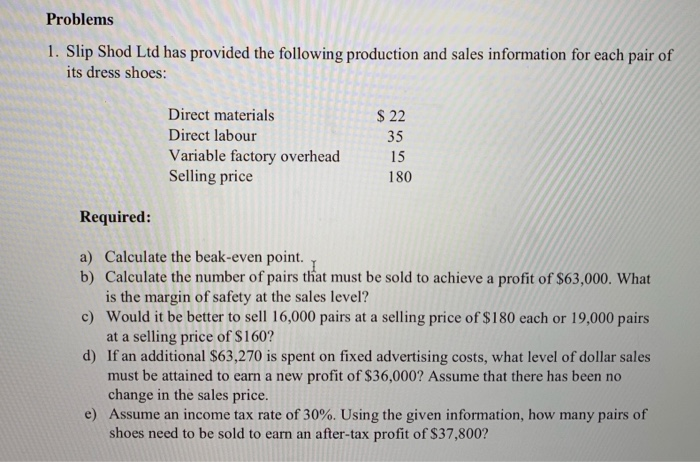

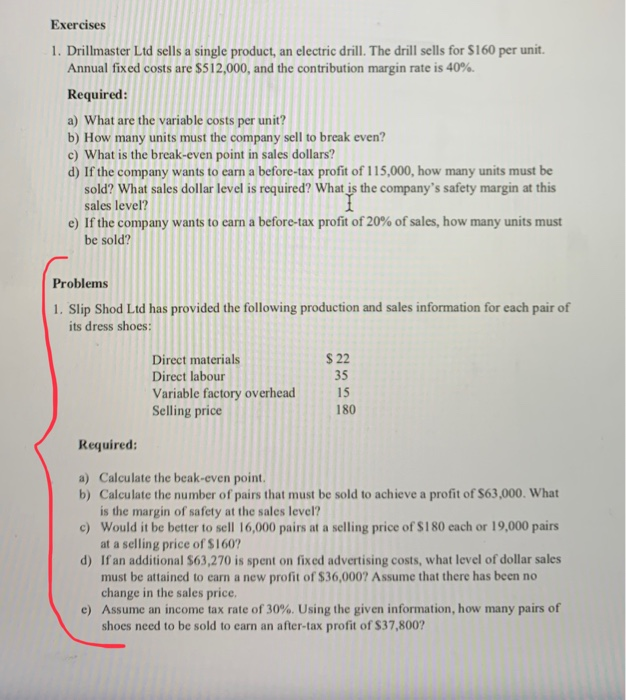

Problems 1. Slip Shod Ltd has provided the following production and sales information for each pair of its dress shoes: Direct materials Direct labour Variable factory overhead Selling price $ 22 35 15 180 Required: a) Calculate the beak-even point. b) Calculate the number of pairs that must be sold to achieve a profit of $63,000. What c) Would it be better to sell 16,000 pairs at a selling price of $180 each or 19,000 pairs d) If an additional $63,270 is spent on fixed advertising costs, what level of dollar sales is the margin of safety at the sales level? at a selling price of $160? must be attained to earn a new profit of $36,000? Assume that there has been no change in the sales price Assume an income tax rate of 30%. Using the given information, how many pairs of shoes need to be sold to earn an after-tax profit of S37,800? e) Exercises 1. Drillmaster Ltd sells a single product, an electric drill. The drill sells for $160 per unit Annual fixed costs are $512,000, and the contribution margin rate is 40%. Required: a) What are the variable costs per unit? b) How many units must the company sell to break even? c) What is the break-even point in sales dollars? d) If the company wants to earn a before-tax profit of 115,000, how many units must be sold? What sales dollar level is required? What is the company's safety margin at this sales level? e) If the company wants to earn a before-tax profit of 20% of sales, how many units must be sold? Problems 1. Slip Shod Ltd has provided the following production and sales information for each pair of its dress shoes S 22 Direct materials Direct labour Variable factory overhead Selling price 35 15 180 Required: a) Calculate the beak-even point. b) Calculate the number of pairs that must be sold to achieve a profit of $63,000. What c) d) is the margin of safety at the sales level? Would it be better to sell 16,000 pairs at a selling price of S180 each or 19,000 pairs at a selling price of $1607 If an additional $63,270 is spent on fixed advertising costs, what level of dollar sales must be attained to earn a new profit of $36,0007 Assume that there has been no change in the sales price Assume an income tax rate of 30%. Using the given information, how many pairs of shoes need to be sold to earn an after-tax profit of $37,800? e)