Question

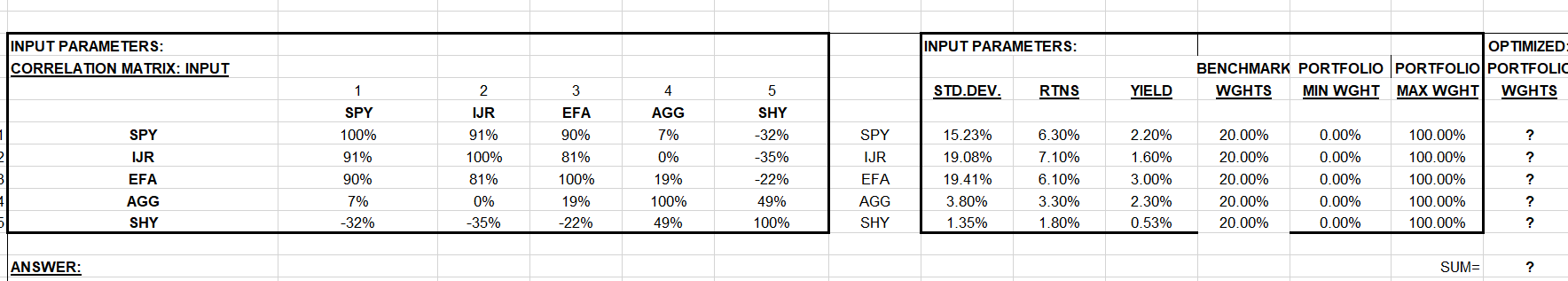

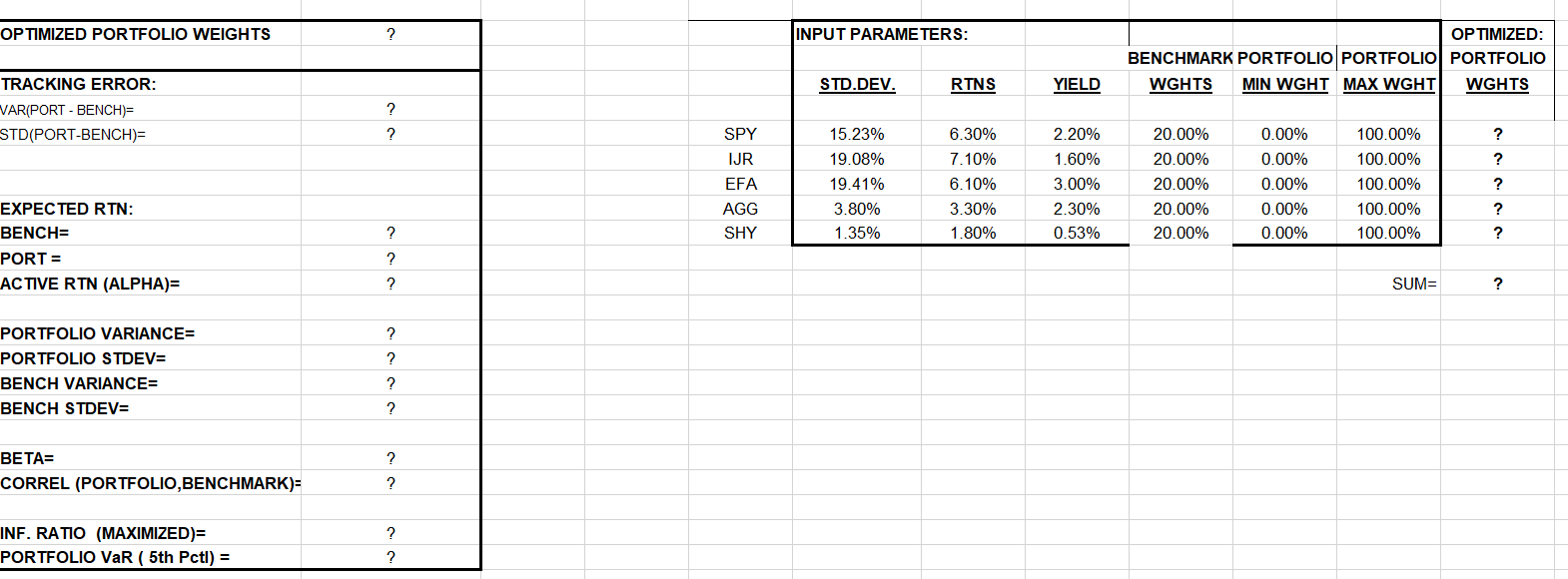

PROBLEM: TRACKING ERROR PORTFOLIO OPTIMIZATION INFORMATION RATIO = (PORTFOLIO RETURN - BENCHMARK RETURN) / TRACKING ERROR INFORMATION RATIO = (PORTFOLIO RETURN - BENCHMARK RETURN) /

PROBLEM: TRACKING ERROR PORTFOLIO OPTIMIZATION

INFORMATION RATIO = (PORTFOLIO RETURN - BENCHMARK RETURN) / TRACKING ERROR

INFORMATION RATIO = (PORTFOLIO RETURN - BENCHMARK RETURN) / TRACKING ERROR

INFORMATION RATIO = (PORTFOLIO RETURN - BENCHMARK RETURN) / TRACKING ERROR

QUESTIONS

* USE SOLVER TO MAXIMIZE ACTIVE RETURN AND SET TRACKING ERROR = 2%: NOTE WE SEEK LONG ONLY ASSET POSITIONS (I.E., PORTFOLIO WEIGHTS >= 0% )

* USE SOLVER TO MAXIMIZE ACTIVE RETURN AND SET TRACKING ERROR = 2%: NOTE WE SEEK LONG ONLY ASSET POSITIONS (I.E., PORTFOLIO WEIGHTS >= 0% )

* YOU ARE TO COMPUTE THE STATISTICS INDICATED WITH A QUESTION MARK "?"

