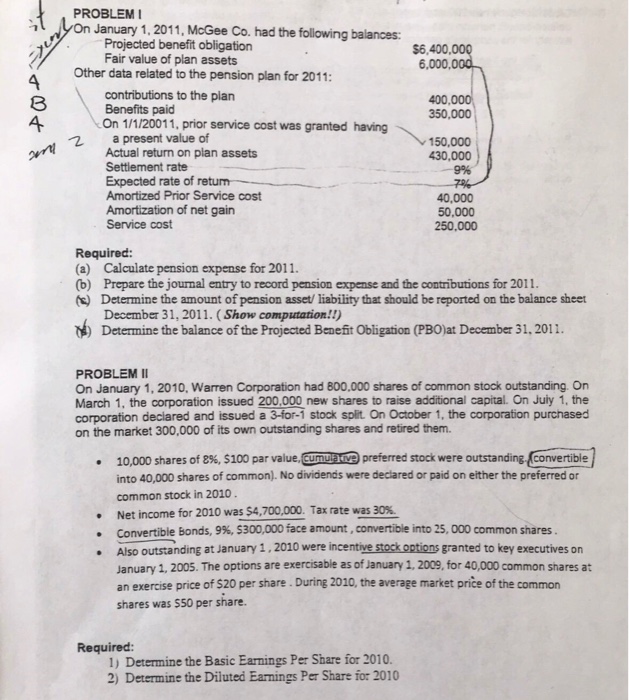

PROBLEMI On January 1, 2011, McGee Co. had the following balances: Projected benefit obligation Fair value of plan assets $6,400 6,000 Other data related to the pension plan for 2011: 8 4 contributions to the plan Benefits paid 400,000 350,000 ?On 1/1/2001 1.priorservice cost was granted having 2 a present value of 150,000 430,000 -9% Actual return on plan assets Settiement rate Expected rate of return Amortized Prior Service cost Amortization of net gain Service cost 40,000 50,000 250,000 Required: (a) Calculate pension expense for 2011. (b) Prepare the journal entry to record pension expense and the contributions for 2011. e) Determine the amount of pension asset/ liability that should be reported on the balance sheer December 31, 2011. (Show computation!!) ) Determine the balance of the Projected Benefit Obligation (PBO)at December 31.2011. PROBLEM II On January 1, 2010, Warren Corporation had 800.000 shares of common stock outstanding. Or March 1, the corporation issued 200,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 3-for-1 stock split. On October 1, the corporation purchased on the market 300,000 of its own outstanding shares and retired them. 10,000 shares of 8%, $100 par value.Cunuan preferred stock were outstanding,Convertible into 40,000 shares of common). No dividends were declared or paid on either the preferred or common stock in 2010 Net income for 2010 was S4-700,000. Tax rate was 30%. convertible bonds, 9%, S300,000 face amount , convertible into 25, 000 common shares. Also outstanding at January 1, 2010 were incentive stock options granted to key executives on January 1, 2005. The options are exercisable as of january 1, 2009, for 40,000 common shares at an exercise price of $20 per share. During 2010, the average market price of the common shares was $50 per share. . . . Required: 1) Determine the Basic Earnings Per Share for 2010 2) Determine the Diluted Earnings Per Share for 2010 PROBLEMI On January 1, 2011, McGee Co. had the following balances: Projected benefit obligation Fair value of plan assets $6,400 6,000 Other data related to the pension plan for 2011: 8 4 contributions to the plan Benefits paid 400,000 350,000 ?On 1/1/2001 1.priorservice cost was granted having 2 a present value of 150,000 430,000 -9% Actual return on plan assets Settiement rate Expected rate of return Amortized Prior Service cost Amortization of net gain Service cost 40,000 50,000 250,000 Required: (a) Calculate pension expense for 2011. (b) Prepare the journal entry to record pension expense and the contributions for 2011. e) Determine the amount of pension asset/ liability that should be reported on the balance sheer December 31, 2011. (Show computation!!) ) Determine the balance of the Projected Benefit Obligation (PBO)at December 31.2011. PROBLEM II On January 1, 2010, Warren Corporation had 800.000 shares of common stock outstanding. Or March 1, the corporation issued 200,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 3-for-1 stock split. On October 1, the corporation purchased on the market 300,000 of its own outstanding shares and retired them. 10,000 shares of 8%, $100 par value.Cunuan preferred stock were outstanding,Convertible into 40,000 shares of common). No dividends were declared or paid on either the preferred or common stock in 2010 Net income for 2010 was S4-700,000. Tax rate was 30%. convertible bonds, 9%, S300,000 face amount , convertible into 25, 000 common shares. Also outstanding at January 1, 2010 were incentive stock options granted to key executives on January 1, 2005. The options are exercisable as of january 1, 2009, for 40,000 common shares at an exercise price of $20 per share. During 2010, the average market price of the common shares was $50 per share. . . . Required: 1) Determine the Basic Earnings Per Share for 2010 2) Determine the Diluted Earnings Per Share for 2010