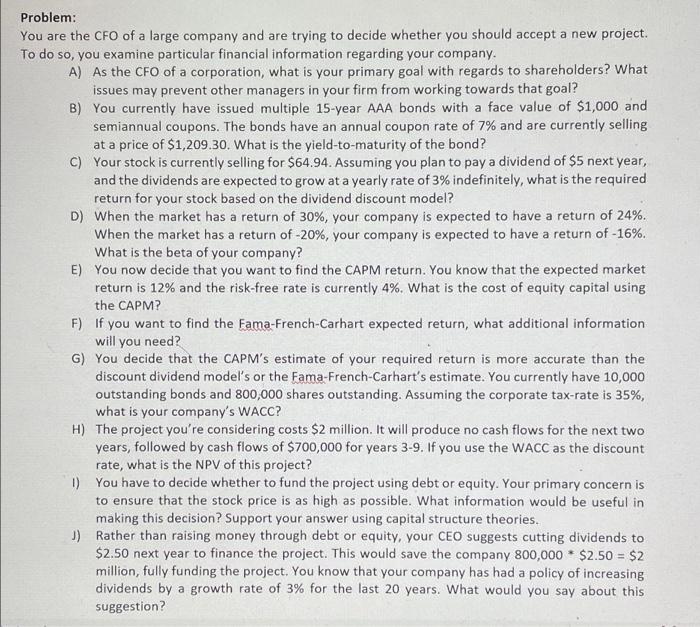

Problem: You are the CFO of a large company and are trying to decide whether you should accept a new project. To do so, you examine particular financial information regarding your company. A) As the CFO of a corporation, what is your primary goal with regards to shareholders? What issues may prevent other managers in your firm from working towards that goal? B) You currently have issued multiple 15-year AAA bonds with a face value of $1,000 and semiannual coupons. The bonds have an annual coupon rate of 7% and are currently selling at a price of $1,209.30. What is the yield-to-maturity of the bond? C) Your stock is currently selling for $64.94. Assuming you plan to pay a dividend of $5 next year, and the dividends are expected to grow at a yearly rate of 3% indefinitely, what is the required return for your stock based on the dividend discount model? D) When the market has a return of 30%, your company is expected to have a return of 24%. When the market has a return of -20%, your company is expected to have a return of -16%. What is the beta of your company? E) You now decide that you want to find the CAPM return. You know that the expected market return is 12% and the risk-free rate is currently 4%. What is the cost of equity capital using the CAPM? F) If you want to find the Fama-French-Carhart expected return, what additional information will you need? G) You decide that the CAPM's estimate of your required return is more accurate than the discount dividend model's or the Fama-French-Carhart's estimate. You currently have 10,000 outstanding bonds and 800,000 shares outstanding. Assuming the corporate tax-rate is 35%, what is your company's WACC? H) The project you're considering costs $2 million. It will produce no cash flows for the next two years, followed by cash flows of $700,000 for years 3-9. If you use the WACC as the discount rate, what is the NPV of this project? 1) You have to decide whether to fund the project using debt or equity. Your primary concern is to ensure that the stock price is as high as possible. What information would be useful in making this decision? Support your answer using capital structure theories. 1) Rather than raising money through debt or equity, your CEO suggests cutting dividends to $2.50 next year to finance the project. This would save the company 800,000 - $2.50 = $2 million, fully funding the project. You know that your company has had a policy of increasing dividends by a growth rate of 3% for the last 20 years. What would you say about this suggestion