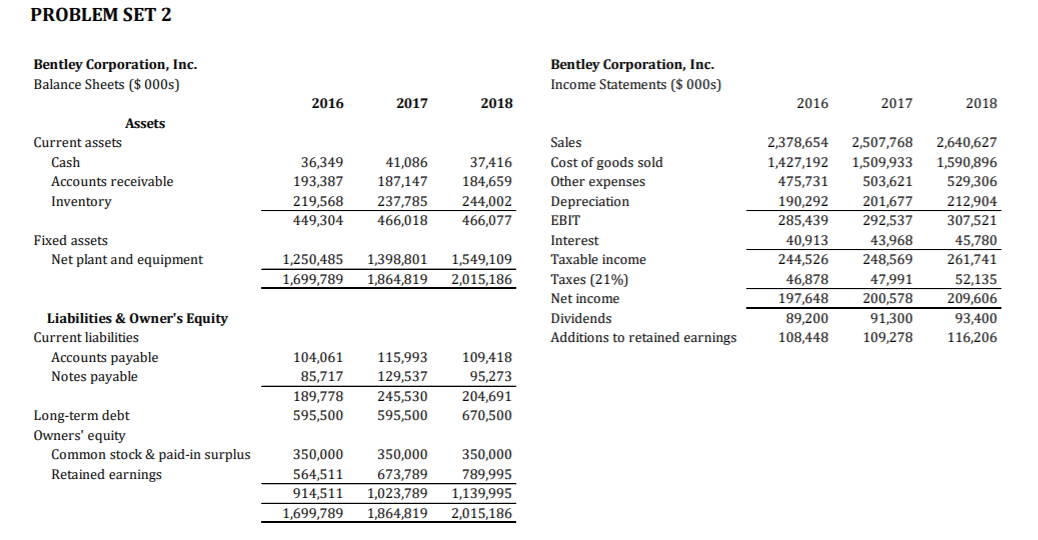

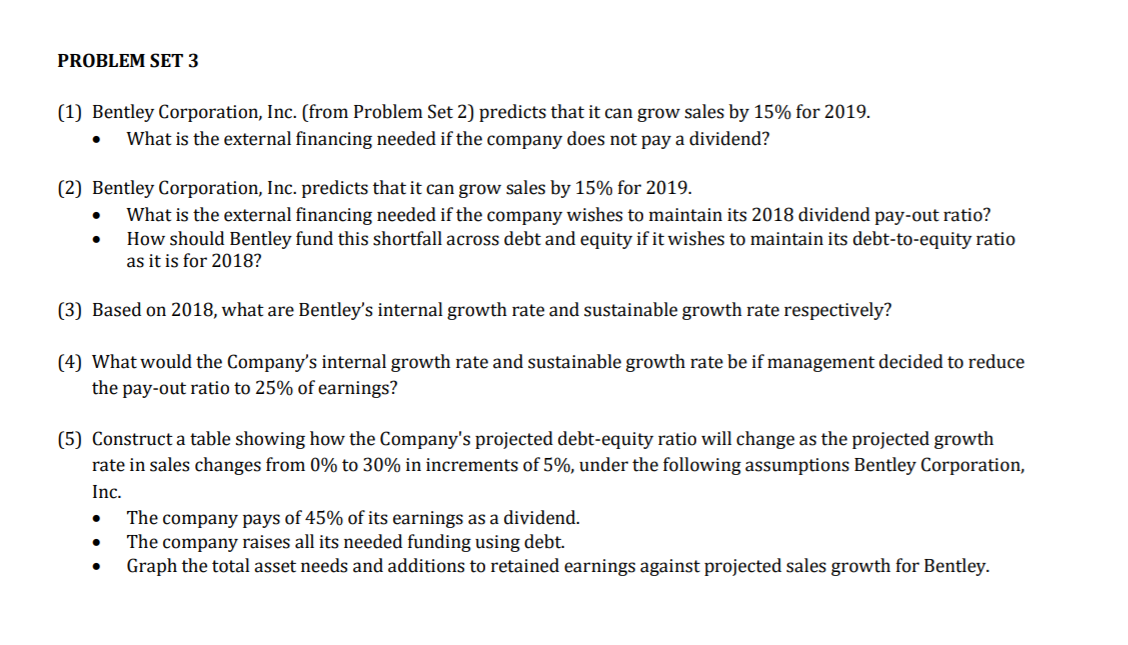

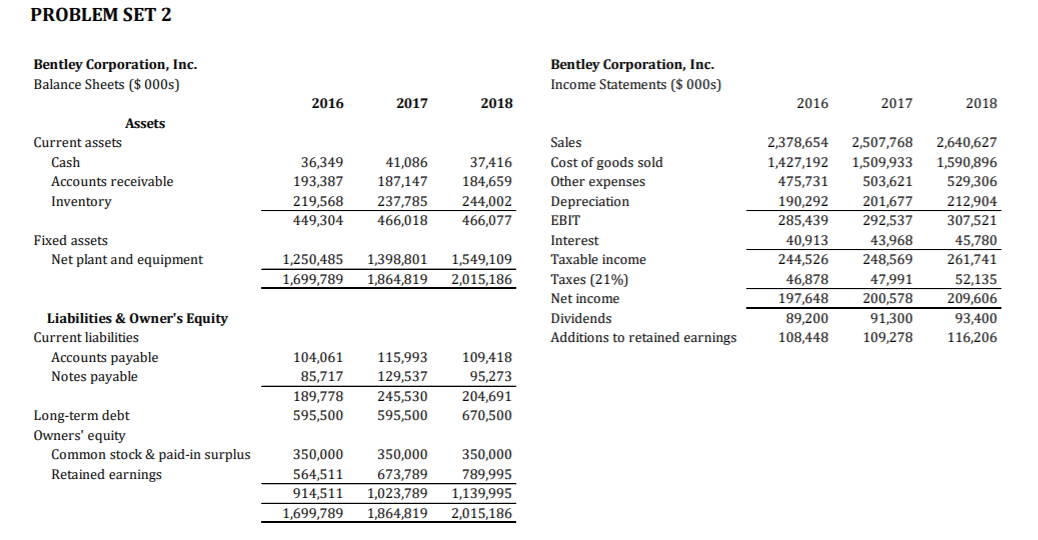

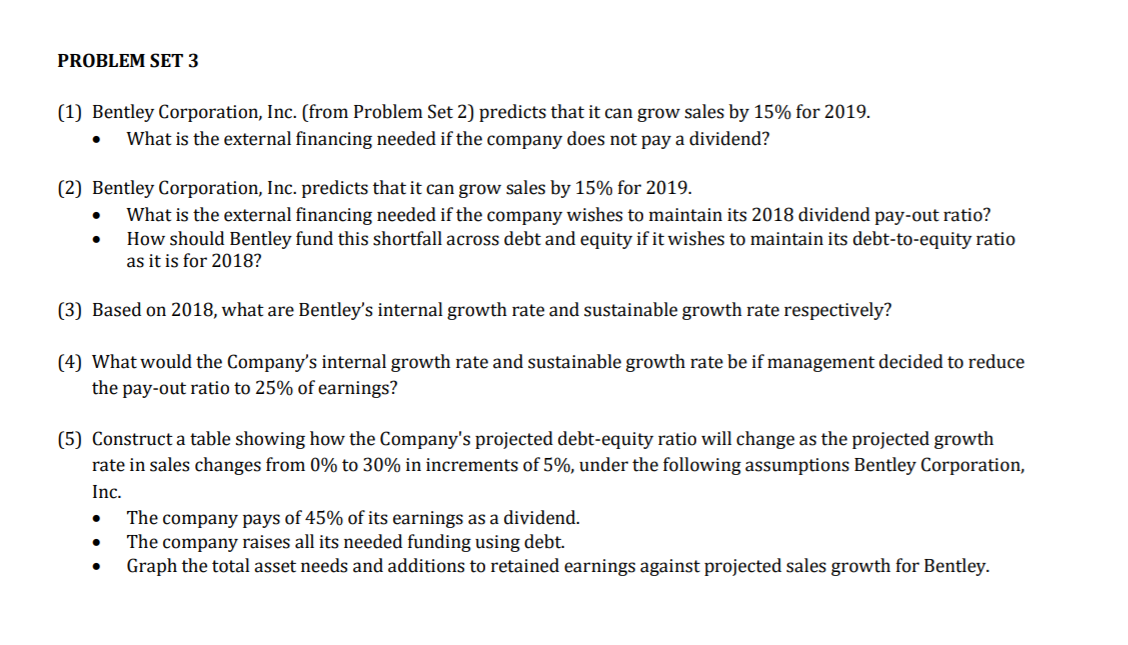

PROBLEM SET 2 Bentley Corporation, Inc. Balance Sheets ($ 000s) Bentley Corporation, Inc. Income Statements ($ 000s) 2016 2017 2018 2016 2017 2018 Assets Current assets Cash Accounts receivable Inventory 36,349 193,387 219,568 449,304 41,086 187,147 237,785 466,018 37,416 184,659 244,002 466,077 Fixed assets Net plant and equipment Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable income Taxes (21%) Net income Dividends Additions to retained earnings 2,378,654 1,427,192 475,731 190,292 285,439 40,913 244,526 46,878 197,648 89,200 108,448 2,507,768 1,509,933 503,621 201,677 292,537 43,968 248,569 47,991 200,578 91,300 109,278 2,640,627 1,590,896 529,306 212,904 307,521 45,780 261,741 52,135 209,606 93,400 116,206 1,250,485 1,699,789 1,398,801 1,549,109 1,864,8192,015,186 Liabilities & Owner's Equity Current liabilities Accounts payable Notes payable 104,061 85,717 189,778 595,500 115,993 129,537 245,530 595,500 109,418 95,273 204,691 670,500 Long-term debt Owners' equity Common stock & paid-in surplus Retained earnings 350,000 564,511 914,511 1,699,789 350,000 350,000 673,789 789,995 1,023,7891,139,995 1,864,8192,015,186 PROBLEM SET 3 (1) Bentley Corporation, Inc. (from Problem Set 2) predicts that it can grow sales by 15% for 2019. What is the external financing needed if the company does not pay a dividend? (2) Bentley Corporation, Inc. predicts that it can grow sales by 15% for 2019. What is the external financing needed if the company wishes to maintain its 2018 dividend pay-out ratio? How should Bentley fund this shortfall across debt and equity if it wishes to maintain its debt-to-equity ratio as it is for 2018? (3) Based on 2018, what are Bentley's internal growth rate and sustainable growth rate respectively? (4) What would the Company's internal growth rate and sustainable growth rate be if management decided to reduce the pay-out ratio to 25% of earnings? (5) Construct a table showing how the Company's projected debt-equity ratio will change as the projected growth rate in sales changes from 0% to 30% in increments of 5%, under the following assumptions Bentley Corporation, Inc. The company pays of 45% of its earnings as a dividend. The company raises all its needed funding using debt. Graph the total asset needs and additions to retained earnings against projected sales growth for Bentley