Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM: WORKSHEET: Hours Worked 40 Name Richards, B. Matthews, M. Ramon, C. Wong, S. Federal Income Tax Withheld $300 $320 $355 $372 Pay Rate $75

PROBLEM:

WORKSHEET:

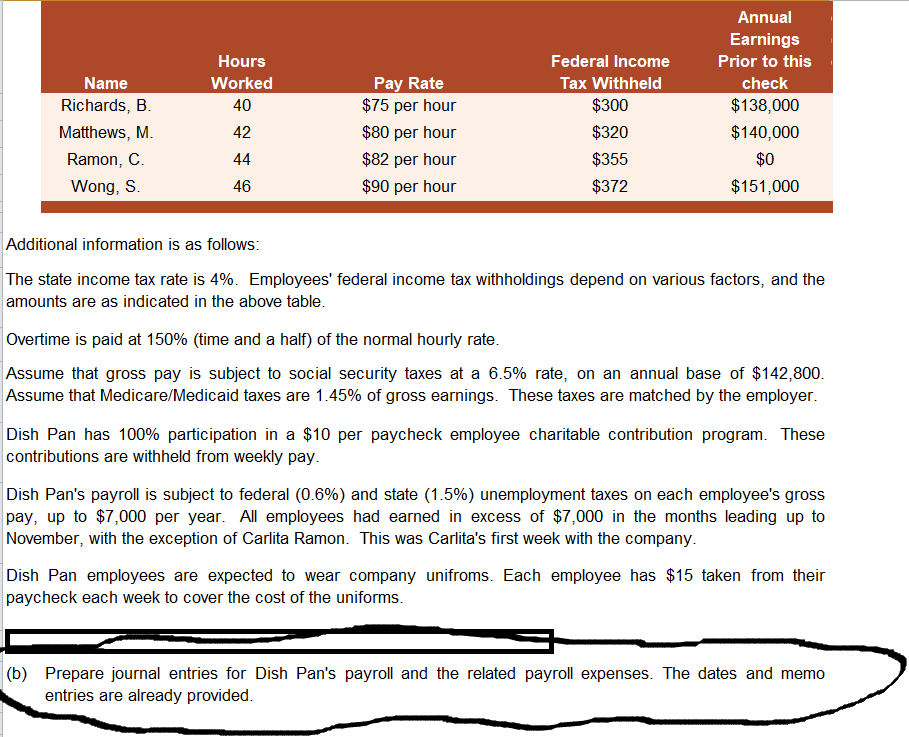

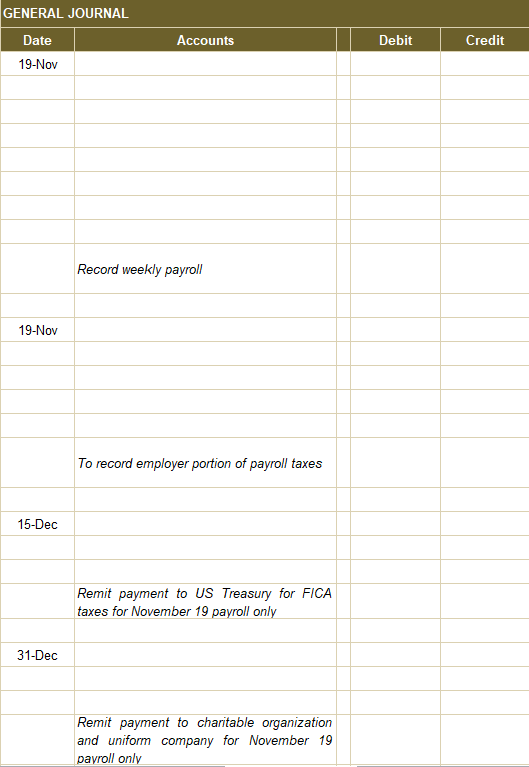

Hours Worked 40 Name Richards, B. Matthews, M. Ramon, C. Wong, S. Federal Income Tax Withheld $300 $320 $355 $372 Pay Rate $75 per hour $80 per hour $82 per hour $90 per hour Annual Earnings Prior to this check $138,000 $140,000 $0 $151,000 42 44 46 Additional information is as follows: The state income tax rate is 4%. Employees' federal income tax withholdings depend on various factors, and the amounts are as indicated in the above table. Overtime is paid at 150% (time and a half) of the normal hourly rate. Assume that gross pay is subject to social security taxes at a 6.5% rate, on an annual base of $142,800. Assume that Medicare/Medicaid taxes are 1.45% of gross earnings. These taxes are matched by the employer. Dish Pan has 100% participation in a $10 per paycheck employee charitable contribution program. These contributions are withheld from weekly pay. Dish Pan's payroll is subject to federal (0.6%) and state (1.5%) unemployment taxes on each employee's gross pay, up to $7,000 per year. All employees had earned in excess of $7,000 in the months leading up to November, with the exception of Carlita Ramon. This was Carlita's first week with the company. Dish Pan employees are expected to wear company unifroms. Each employee has $15 taken from their paycheck each week to cover the cost of the uniforms. (b) Prepare journal entries for Dish Pan's payroll and the related payroll expenses. The dates and memo entries are already provided. GENERAL JOURNAL Date 19-Nov Accounts Debit Credit Record weekly payroll 19-Nov To record employer portion of payroll taxes 15-Dec Remit payment to US Treasury for FICA taxes for November 19 payroll only 31-Dec Remit payment to charitable organization and uniform company for November 19 payroll only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started