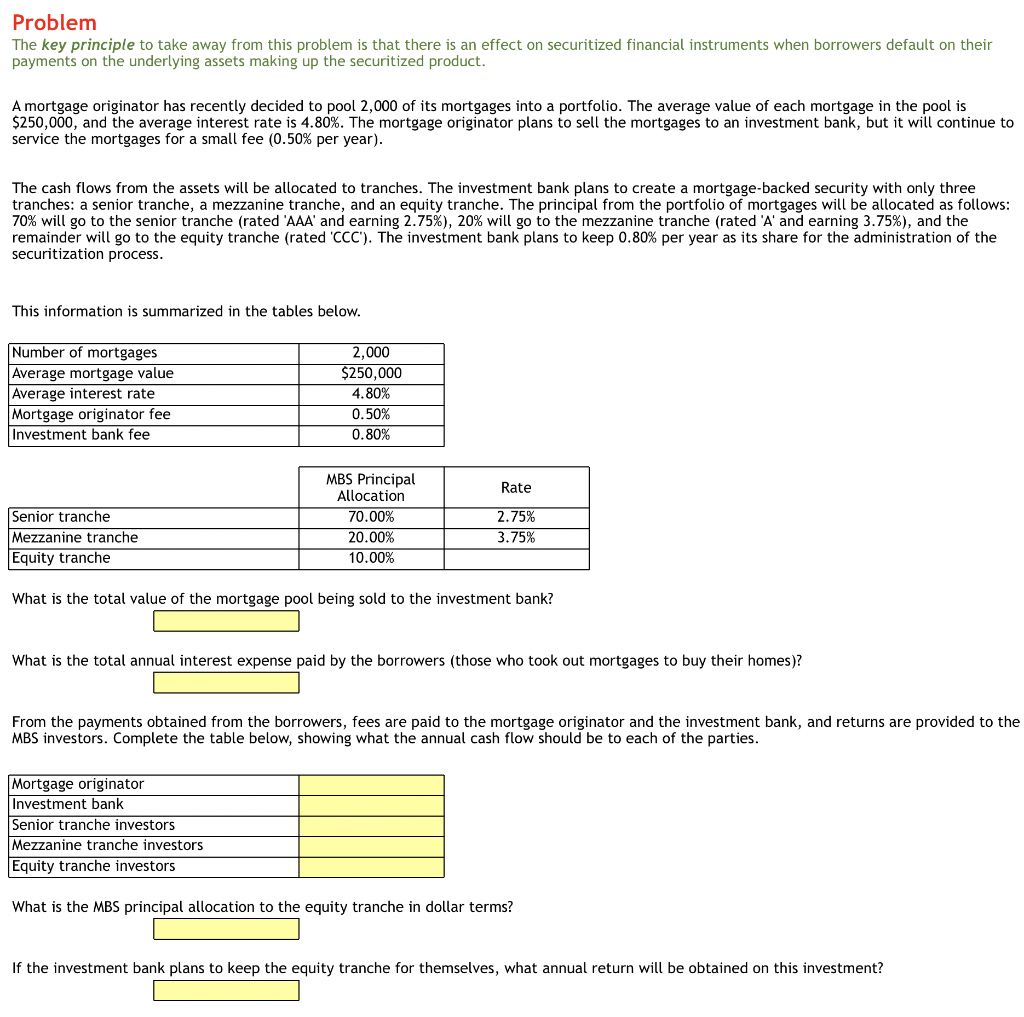

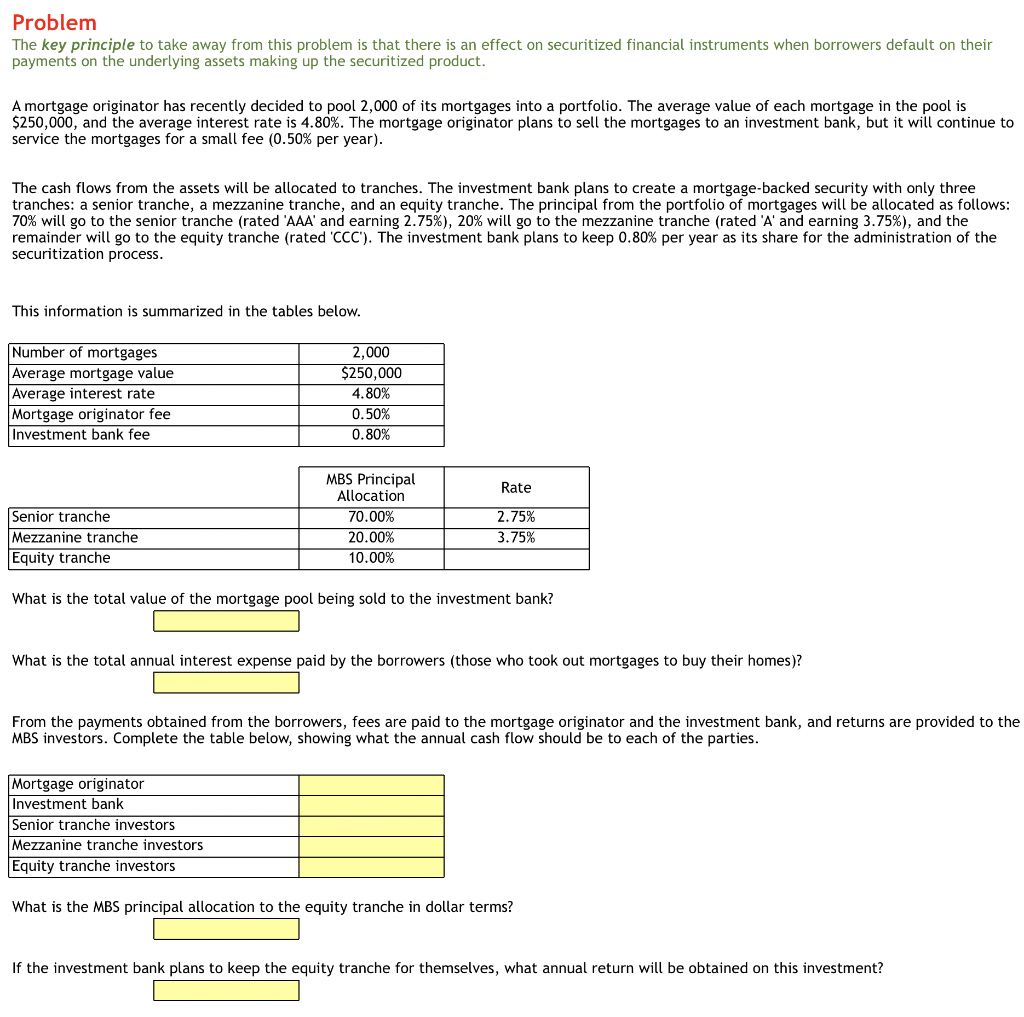

Problem The key principle to take away from this problem is that there is an effect on securitized financial instruments when borrowers default on their payments on the underlying assets making up the securitized product. A mortgage originator has recently decided to pool 2,000 of its mortgages into a portfolio. The average value of each mortgage in the pool is $250,000, and the average interest rate is 4.80%. The mortgage originator plans to sell the mortgages to an investment bank, but it will continue to service the mortgages for a small fee (0.50% per year). The cash flows from the assets will be allocated to tranches. The investment bank plans to create a mortgage-backed security with only three tranches: a senior tranche, a mezzanine tranche, and an equity tranche. The principal from the portfolio of mortgages will be allocated as follows: 70% will go to the senior tranche (rated 'AAA' and earning 2.75%), 20% will go to the mezzanine tranche (rated 'A' and earning 3.75%), and the remainder will go to the equity tranche (rated 'CCC). The investment bank plans to keep 0.80% per year as its share for the administration of the securitization process. This information is summarized in the tables below. Number of mortgages Average mortgage value Average interest rate Mortgage originator fee Investment bank fee 2,000 $250,000 4.80% 0.50% 0.80% Rate Senior tranche Mezzanine tranche Equity tranche MBS Principal Allocation 70.00% 20.00% 10.00% 2.75% 3.75% What is the total value of the mortgage pool being sold to the investment bank? What is the total annual interest expense paid by the borrowers (those who took out mortgages to buy their homes)? From the payments obtained from the borrowers, fees are paid to the mortgage originator and the investment bank, and returns are provided to the MBS investors. Complete the table below, showing what the annual cash flow should be to each of the parties. Mortgage originator Investment bank Senior tranche investors Mezzanine tranche investors Equity tranche investors What is the MBS principal allocation to the equity tranche in dollar terms? If the investment bank plans to keep the equity tranche for themselves, what annual