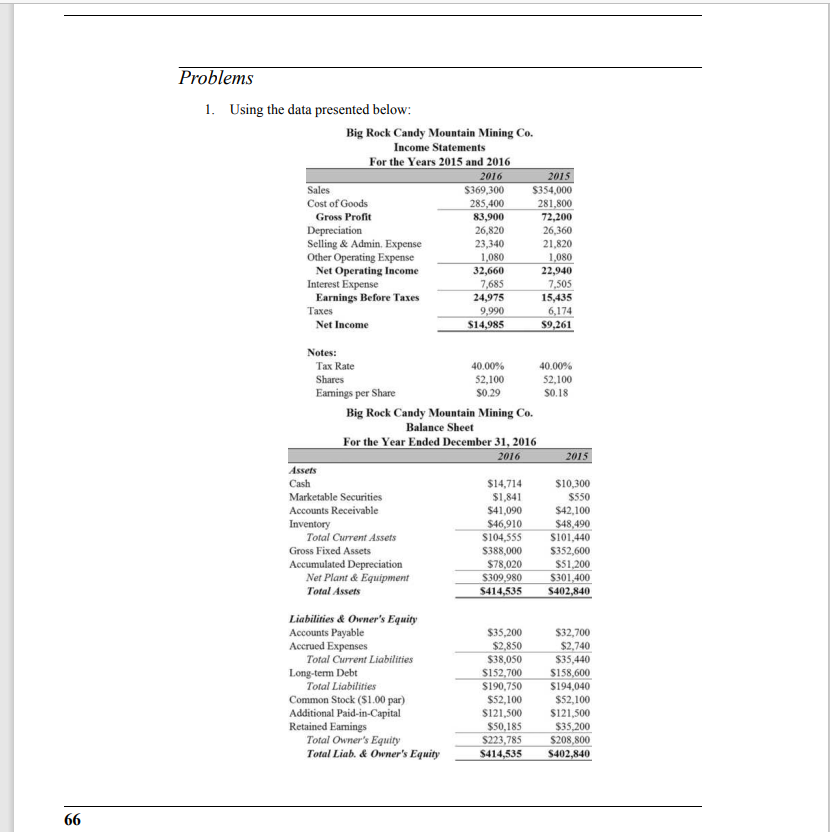

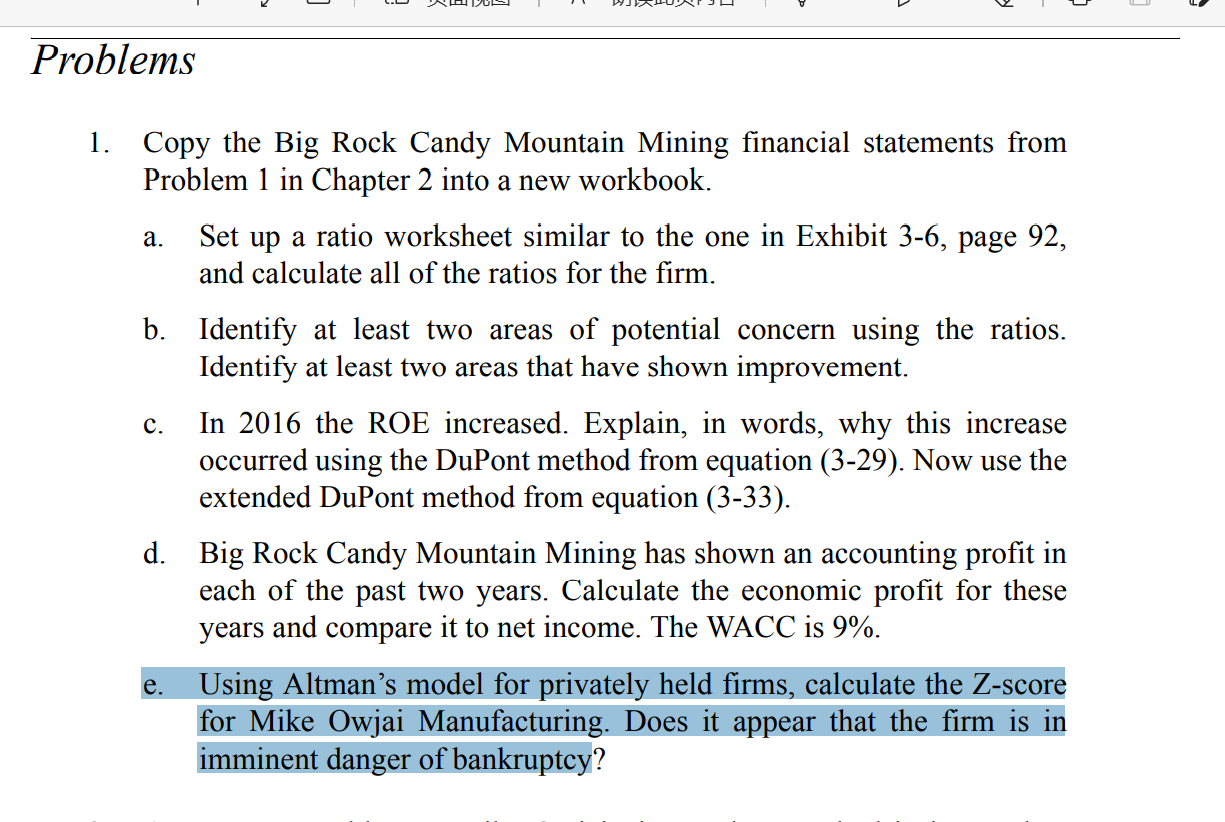

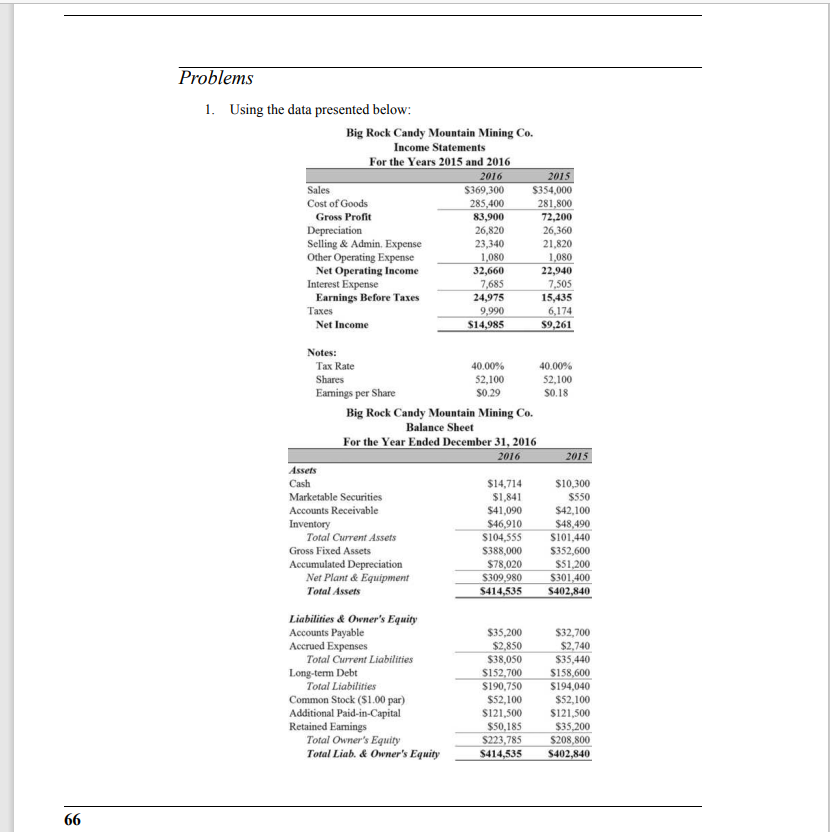

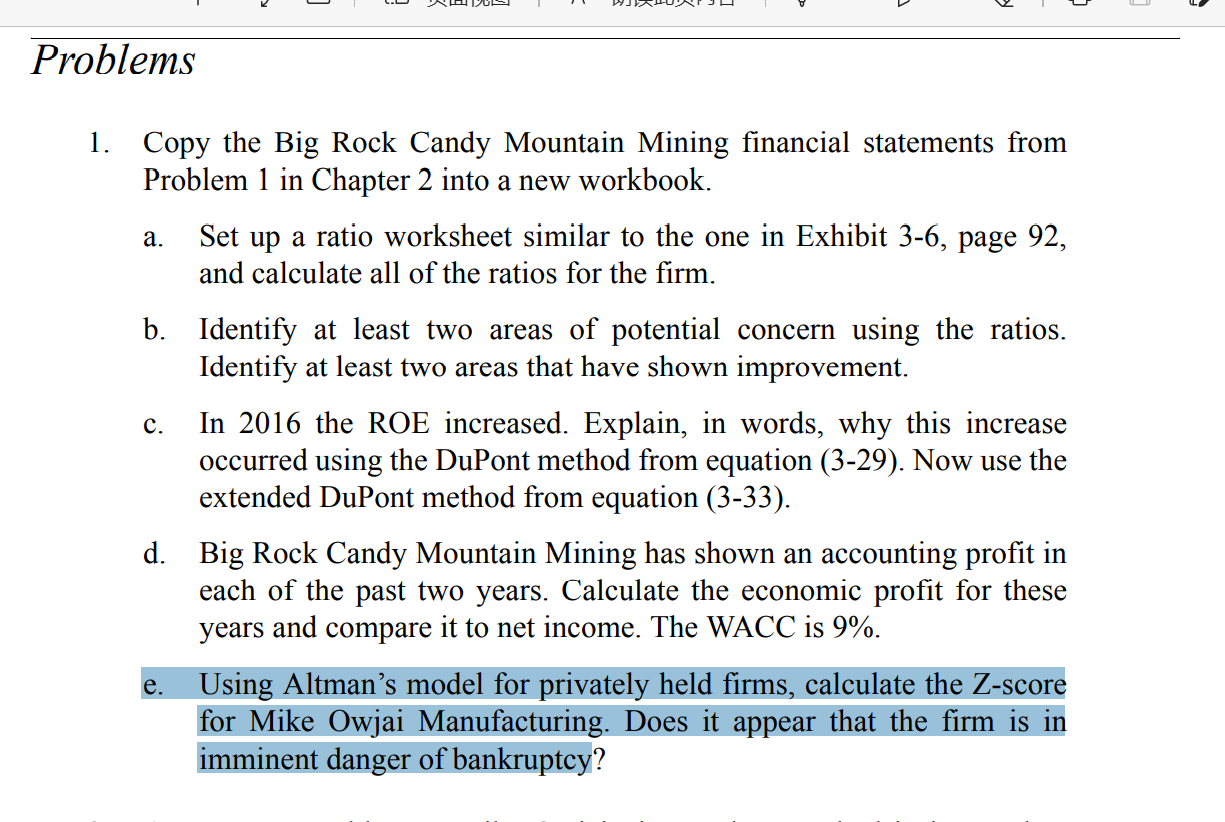

Problems 1. Using the data presented below: Big Rock Candy Mountain Mining Co. Income Statements For the Years 2015 and 2016 2016 2015 Sales $369,300 $354,000 Cost of Goods 285,400 281,800 Gross Profit 83,900 72,200 Depreciation 26,820 26,360 Selling & Admin. Expense 23,340 21,820 Other Operating Expense 1,080 1,080 Net Operating Income 32,660 22,940 Interest Expense 7,685 7,505 Earnings Before Taxes 24,975 15,435 Taxes 9,990 6,174 Net Income $14,985 59,261 Notes: Tax