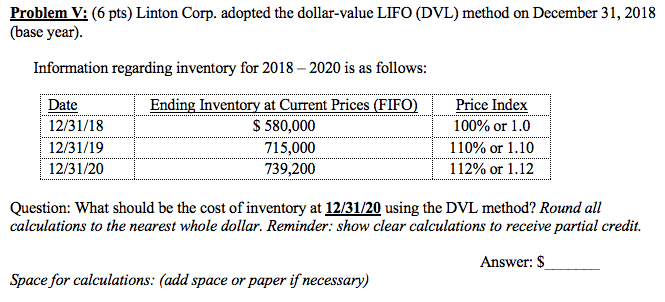

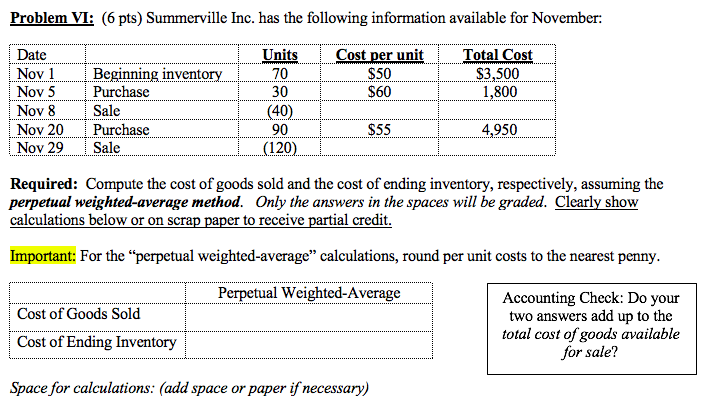

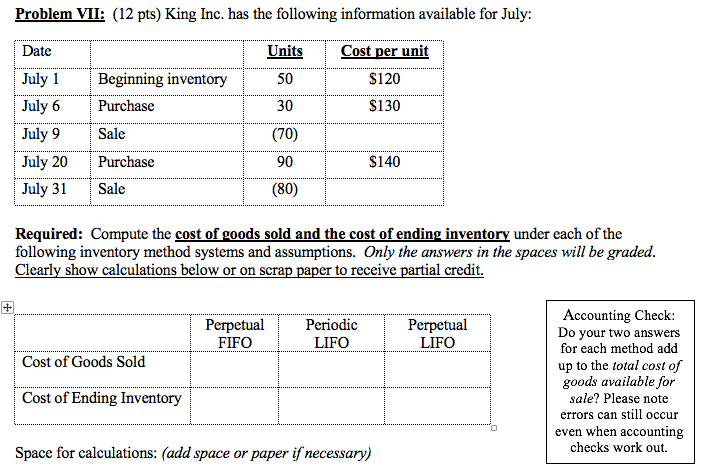

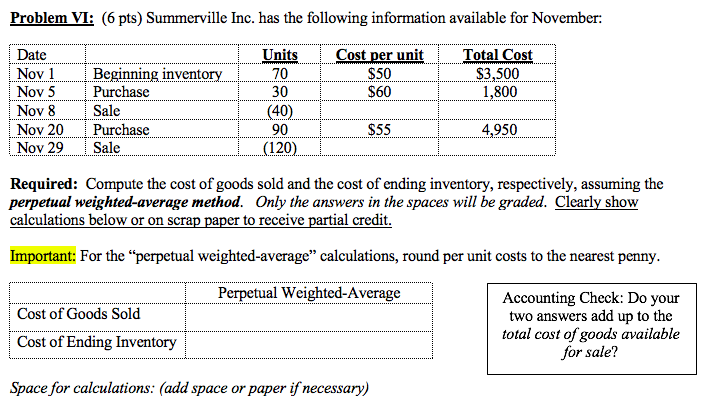

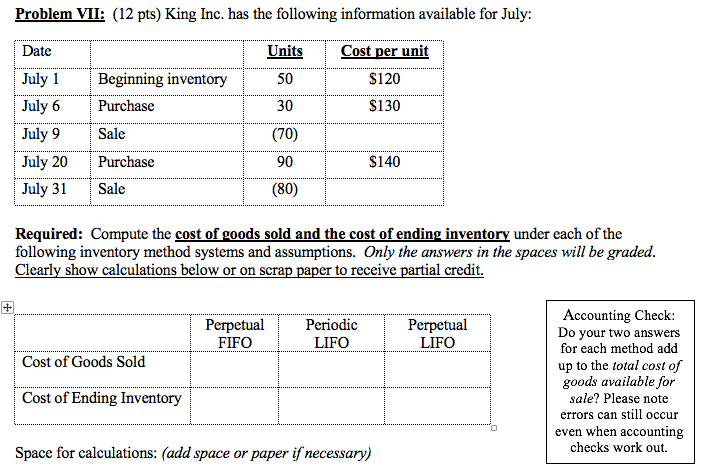

Problem V: (6 pts) Linton Corp. adopted the dollar-value LIFO (DVL) method on December 31, 2018 (base year). Information regarding inventory for 2018 - 2020 is as follows: Date 12/31/18 12/31/19 12/31/20 Ending Inventory at Current Prices (FIFO) $ 580,000 715,000 739,200 Price Index 100% or 1.0 110% or 1.10 112% or 1.12 Question: What should be the cost of inventory at 12/31/20 using the DVL method? Round all calculations to the nearest whole dollar. Reminder: show clear calculations to receive partial credit. Answer: $ Space for calculations: (add space or paper if necessary) Problem VI: (6 pts) Summerville Inc. has the following information available for November: Cost per unit $50 $60 Total Cost $3,500 1,800 Date Nov 1 Nov 5 Nov 8 Nov 20 Nov 29 Beginning inventory Purchase Sale Purchase Sale Units 70 30 (40) 90 (120) $55 4,950 Required: Compute the cost of goods sold and the cost of ending inventory, respectively, assuming the perpetual weighted-average method. Only the answers in the spaces will be graded. Clearly show calculations below or on scrap paper to receive partial credit. Important: For the "perpetual weighted-average calculations, round per unit costs to the nearest penny. Perpetual Weighted-Average Cost of Goods Sold Cost of Ending Inventory Accounting Check: Do your two answers add up to the total cost of goods available for sale? Space for calculations: (add space or paper if necessary) Problem VII: (12 pts) King Inc. has the following information available for July: Date Units Cost per unit $120 Beginning inventory Purchase 50 30 $130 July 1 July 6 July 9 July 20 Sale Purchase Sale (70) 90 (80) $140 July 31 Required: Compute the cost of goods sold and the cost of ending inventory under each of the following inventory method systems and assumptions. Only the answers in the spaces will be graded. Clearly show calculations below or on scrap paper to receive partial credit. + Perpetual FIFO Periodic LIFO Perpetual LIFO Cost of Goods Sold Accounting Check: Do your two answers for each method add up to the total cost of goods available for sale? Please note errors can still occur even when accounting checks work out. Cost of Ending Inventory Space for calculations: (add space or paper if necessary)