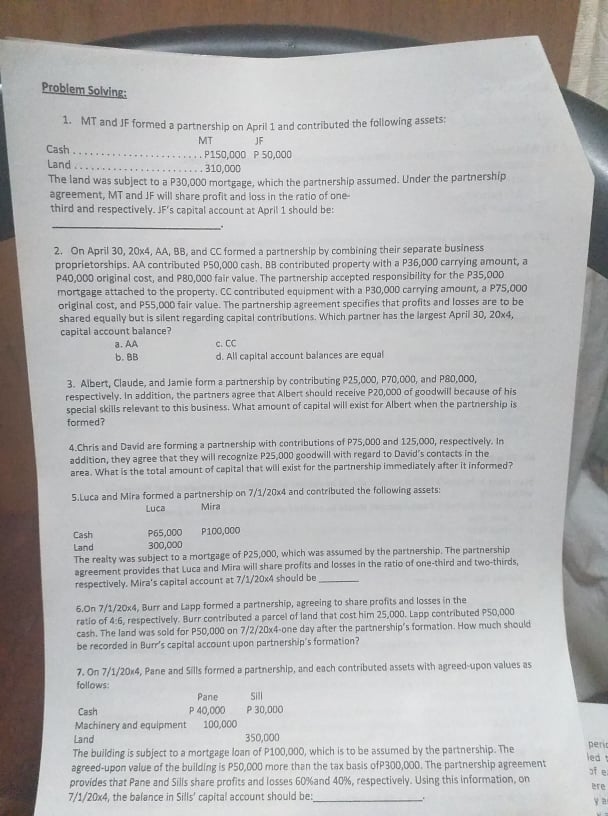

Problem Solving: 1. MT and IF formed a partnership on April 1 and contributed the following assets; MT JF Cash . . . . . ..... . P150,000 P 50,000 Land . .. ....: 310,000 The land was subject to a P30,000 mortgage, which the partnership assumed. Under the partnership agreement, MT and IF will share profit and loss in the ratio of one- third and respectively. IF's capital account at April 1 should be: 2. On April 30, 20x4, AA, BB, and CC formed a partnership by combining their separate business proprietorships. AA contributed P50,000 cash, BB contributed property with a P36,000 carrying amount, a P40,000 original cost, and PBD,000 fair value, The partnership accepted responsibility for the P35,000 mortgage attached to the property. CC contributed equipment with a P30,000 carrying amount, a P75,000 original cost, and P55,000 fair value. The partnership agreement specifies that profits and losses are to be shared equally but is silent regarding capital contributions. Which partner has the largest April 30, 20x4, capital account balance? a. AA C. CC b. BB d. All capital account balances are equal 3. Albert, Claude, and Jamie form a partnership by contributing P25,000, P70,000, and P80,000, respectively. In addition, the partners agree that Albert should receive P20,000 of goodwill because of his special skills relevant to this business, What amount of capital will exist for Albert when the partnership is formed? 4.Chris and David are forming a partnership with contributions of P75,000 and 125,000, respectively. In addition, they agree that they will recognize P25,000 goodwill with regard to David's contacts in the area. What Is the total amount of capital that will exist for the partnership immediately after it informed? 5.Luca and Mira formed a partnership on 7/1/20x4 and contributed the following assets: Luca Mira Cash P65,000 P100,000 Land 300,000 The realty was subject to a mortgage of P25,000, which was assumed by the partnership, The partnership agreement provides that Luca and Mira will share profits and losses in the ratio of one-third and two thirds, respectively. Mira's capital account at 7/1/20x4 should be 6.On 7/1/20x4, Burr and Lapp formed a partnership, agreeing to share profits and losses in the ratio of 4:6, respectively. Burr contributed a parcel of land that cost him 25,000, Lapp contributed P50,000 cash. The land was sold for P50,000 on 7/2/20x4-one day after the partnership's formation. How much should be recorded in Burr's capital account upon partnership's formation? 7. On 7/1/20 4, Pane and Sills formed a partnership, and each contributed assets with agreed upon values as follows: Pane Cash P 40,000 P 30,000 Machinery and equipment 100,000 Land 350,000 The building is subject to a mortgage loan of P100,000, which is to be assumed by the partnership. The per agreed-upon value of the building is P50,000 more than the tax basis ofP300,000. The partnership agreement led provides that Pane and Sills share profits and losses 60%and 40%, respectively. Using this information, on 7/1/20x4, the balance in Sills' capital account should be: ere