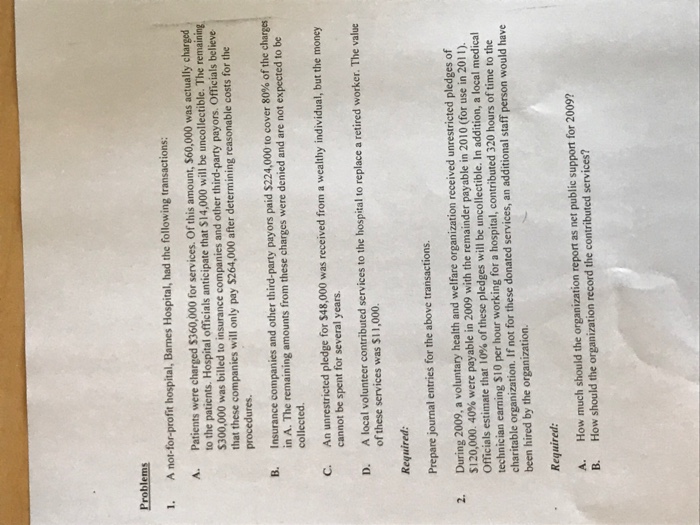

Problems 1. A not-for-profit hospital, Barnes Hospital, had the following transactions: A. Patients were charged $360,000 for services. Of this amount, $60,000 was actually charged to the patients. Hospital officials anticipate that $14,000 will be uncollectible. The remaining S300.000 was billed to insurance companies and other third-party payors. Officials believe that these companies will only pay $264,000 after determining reasonable costs for the procedures B insurance companies and other third party payors paid S224 000 to cover 80% of the charges in A. The remaining amounts from these charges were denied and are not expected to be collected C. An unrestricted pledge for $48,000 was received from a wealthy individual, but the money D. A local volunteer contributed services to the hospital to replace a retired worker. The value Required Prepare journal entries for the above transactions. cannot be spent for several years of these services was S11,000. 2. During 2009, a voluntary health and welfare organization received unrestricted pledges of $120,000 40% were payable in 2009 with the remainder payable in 2010 (for use in 2011). Officials estimate that 10% of these pledges will be uncollectible. In addition, a local medical technician earning $10 per hour working for a hospital, contributed 320 hours of time to the charitable organization. If not for these donated services, an additional staff person would have been hired by the organization Required: A. B. How much should the organization report as net public support for 2009? How should the organization record the contributed services? Problems 1. A not-for-profit hospital, Barnes Hospital, had the following transactions: A. Patients were charged $360,000 for services. Of this amount, $60,000 was actually charged to the patients. Hospital officials anticipate that $14,000 will be uncollectible. The remaining S300.000 was billed to insurance companies and other third-party payors. Officials believe that these companies will only pay $264,000 after determining reasonable costs for the procedures B insurance companies and other third party payors paid S224 000 to cover 80% of the charges in A. The remaining amounts from these charges were denied and are not expected to be collected C. An unrestricted pledge for $48,000 was received from a wealthy individual, but the money D. A local volunteer contributed services to the hospital to replace a retired worker. The value Required Prepare journal entries for the above transactions. cannot be spent for several years of these services was S11,000. 2. During 2009, a voluntary health and welfare organization received unrestricted pledges of $120,000 40% were payable in 2009 with the remainder payable in 2010 (for use in 2011). Officials estimate that 10% of these pledges will be uncollectible. In addition, a local medical technician earning $10 per hour working for a hospital, contributed 320 hours of time to the charitable organization. If not for these donated services, an additional staff person would have been hired by the organization Required: A. B. How much should the organization report as net public support for 2009? How should the organization record the contributed services