Rate 40.00% 40.00% Shares 52,100 52,100 Earnings per Share 50.29 S0.18 Big Rock Candy Mountain Mining Co. Balance Sheet For the Year Ended December 31, 2016 2016 2015 Assets Cash $14,714 $10,300 Marketable Securities $1,841 $550 Accounts Receivable $41,090 $42,100 Inventory $46,910 $48,490 Total Current Assets $104,555 $101.440 Gross Fixed Assets $388,000 $352,600 Accumulated Depreciation $78,020 $51,200 Net Plant & Equipment $309,980 $301,400 Total Assets S414,535 5402,840 Liabilities & Owner's Equity Accounts Payable $35,200 $32,700 Accrued Expenses $2,850 $2,740 Total Current Liabilities $38,050 $35,440 Long-term Debt $152.700 $158,600 Total Liabilities $190,750 $194,040 Common Stock ($1.00 par) $52,100 $52,100 Additional Paid-in-Capital $121,500 $121,500 Retained Eamings $50,185 $35,200 Total Owner's Equity $223,785 $208,800 Total Liab. & Owner's Equity $414,535 $402,840 66 Problems a. c. 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 92, and calculate all of the ratios for the firm. b. Identify at least two areas of potential concern using the ratios. Identify at least two areas that have shown improvement. In 2016 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 9%. Using Altmans model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? e