* IF YOUR EQUATIONS ARE CORRECT: CHECK IF PORTFOLIO WEIGHTS = BENCHMARK WEIGHTS THEN BETA= 1, CORRELATION = 100%, TRACKING ERROR = 0,

FOR YOUR INFORMATION:

SPY = S&P500_ETF , IJR = S&P_SMALL_CAP_ETF , EFA= MSCI_EAFE_ETF , AGG= U.S._AGGREGATE_BOND_ETF , SHY = U.S._TREASURY_1_3_YEAR_BOND_ETF

INPUT PARAMETERS:

INPUT PARAMETERS: INPUT PARAMETERS: CORRELATION MATRIX: INPUT OPTIMIZED BENCHMARK PORTFOLIO PORTFOLIO PORTFOLIC WGHTS MIN WGHT MAX WGHT WGHTS 2 STD.DEV. RINS YIELD IJR AGG EFA 90% 81% SPY IJR 7% 15.23% 19.08% 0% SPY 100% 91% 90% 7% -32% ULLI SHY -32% -35% -22% 49% 100% 91% 100% 81% 0% -35% 19% EFA AGG SHY 100% 19% -22% SPY IJR EFA AGG SHY 6.30% 7.10% 6.10% 3.30% 1.80% 19.41% 3.80% 1.35% 2.20% 1.60% 3.00% 2.30% 0.53% 20.00% 20.00% 20.00% 20.00% 20.00% 0.00% 0.00% 0.00% 0.00% 0.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100% 49% ANSWER: SUM= OPTIMIZED PORTFOLIO WEIGHTS INPUT PARAMETERS: OPTIMIZED: BENCHMARK PORTFOLIO PORTFOLIO PORTFOLIO WGHTS MIN WGHT MAX WGHT WGHTS STD.DEV. RINS YIELD TRACKING ERROR: VAR(PORT - BENCH)= STD(PORT-BENCH)= SPY IJR EFA AGG SHY 15.23% 19.08% 19.41% 3.80% 1.35% 6.30% 7.10% 6.10% 3.30% 1.80% 2.20% 1.60% 3.00% 2.30% 0.53% 20.00% 20.00% 20.00% 20.00% 20.00% 0.00% 0.00% 0.00% 0.00% 0.00% 100.00% 100.00% 100.00% 100.00% 100.00% EXPECTED RTN BENCH= PORT = ACTIVE RTN (ALPHA= SUM= PORTFOLIO VARIANCE= PORTFOLIO STDEV= BENCH VARIANCE= BENCH STDEV= BETA= CORREL (PORTFOLIO, BENCHMARK)= INF. RATIO (MAXIMIZED)= PORTFOLIO VaR ( 5th Pctl) = ? INPUT PARAMETERS: INPUT PARAMETERS: CORRELATION MATRIX: INPUT OPTIMIZED BENCHMARK PORTFOLIO PORTFOLIO PORTFOLIC WGHTS MIN WGHT MAX WGHT WGHTS 2 STD.DEV. RINS YIELD IJR AGG EFA 90% 81% SPY IJR 7% 15.23% 19.08% 0% SPY 100% 91% 90% 7% -32% ULLI SHY -32% -35% -22% 49% 100% 91% 100% 81% 0% -35% 19% EFA AGG SHY 100% 19% -22% SPY IJR EFA AGG SHY 6.30% 7.10% 6.10% 3.30% 1.80% 19.41% 3.80% 1.35% 2.20% 1.60% 3.00% 2.30% 0.53% 20.00% 20.00% 20.00% 20.00% 20.00% 0.00% 0.00% 0.00% 0.00% 0.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100% 49% ANSWER: SUM= OPTIMIZED PORTFOLIO WEIGHTS INPUT PARAMETERS: OPTIMIZED: BENCHMARK PORTFOLIO PORTFOLIO PORTFOLIO WGHTS MIN WGHT MAX WGHT WGHTS STD.DEV. RINS YIELD TRACKING ERROR: VAR(PORT - BENCH)= STD(PORT-BENCH)= SPY IJR EFA AGG SHY 15.23% 19.08% 19.41% 3.80% 1.35% 6.30% 7.10% 6.10% 3.30% 1.80% 2.20% 1.60% 3.00% 2.30% 0.53% 20.00% 20.00% 20.00% 20.00% 20.00% 0.00% 0.00% 0.00% 0.00% 0.00% 100.00% 100.00% 100.00% 100.00% 100.00% EXPECTED RTN BENCH= PORT = ACTIVE RTN (ALPHA= SUM= PORTFOLIO VARIANCE= PORTFOLIO STDEV= BENCH VARIANCE= BENCH STDEV= BETA= CORREL (PORTFOLIO, BENCHMARK)= INF. RATIO (MAXIMIZED)= PORTFOLIO VaR ( 5th Pctl) =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started