Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem: The Solid Furniture started the business on February, 2018 in manufacturing wooden stool. The company manufactured 434 and 560 stools in 2018 and 2019,

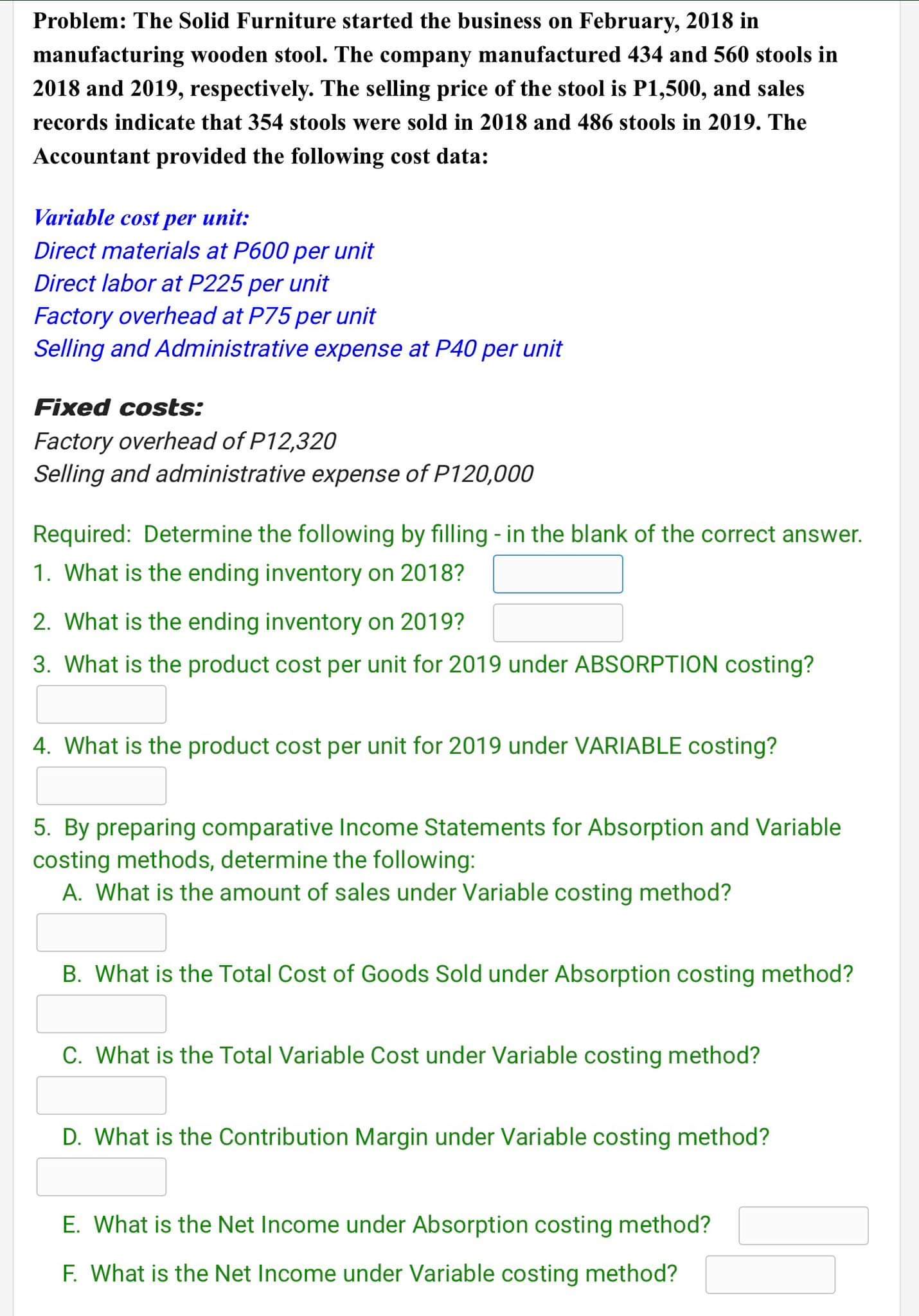

Problem: The Solid Furniture started the business on February, 2018 in manufacturing wooden stool. The company manufactured 434 and 560 stools in 2018 and 2019, respectively. The selling price of the stool is P1,500, and sales records indicate that 354 stools were sold in 2018 and 486 stools in 2019. The Accountant provided the following cost data: Variable cost per unit: Direct materials at P600 per unit Direct labor at P225 per unit Factory overhead at P75 per unit Selling and Administrative expense at P40 per unit Fixed costs: Factory overhead of P12,320 Selling and administrative expense of P120,000 Required: Determine the following by filling - in the blank of the correct answer. 1. What is the ending inventory on 2018 ? 2. What is the ending inventory on 2019 ? 3. What is the product cost per unit for 2019 under ABSORPTION costing? 4. What is the product cost per unit for 2019 under VARIABLE costing? 5. By preparing comparative Income Statements for Absorption and Variable costing methods, determine the following: A. What is the amount of sales under Variable costing method? B. What is the Total Cost of Goods Sold under Absorption costing method? C. What is the Total Variable Cost under Variable costing method? D. What is the Contribution Margin under Variable costing method? E. What is the Net Income under Absorption costing method? F. What is the Net Income under Variable costing method

Problem: The Solid Furniture started the business on February, 2018 in manufacturing wooden stool. The company manufactured 434 and 560 stools in 2018 and 2019, respectively. The selling price of the stool is P1,500, and sales records indicate that 354 stools were sold in 2018 and 486 stools in 2019. The Accountant provided the following cost data: Variable cost per unit: Direct materials at P600 per unit Direct labor at P225 per unit Factory overhead at P75 per unit Selling and Administrative expense at P40 per unit Fixed costs: Factory overhead of P12,320 Selling and administrative expense of P120,000 Required: Determine the following by filling - in the blank of the correct answer. 1. What is the ending inventory on 2018 ? 2. What is the ending inventory on 2019 ? 3. What is the product cost per unit for 2019 under ABSORPTION costing? 4. What is the product cost per unit for 2019 under VARIABLE costing? 5. By preparing comparative Income Statements for Absorption and Variable costing methods, determine the following: A. What is the amount of sales under Variable costing method? B. What is the Total Cost of Goods Sold under Absorption costing method? C. What is the Total Variable Cost under Variable costing method? D. What is the Contribution Margin under Variable costing method? E. What is the Net Income under Absorption costing method? F. What is the Net Income under Variable costing method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started