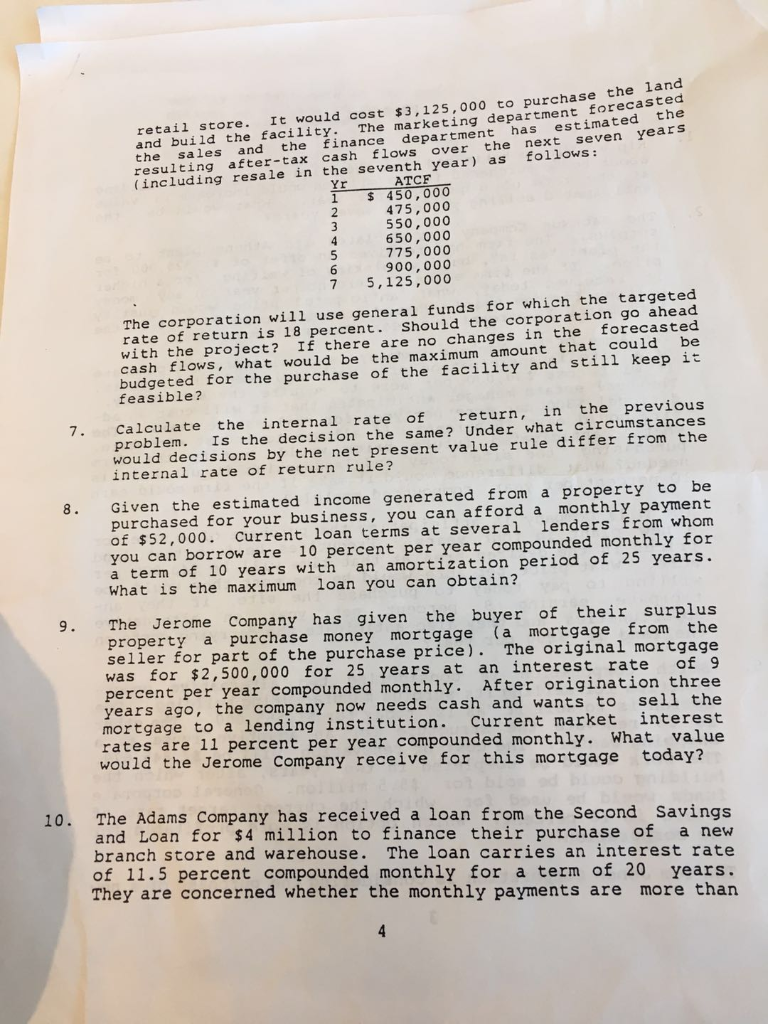

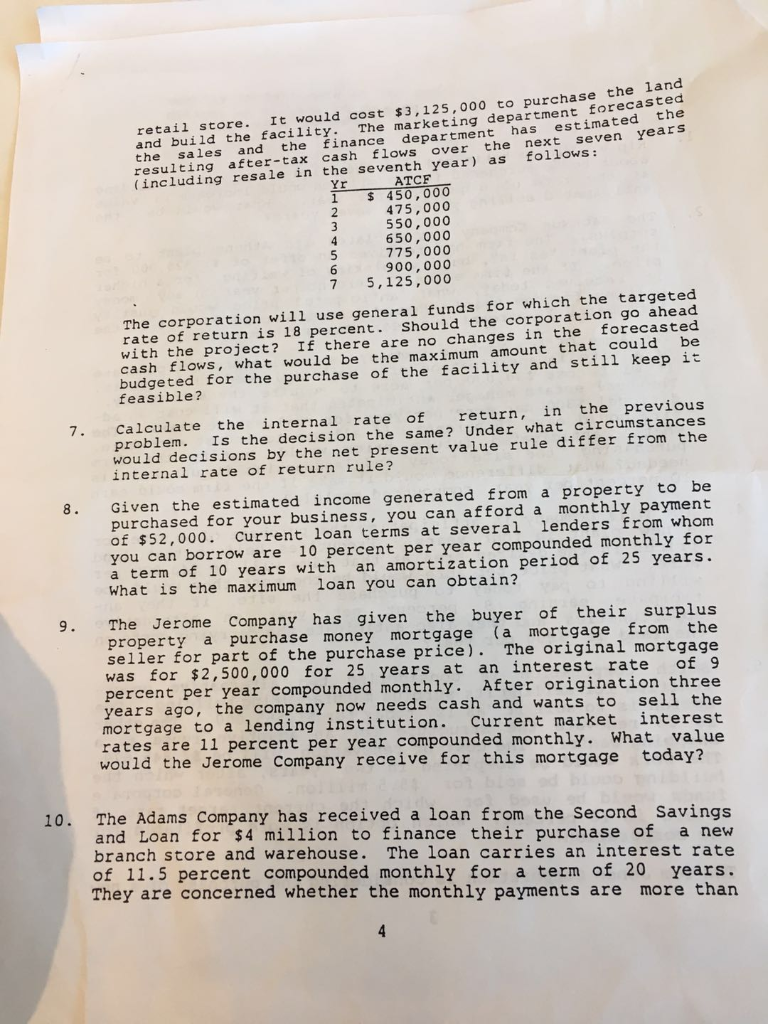

PROBLEMS 1. Rip v. Wingle estimated that the price of the office building about to be purchased for $3 million would increase in value at the rate of 6 percent per year. What would be the anticipated selling price in seven years? 2. The Jackson Company has declared its Athens plant to be surplus. The firm has received an offer of $1,325,000 for the plant "as is", but is thinking of waiting for a higher price. If the firm earns 11 percent per year on any money it receives today, what anticipated price would justify waiting for one year? What difference would it make if the firm earns 11 percent per year compounded monthly? 3. The Acme Office Machine Company is considering the purchase of a site in anticipation of a potential need in six years It will cost $30,000 per acre to acquire the site today The real estate manager anticipates that it wil1 cost an ad- ditional $300 per acre per year for real estate taxes. The firm could earn 10 percent, if allowed to invest elsewhere. What anticipated future price would justify the firrm purchasing the site today and landbanking it until it is needed? What difference would it make if the firm could earn 10 percent per year compounded monthly? 4. The Mill Company is anticipating the purchase of a site for s. Executives believe that land prices in the desired area at that time will be $40,000 per acre. What price per acre would be the most they would be if they an- ticipa e earning 9 percent per year on alternative opportunities and they also anticipate the carrying costs or a new plant in four years. willing to pay today to purchase the site, the land at $800 per year? 5. Smith Corporation is considering two alternative oppor- tunities for selling its surplus manufacturing building. One ption is to sell it "as is" today for $1,565,000. The other is to renovate the structure for an adaptive reuse as a shopping center. The cost of renovation will be $2,845,679 The work would be completed in two years, after which the building could be sold for $5.5 million. General corporate funds would be used for which the current target rate of return is 16 percent. Which option is more profitable for the corporation? 6. The Tom Jones Corporation is considering the purchase of a new retail store. It would cost $3,125,000 to purchase the land and build the facility. The marketing department forecastea the sales and the finance department has estimated the resulting after-tax cash flows over the next seven years (including resale in the seventh year) as follows: ATCF Yr 1 450,000 475,000 550,000 650,000 775,000 900,000 7 5,125,000 The corporation will use general funds for which the targeted rate of return is 18 percent. Should the corporation go ahead with the project? If there are no changes in the forecasted cash flows, what would be the maximum amount that could be budgeted for the purchase of the facility and still keep it feasible? 