Question

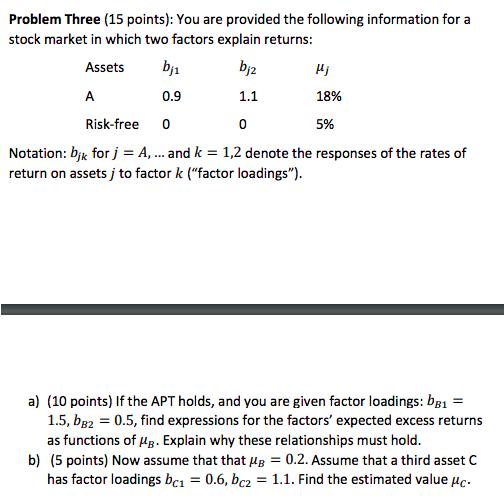

Problem Three (15 points): You are provided the following information for a stock market in which two factors explain returns: Assets bj bj2 Hj

Problem Three (15 points): You are provided the following information for a stock market in which two factors explain returns: Assets bj bj2 Hj A 0.9 1.1 18% Risk-free 0 0 5% Notation: bjk for j = A, ... and k = 1,2 denote the responses of the rates of return on assetsj to factor k ("factor loadings"). = a) (10 points) If the APT holds, and you are given factor loadings: bB1 1.5, bB2 = 0.5, find expressions for the factors' expected excess returns as functions of g. Explain why these relationships must hold. b) (5 points) Now assume that that g = 0.2. Assume that a third asset C has factor loadings bc1 = 0.6, bc2 = 1.1. Find the estimated value c.

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

aThe expected excess return on factor 1 is equal to the sum of the factor loadings multiplied by t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

10th edition

77861671, 978-0077861674

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App