Answered step by step

Verified Expert Solution

Question

1 Approved Answer

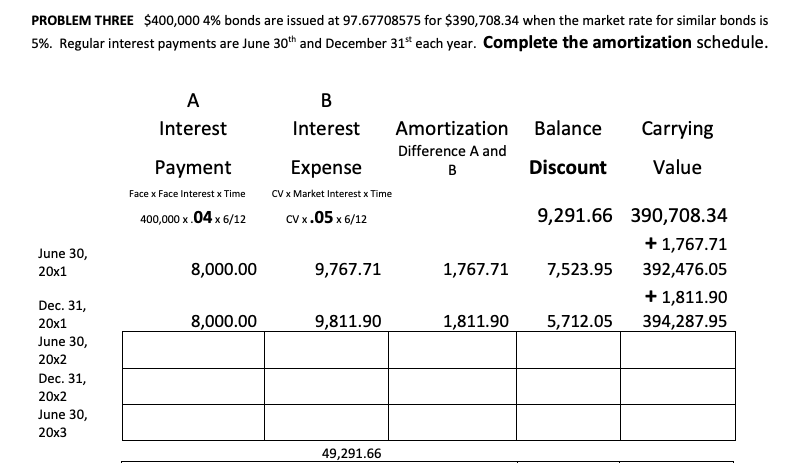

PROBLEM THREE $400,000 4% bonds are issued at 97.67708575 for $390,708.34 when the market rate for similar bonds is 5%. Regular interest payments are

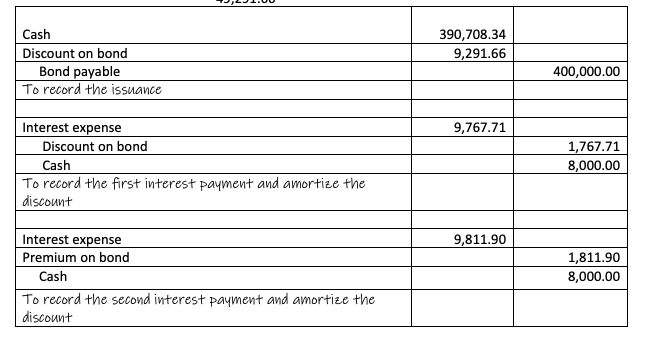

PROBLEM THREE $400,000 4% bonds are issued at 97.67708575 for $390,708.34 when the market rate for similar bonds is 5%. Regular interest payments are June 30th and December 31st each year. Complete the amortization schedule. A B Interest Interest June 30, Payment Face x Face Interest x Time 400,000 x .04 x 6/12 Expense Amortization Balance Difference A and B Carrying Discount Value CV x Market Interest x Time CV x .05 x 6/12 20x1 8,000.00 9,767.71 1,767.71 7,523.95 9,291.66 390,708.34 + 1,767.71 392,476.05 + 1,811.90 Dec. 31, 20x1 8,000.00 9,811.90 1,811.90 5,712.05 394,287.95 June 30, 20x2 Dec. 31, 20x2 June 30, 20x3 49,291.66 Cash Discount on bond Bond payable To record the issuance Interest expense Discount on bond Cash To record the first interest payment and amortize the discount Interest expense Premium on bond Cash To record the second interest payment and amortize the discount 390,708.34 9,291.66 400,000.00 9,767.71 1,767.71 8,000.00 9,811.90 1,811.90 8,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started