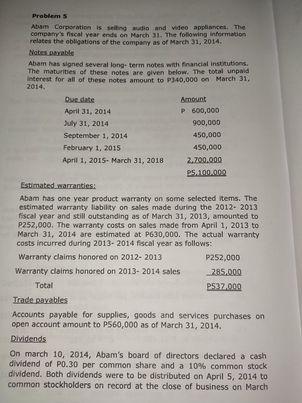

Problem S Abam Corporation is selling audio and video appliances. The company's fiscal year ends on March 31. The following information relates the obligations

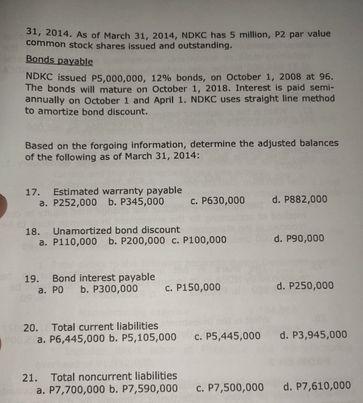

Problem S Abam Corporation is selling audio and video appliances. The company's fiscal year ends on March 31. The following information relates the obligations of the company as of March 31, 2014. Notes payable Abam has signed several long-term notes with financial institutions. The maturities of these notes are given below. The total unpaid Interest for all of these notes amount to P340,000 on March 31, 2014. Que date Amount P 600,000 April 31, 2014 July 31, 2014 900,000 September 1, 2014 450,000 February 1, 2015 450,000 April 1, 2015- March 31, 2018 2.700.000 P5.100.000 Estimated warranties: Abam has one year product warranty on some selected items. The estimated warranty liability on sales made during the 2012-2013 fiscal year and still outstanding as of March 31, 2013, amounted to P252,000. The warranty costs on sales made from April 1, 2013 to March 31, 2014 are estimated at P630,000. The actual warranty costs incurred during 2013-2014 fiscal year as follows: Warranty claims honored on 2012-2013 P252,000 285.000 Warranty claims honored on 2013-2014 sales Total P537.000 Trade pavables Accounts payable for supplies, goods and services purchases on open account amount to P560,000 as of March 31, 2014. Dividends On march 10, 2014, Abam's board of directors declared a cash dividend of P0.30 per common share and a 10% common stock dividend. Both dividends were to be distributed on April 5, 2014 to common stockholders on record at the close of business on March 31, 2014. As of March 31, 2014, NDKC has 5 million, P2 par value common stock shares issued and outstanding. Bonds payable NDKC issued P5,000,000, 12% bonds, on October 1, 2008 at 96. The bonds will mature on October 1, 2018. Interest is paid semi- annually on October 1 and April 1. NDKC uses straight line method to amortize bond discount. Based on the forgoing information, determine the adjusted balances of the following as of March 31, 2014: 17. Estimated warranty payable a. P252,000 b. P345,000 c. P630,000 d. P882,000 18. Unamortized bond discount a. P110,000 b. P200,000 c. P100,000 d. P90,000 19. Bond interest payable a. PO b. P300,000 c. P150,000 d. P250,000 20. Total current liabilities a. P6,445,000 b. P5,105,000 d. P3,945,000 21. Total noncurrent liabilities. a. P7,700,000 b. P7,590,000 d. P7,610,000 c. P5,445,000 c. P7,500,000

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution 17 Openining Balance on April 12019 Add Warranty Cost Less Warranty C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started