Answered step by step

Verified Expert Solution

Question

1 Approved Answer

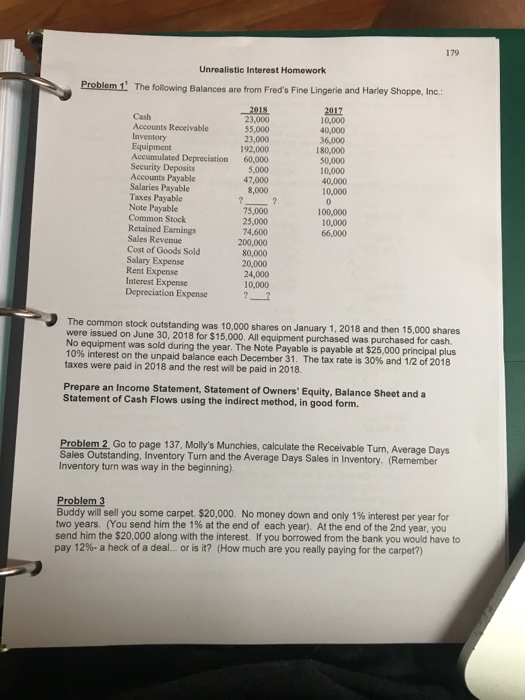

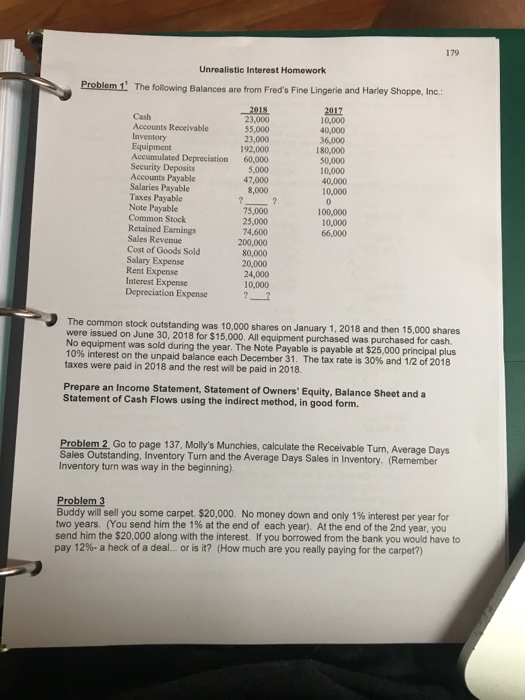

Problems 1 and 3 179 Unrealistic Interest Homework Problem 1 The following Balances are from Fred's Fine Lingerie and Hariley Shoppe, Ind 2018 23,000 55,000

Problems 1 and 3

179 Unrealistic Interest Homework Problem 1 The following Balances are from Fred's Fine Lingerie and Hariley Shoppe, Ind 2018 23,000 55,000 23,000 192,000 60,000 5,000 47,000 8,000 2017 10,000 40,000 6,000 180,000 0,000 10,000 40,000 10,000 Cash Accounts Receivable Equipment Accumulated Depreciation Security Deposits Accounts Payable Salaries Payable Taxes Payable Note Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salary Expense Rent Expense Interest Expense Depreciation Expense 100,000 10,000 75,000 25,000 74,600 200,000 80,000 20,000 24,000 10,000 The common stock outstanding was 10,000 shares on January 1, 2018 and then 15 were issued on June 30, 2018 for $15,000. All equipment purchased was purchased for cash. No equipment was sold during the year. The Note Payable is payable at $25,000 principal plus 10% interest on the unpaid balance each December 31. The tax rate is 30% and 12 of taxes were paid in 2018 and the rest will be paid in 2018. ,000 shares 2018 Prepare an Income Statement, Statement of Owners' Equity, Balance Sheet and a Statement of Cash Flows using the indirect method, in good form. Problem 2 Go to page 137, Molly's Munchies, calculate the Receivable Turn, Average Days Sales Outstanding, Inventory Turn and the Average Days Sales in Inventory. (Remember Inventory turn was way in the beginning) Problem 3 Buddy will sell you some carpet, $20,000. No money down and only 1% interest per year for two years. (You send him the 1% at the end of each year). At the end of the 2nd year, you send him the $20,000 along with the interest. If you borrowed from the bank you would have to pay 12%-a heck of a deal or is it? (How much are you really paying for the carpet?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started