Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Solving ( 3 5 marks ) : Consider the following information about Firm ABC: table [ [ Firm ABC Overview ] , [

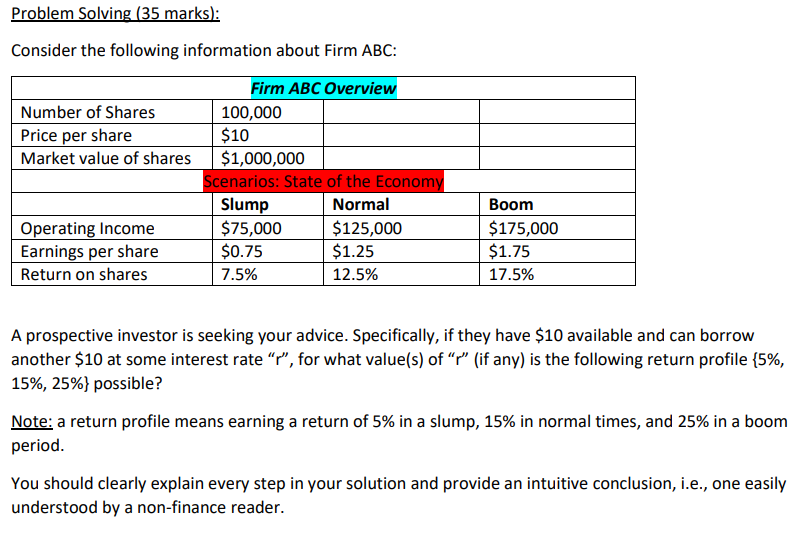

Problem Solving marks:

Consider the following information about Firm ABC:

tableFirm ABC OverviewNumber of Shares,Price per share,$Market value of shares,$BoomScenarios: State of the EconomySlump,Normal,$Operating Income,$$$Earnings per share,$$Return on shares,

A prospective investor is seeking your advice. Specifically, if they have $ available and can borrow another $ at some interest rate for what values of if any is the following return profile possible?

Note: a return profile means earning a return of in a slump, in normal times, and in a boom period.

You should clearly explain every step in your solution and provide an intuitive conclusion, ie one easily understood by a nonfinance reader.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started