Answered step by step

Verified Expert Solution

Question

1 Approved Answer

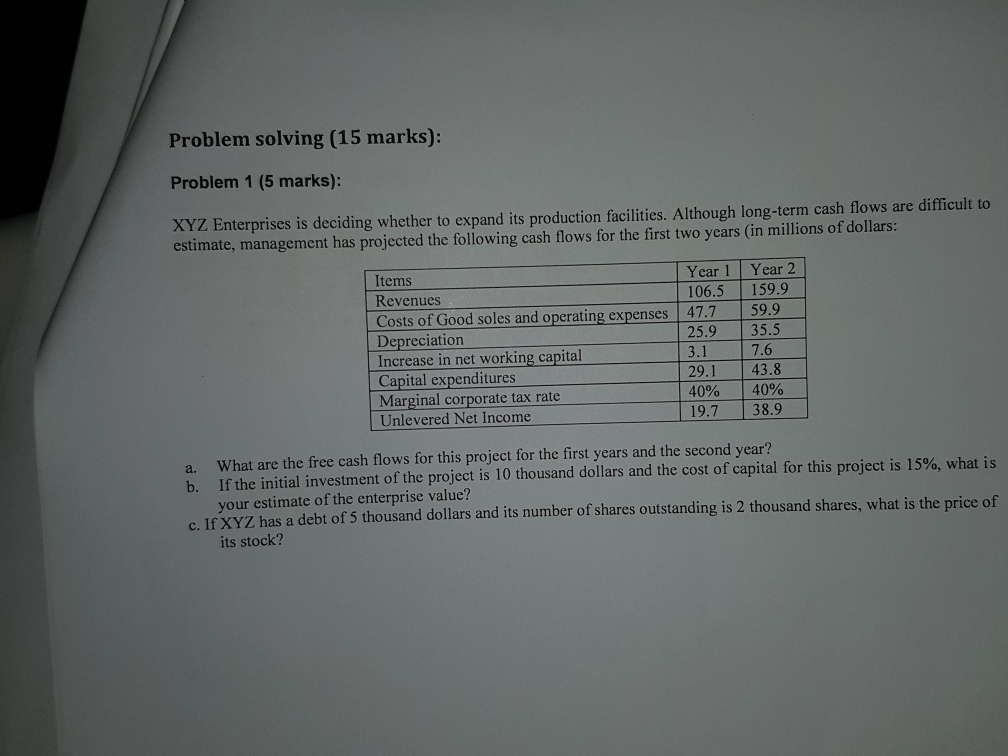

Problem solving (15 marks): Problem 1 (5 marks): XYZ Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to

Problem solving (15 marks): Problem 1 (5 marks): XYZ Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars: Items Year 1 Year 2 Revenues 106.5 159.9 Costs of Good soles and operating expenses 47.7 59.9 Depreciation 25.9 35.5 Increase in net working capital 3.1 7.6 Capital expenditures 29.1 43.8 Marginal corporate tax rate 40% 40% Unlevered Net Income 19.7 38.9 a. What are the free cash flows for this project for the first years and the second year? h If the initial investment of the project is 10 thousand dollars and the cost of capital for this project is 15%, what is your estimate of the enterprise value? CIF XYZ has a debt of 5 thousand dollars and its number of shares outstanding is 2 thousand shares, what is the price of its stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started