Question

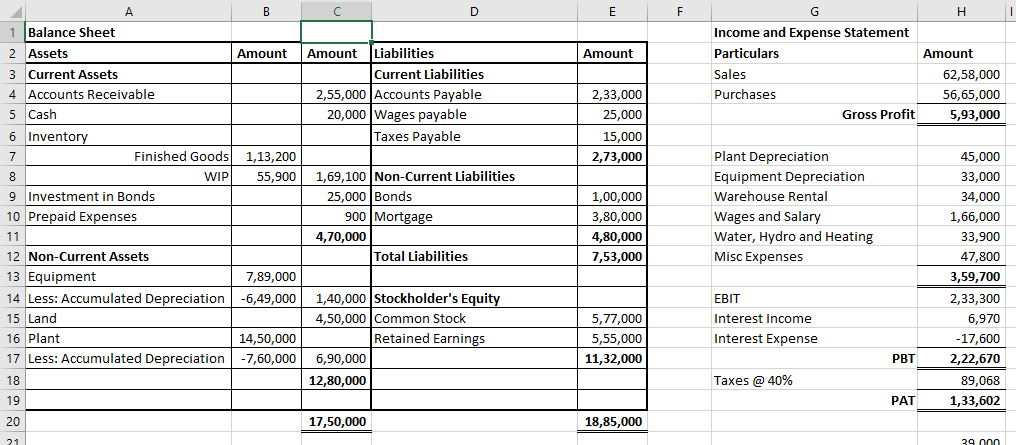

Problem Statement Assume that calendar year 2017 ended a few weeks ago. Prepare Soaring Companys Balance Sheet at December 31, 2017 and its Income and

Problem Statement

Assume that calendar year 2017 ended a few weeks ago.

Prepare Soaring Companys Balance Sheet at December 31, 2017 and its Income and Expense Statement for calendar year 2017 from the information in the Table below.

The Balance Sheet and Income and Expense Statements will provide the basis for an elementary financial analysis of the Soaring Company.

The income tax rate on capital gains, corporate income and recaptured depreciation is 40%.

Reference Description Amount

1. Accounts payable by January 23, 2018 $233,000

2. Accounts receivable by February 28, 2018. $255,000

3. Unpaid wages payable before January 31, 2018. $25,000

4. Cash $20,000

5. Common Share Capital on December 31, 2017. $577,000

6. Goods purchased for resale in 2017. $5,665,000

7. Cumulative depreciation of plant on December 31, 2017. $760,000

8. Cumulative depreciation of equipment on December 31, 2017. $649,000

9. Plant depreciation in 2017. $45,000

10. Equipment depreciation in 2017. $33,000

11. Historical cost of equipment purchases $789,000

12. 2017 federal income taxes payable by April 20, 2018. $15,000

13. Interest paid on loans paid in 2017. $17,600

14. Inventory of finished goods on December 31, 2017 $113,200

15. Inventory of unfinished goods on December 31, 2017 $55,900

16. Land $450,000

17. 10-year bonds issued by Soaring Company on June 15, 2012. $100,000

18. Short-term provincial bonds purchased by Soaring Company in December2017 $25,000

19. Mortgage due in December 2020 $380,000

20. Miscellaneous operating expenses in 2017 $47,800

21. Cumulative cost of plant (building purchases) over the years $1,450,000

22. Prepaid expenses (computer services .) in 2017 $900

23. Soaring Company total sales in 2017 $6,258,000

24. Retained earnings (after dividends) on December 31, 2017. $555,000

25. Warehouse rental expense in 2017 $34,000

26. Wages and salaries paid in 2017. $166,000

27. Water, hydro, heating and property taxes in 2017. $33,900

28. Interest income in 2017 from financial investments. $6,970

29. Market price of Soaring Company common shares on December 31, 2017. $20

30. Dividends per common share declared and paid on December 21, 2017. $0.65

31. Number of Soaring Company common shares on December 31, 2017. $60,000

Question

1. Soaring Companys dividend-payout percentage (1st decimal; no rounding) is a) 25.3%; b) 27.9%; c) 28.1%; d) 29.1%.

2. Soaring Companys percentage return on equity (1st decimal; no rounding) is a) 10.8%; b) 11.8%; c) 14.1%; d) 15.5%.

3. To which financial statement item would Soaring Companys not allocate its before-tax profits?

a) dividends; b) operating expenses; c) corporate taxes; d) retained earnings.

1 Balance Sheet 2 Assets 3 Current Assets 4 Accounts Receivable 5 Cash 6 Invento Income and Expense Statement Particulars Sales Purchases Amount Amount Liabilities Amount Amount Current Liabilities 2,55,000 Accounts Payable 20,000 Wages payable 62,58,000 56,65,000 5,93,000 2,33,000 25,000 15,000 2,73,000 Gross Profit Taxes Payable Finished Goods1,13,200 Plant Depreciation Equipment Depreciation Warehouse Rental Wages and Salary Water, Hydro and Heating Misc Expenses 45,000 33,000 34,000 1,66,000 33,900 47,800 3,59,700 2,33,300 6,970 -17,600 2,22,670 89,068 1,33,602 WIP55,9001,69,100 Non-Current Liabilities 9 Investment in Bonds 10 Prepaid Expenses 25,000 Bonds 1,00,000 3,80,000 4,80,000 7,53,000 900 Mortgage 4,70,000 Total Liabilities 12 Non-Current Assets 13 Equipment 14 Less: Accumulated Depreciation-6,49,000 1,40,000 Stockholder's Equit 15 Land 16 Plant 17 Less: Accumulated Depreciation7,60,000 6,90,000 7,89,000 EBIT Interest Income Interest Expense 4,50,000 Common Stock 5,77,000 5,55,000 11,32,000 14,50,000 Retained Earnings PBT 12,80,000 Taxes @ 40% 19 PAT 20 17,50,000 18,85,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started