Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM: The Mahoney Partnership is being liquidated. The beginning balance in each of the four partners accounts are as follows: Partner A-$30,000 (junior partner)

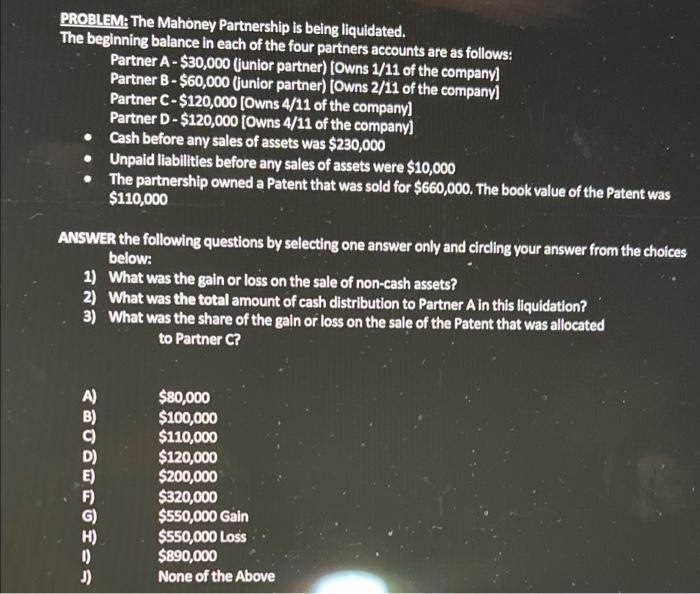

PROBLEM: The Mahoney Partnership is being liquidated. The beginning balance in each of the four partners accounts are as follows: Partner A-$30,000 (junior partner) [Owns 1/11 of the company] Partner B-$60,000 (junior partner) [Owns 2/11 of the company] Partner C-$120,000 [Owns 4/11 of the company] Partner D-$120,000 [Owns 4/11 of the company] Cash before any sales of assets was $230,000 Unpaid liabilities before any sales of assets were $10,000 The partnership owned a Patent that was sold for $660,000. The book value of the Patent was $110,000 ANSWER the following questions by selecting one answer only and circling your answer from the choices below: 1) What was the gain or loss on the sale of non-cash assets? 2) What was the total amount of cash distribution to Partner A in this liquidation? What was the share of the gain or loss on the sale of the Patent that was allocated to Partner C? 3) 2a0aGF== F) $80,000 $100,000 $110,000 $120,000 $200,000 $320,000 $550,000 Gain $550,000 Loss $890,000 None of the Above

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

2 3 Gain or loss on sale of non cash assets Sale price of patent 1 660000 Book Value of Patent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started