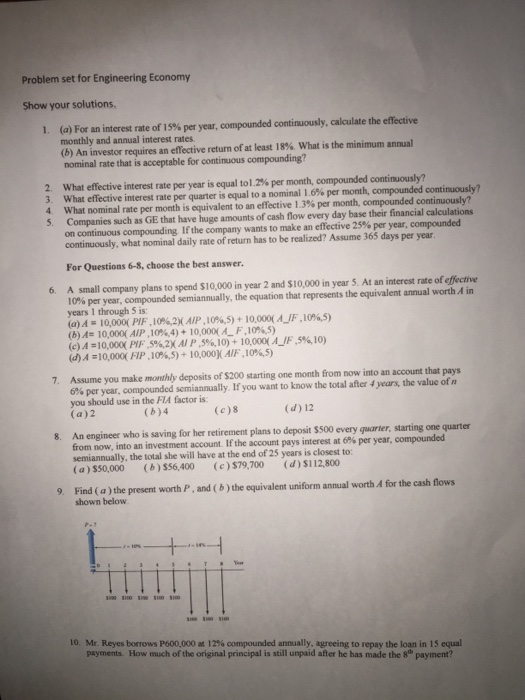

Problem set for Engineering Economy Show your solutions. For an interest rate of 15% per year, compounded continuously, calculate the effective monthly and annual interest rates. An investor requires an effective return of at Least 18%. What is the minimum annual nominal rate that is acceptable for continuous compounding? What effective interest rate pet year is equal to 1.2% per month, compounded continuously? What effective interest rate per quarter is equal 10 a nominal 1.6% per month, compounded continuously? What nominal rate per month is equivalent to an effective 1.3%. per month, compounded continuously? Companies such as greaterthanorequalto that have huge amounts of cash flow every day base their financial calculations on continuous compounding lf the company wants to make an effective 25% per year, compounded continuously, what nominal daily rate of return has to be realized? Assume 365 days per year. A small company plans to spend $10.000 in year 2 and $10,000 in scar 5 At an interest rate of effective 10% per year, compounded semiannually the equation shat represents the equivalent annual worth A in years 1 through 5 is A = 10,000(PIF, 10%, 2)(AIP, 10%, 5) + 10.000(A_IF, 10%, 5) A = 10,000(AIP, 10%, 4) + 10.000(A_F, 10%, 5) A = 10,000(PIF, 5%, 2)(AIP, 5%, 10) + 10.000(A_IF, 5%, 10) A = 10,000(PIP, 10%, 5) + 10.000](AIF, 10%, 5) Assume you make monthly deposits of $200 starting one month from now into an account that pays 6% per year, compounded semiannually If you want to know the total after 4 years, the value of n you should use in the FIA factor is 2 4 8 12 An engineer who is saving for her retirement plans to deposit $500 every quarter, starting one quarter from now, into an investment account. If the account pays interest at 6% per year, compounded semiannually. the total she will have at the end of 25 years is closest to $50.000 $56.400 $79.700 $112.800 Find (a) the present worth P, and (b) the equivalent uniform annual worth A for the cash flows shown below. Mr. Reyes borrows P600.000 at 12% compounded annually, agreeing to repay the loan in 15 equal payments. How much of the original principal is still unpaid after he has made the 8^th payment