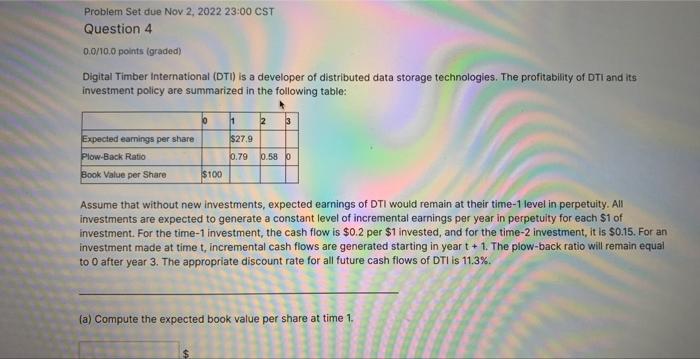

Problem Set due Nov 2, 2022 23:00 CST Question 4 0.0/10.0 points (graded) Digital Timber international (DTI) is a developer of distributed data storage technologies. The profitability of DTI and its investment policy are summarized in the following table: Assume that without new investments, expected earnings of DTI would remain at their time- 1 level in perpetuity. All investments are expected to generate a constant level of incremental earnings per year in perpetuity for each \$1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated starting in year t+1. The plow-back ratio will remain equal to 0 after year 3 . The appropriate discount rate for all future cash flows of DTi is 11.3%. (a) Compute the expected book value per share at time 1 . (a) Compute the expected book value per share at time 1 . (b) Compute the expected earrings per share of DTI at time 2 . 3 (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected ralue of the ex-dividend stock prioe at time 0 . 5 (e) Compute the expected retum (over a single-period) on the stock of oTl at time 0( in % ). Problem Set due Nov 2, 2022 23:00 CST Question 4 0.0/10.0 points (graded) Digital Timber international (DTI) is a developer of distributed data storage technologies. The profitability of DTI and its investment policy are summarized in the following table: Assume that without new investments, expected earnings of DTI would remain at their time- 1 level in perpetuity. All investments are expected to generate a constant level of incremental earnings per year in perpetuity for each \$1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated starting in year t+1. The plow-back ratio will remain equal to 0 after year 3 . The appropriate discount rate for all future cash flows of DTi is 11.3%. (a) Compute the expected book value per share at time 1 . (a) Compute the expected book value per share at time 1 . (b) Compute the expected earrings per share of DTI at time 2 . 3 (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected ralue of the ex-dividend stock prioe at time 0 . 5 (e) Compute the expected retum (over a single-period) on the stock of oTl at time 0( in % )