return will be obtained on this investment? Problem The key principle to take away from this problem is that there is an effect on securitized financial instruments when borrowers default on their payments on the underlying assets making up the securitized product. A mortgage originator has recently decided to pool 2,000 of its mortgages into a portfolio. The average value of each mortgage in the pool is $250,000, and the average interest rate is 4.80%. The mortgage originator plans to sell the mortgages to an investment bank, but it will continue to service the mortgages for a small fee (0.50% per year). The cash flows from the assets will be allocated to tranches. The investment bank plans to create a mortgage-backed security with only three tranches: a senior tranche, a mezzanine tranche, and an equity tranche. The principal from the portfolio of mortgages will be allocated as follows: 70% will go to the senior tranche (rated 'AAA' and earning 2.75%), 20% will go to the mezzanine tranche (rated 'A' and earning 3.75%), and the remainder will go to the equity tranche (rated 'CCC). The investment bank plans to keep 0.80% per year as its share for the administration of the securitization process. This information is summarized in the tables below. Number of mortgages Average mortgage value Average interest rate Mortgage originator fee Investment bank fee 2,000 $250,000 4.80% 0.50% 0.80% Rate Senior tranche Mezzanine tranche Equity tranche MBS Principal Allocation 70.00% 20.00% 10.00% 2.75% 3.75% What is the total value of the mortgage pool being sold to the investment bank? What is the total annual interest expense paid by the borrowers (those who took out mortgages to buy their homes)? From the payments obtained from the borrowers, fees are paid to the mortgage originator and the investment bank, and returns are provided to the MBS investors. Complete the table below, showing what the annual cash flow should be to each of the parties. Mortgage originator Investment bank Senior tranche investors Mezzanine tranche investors Equity tranche investors What is the MBS principal allocation to the equity tranche in dollar terms? If the investment bank plans to keep the equity tranche for themselves, what annual return will be obtained on this investment