7. Calculate the internal rate of return, in the previous problem Is the decision the same? Under what circumstances would decisions by the net present value rule differ from the internal rate of return rule? 8. Given the estimated income generated from a property to be purchased for your business, you can afford a monthly payment of $52,000. current loan terms at several lenders from whom you can borrow are 10 percent per year compounded monthly for a term of 10 years with an amortization period of 25 years What is the maximum loan you can obtain? The Jerome Company has given the buyer of their surplus property a purchase money mortgage (a mortgage from the seller for part of the purchase price). The original mortgage for 25 years at an interest rate of 9 . After origination three was for $2,500,000 percent per year compounded monthly years ago, the company now needs cash and wants to sell the mortgage to a lending institution. Current market interest rates are 11 percent per year compounded monthly. What value would the Jerome Company receive for this mortgage today? 10. The Adams Company has received a loan from the second Savings and Loan for $4 million to finance their purchase of a new branch store and warehouse. The loan carries an interest rate of 11.5 percent compounded monthly for a term of 20 years. They are concerned whether the monthly payments are more than the budgeted amount of $40,000. They may have to renegotiate the loan if payments exceed $42,000 per month have to renegotiate? What is the monthly payment? Will they $4 million for a term of 10 years at an interest rate of 11.25 percent compounded monthly, if the loan wil1 be due in 0 years, although payments are established as if amortized 11. The Second Savings and Loan will agree to grant the loan of over 20 years wil1 this bring the monthly payments under $42,000 a month? How much will they have to pay? 12. The XY2 Manufacturing Corporation is about to purchas arehouse for $6.5 million. They have obtained a mortgage 000 at 12 percent compounded monthly for a term of of $4,875, impact of the purchase on taxes and shareholder value, to interest and principal each year for 10 years refinanced at the end of ten years 10 years with amortization of 25 years. In calculating the the real estate director needs to know the amounts attributable . Calcu- late these amounts as ell as the outstanding balance to be 13. .J. Smith has a chance to lease an office of 2,5C square feet for $15 per square foot per year for five years. An al- ternative is an equally desirable office of 2,500 square feet, but the rent is $13.75 per square foot for the first year with rate hikes of 5 percent per year for the remaining four years. The utilities and other charges are the same for both buildings. Annual rent in both cases is to be paid at the beginning of each yea The firm discounts these future cash flows at 12 percent Which is the least expensive lease? Why? 14. The Fleet Foot Shoe Company is negotiating with Big Bucks Development Corporation for space in the Good Times Mall So far, two options have been discussed. One is a nine year step-ups at the end of every third year of 19 The other is a lease tied to the Consumer Price Index, which Fleet anticipates will increase at 6 percent per year. Adjustments will be made annually. This option is also Both options require payments at the lease with percent. for nine years. beginning of the month, and both would begin with monthly paym flows at 11 percent. Which option should the shoe company choose? Why? ents of $3,200. The firm discounts these future cash 15. Delicious Candies is considering which lease option to take for the best location in the J Square Mall. One option is a percentage lease requiring the firm to pay a base rent of $25 a square foot per year for five years, paid in equal monthly installments at the beginning of each month. In ad- dition, an overage is paid at the end of each year, which is the difference between 8 percent of sales and the minimum rent. Sales for the next five years are estimated at $300, $400, $500, $600, and $650 per square foot for the 700 square feet to be leased. The other option is a flat lease of $42 per square foot per year paid in equal monthly installments at the beginning of each month. The firm discounts these cash ows at 13 percent. Which is the best alternative and why? 16. Shirts, Inc. holds a lease on 20,000 square feet of office space in New York. The original lease price was $26 per square foot per year paid in equal installments at the beginning of each month. The term was for 10 years. After two years the firm no longer needs the space, but does have the right to sublease it. Current market rent for this type of space is $30 per square foot per year paid in equal installments at the beginning of each month. If the firm were able to assign their rights to another firm, what would be its value at an interest rate of 11 percent per year? If current market rents were $24 per square foot per year paid in equal installments at the beginning of each month, what price would the landlord charge to let the firm out of the lease